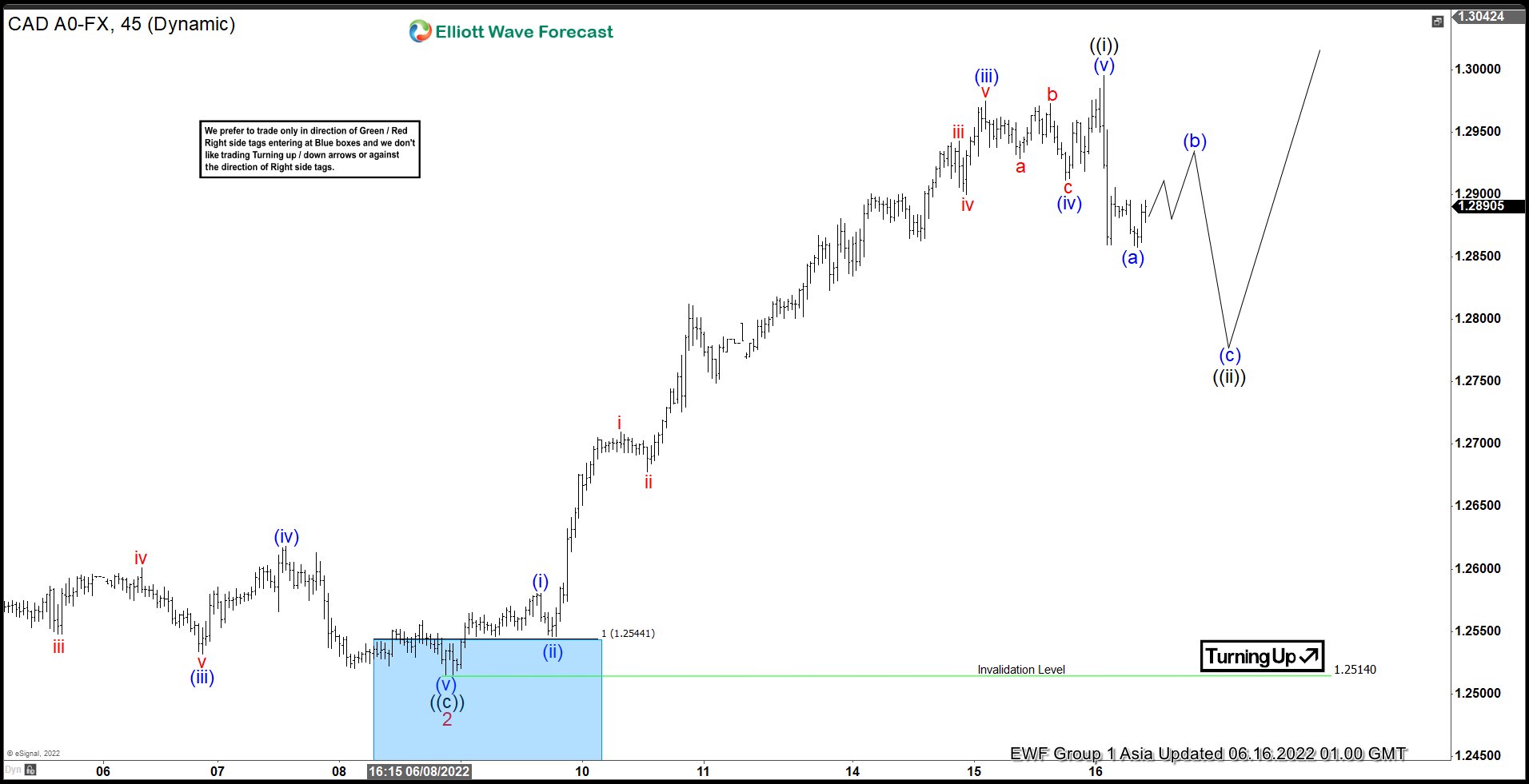

Short Term View in USDCAD suggests cycle from 06.08.2022 blue box low finished as a 5 waves impulse Elliott Wave structure. Up from June 08 low, wave (i) ended at 1.2580 and dips in wave (ii) ended at 1.2546. Pair then resumes higher in wave (iii) with internal subdivision as an impulse in lesser degree. Up from wave (ii), wave i ended at 1.2709 and pullback in wave ii ended at 1.2677. Pair then resumes higher in wave iii towards 1.2943, wave iv ended at 1.2900. Final wave v ended at 1.2975 which completed wave (iii).

Pullback in wave (iv) unfolded as a flat structure. Down from wave (iii), wave a ended at 1.2929, wave b ended at 1.2973, and wave c ended at 1.2912 which completed wave (iv). Pair has resumed higher in wave (v) ended at 1.2996 and also wave ((i)) cycle was completed. Near term, we are calling a zigzag structure before see further upside. Wave (a) ended at 1.2858 and wave (b) rally is in progress. This rally should be rejected and pair should see another leg lower to finish wave (c) and ((ii)) before the rally resumes. As far as pivot at 1.2514 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.