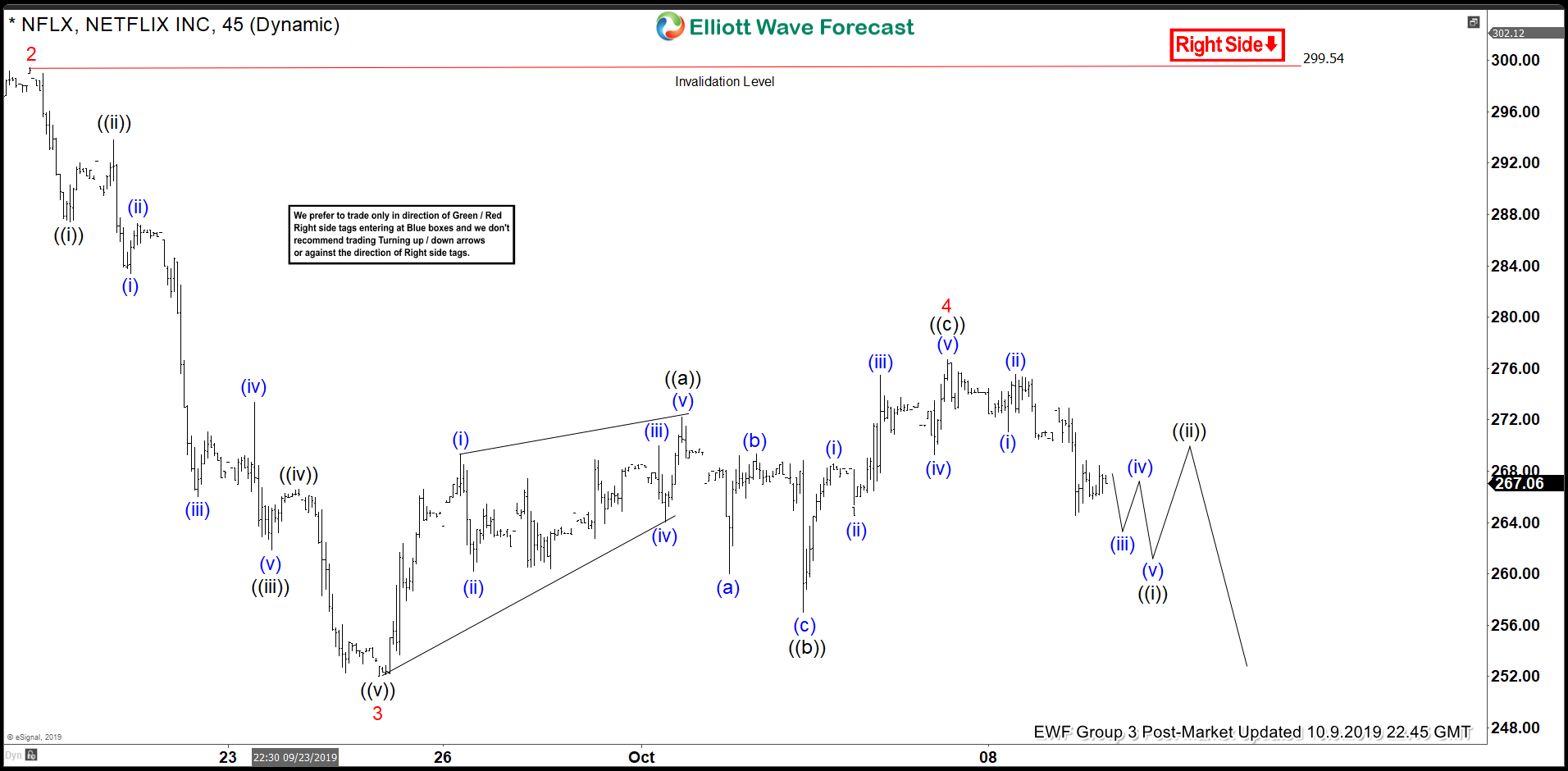

Short term Elliott Wave view suggests the rally to $299.5 in Netflix ($NFLX) ended wave 2. From there, the stock resumed lower and ended wave 3 at $252.03. Internal of wave 3 unfolded as a 5 waves impulse Elliott Wave structure. Down from $299.5, wave ((i)) ended at $287.45 and wave ((ii)) bounce ended at $293.81. The stock extends lower and ended wave ((iii)) at $261.89, wave ((iv)) bounce ended at $266.60, and wave ((v)) of 3 ended at $252.03.

Wave 4 bounce ended at $276.68 as a zigzag Elliott Wave structure. Wave ((a)) of 4 ended at $272.2, wave ((b)) of 4 ended at $257.01, and wave ((c)) of 4 ended at $276.68. The stock has resumed lower in wave 5 which should unfold in 5 waves impulse. Down from 276.68, wave (i) ended at 271.08, and wave (ii) bounce ended at 275.53. Expect Netflix to extend a few more lows before ending wave (v) of ((i)). Then it should bounce in wave ((ii)) to correct the decline from wave 4 before further downside. Near term, while bounce stays below wave 4 at $276.68, and more importantly below $299.54, expect Netflix to extend lower. We don’t like buying the stock.