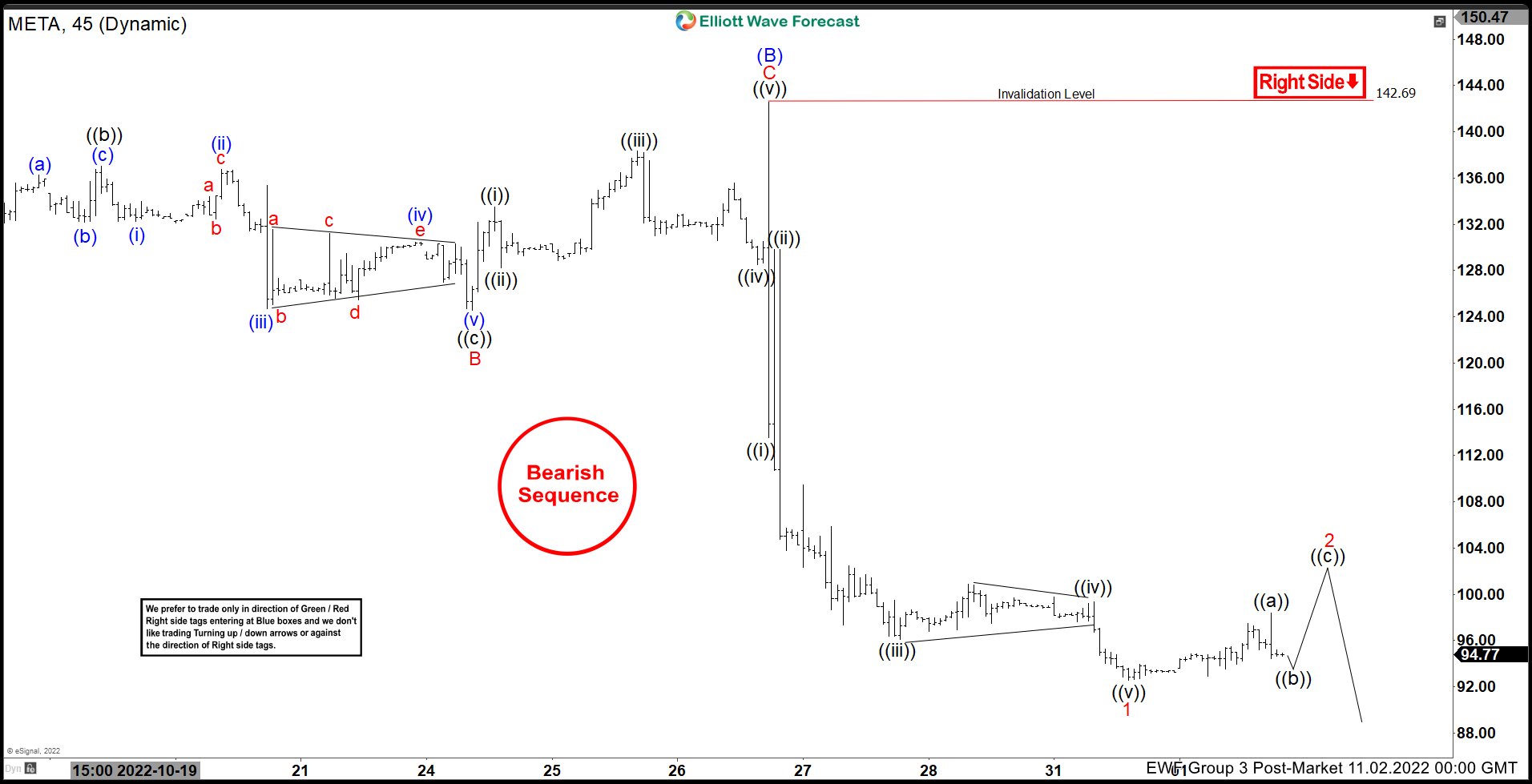

Short term Elliott Wave view on META suggests the decline from 7.21.2022 peak is unfolding as a 3 waves zig zag structure. Down from 7.21.2022 high, wave 1 ended at 157.92 and rally in wave 2 ended at 183.22. Stock resumed lower in wave 3 towards 131.92 and rally in wave 4 ended at 142.141. Last push lower to complete wave 5 of (A) ended at 122.28. Then stock bounced in a flat corretive structure. Wave A ended at 137.93, wave B ended at 124.37, and wave C ended at 142.69. This completed wave (B).

From wave (B), META reacted lower as 5 waves impulse in lesser degree. Down from wave (B), wave ((i)) ended at 113.59, and rally in wave ((ii)) ended at 129.79. Stock resumes lower in wave ((iii)) towards 96.05, and rally in wave ((iv)) ended at 99.29 as triangle structure. Wave ((v)) lower ended at 92.50 which completed wave 1. Wave 2 is in progress, as 3, 7 or 11 swings higher fail below 142.69, expect the stock to extend lower.