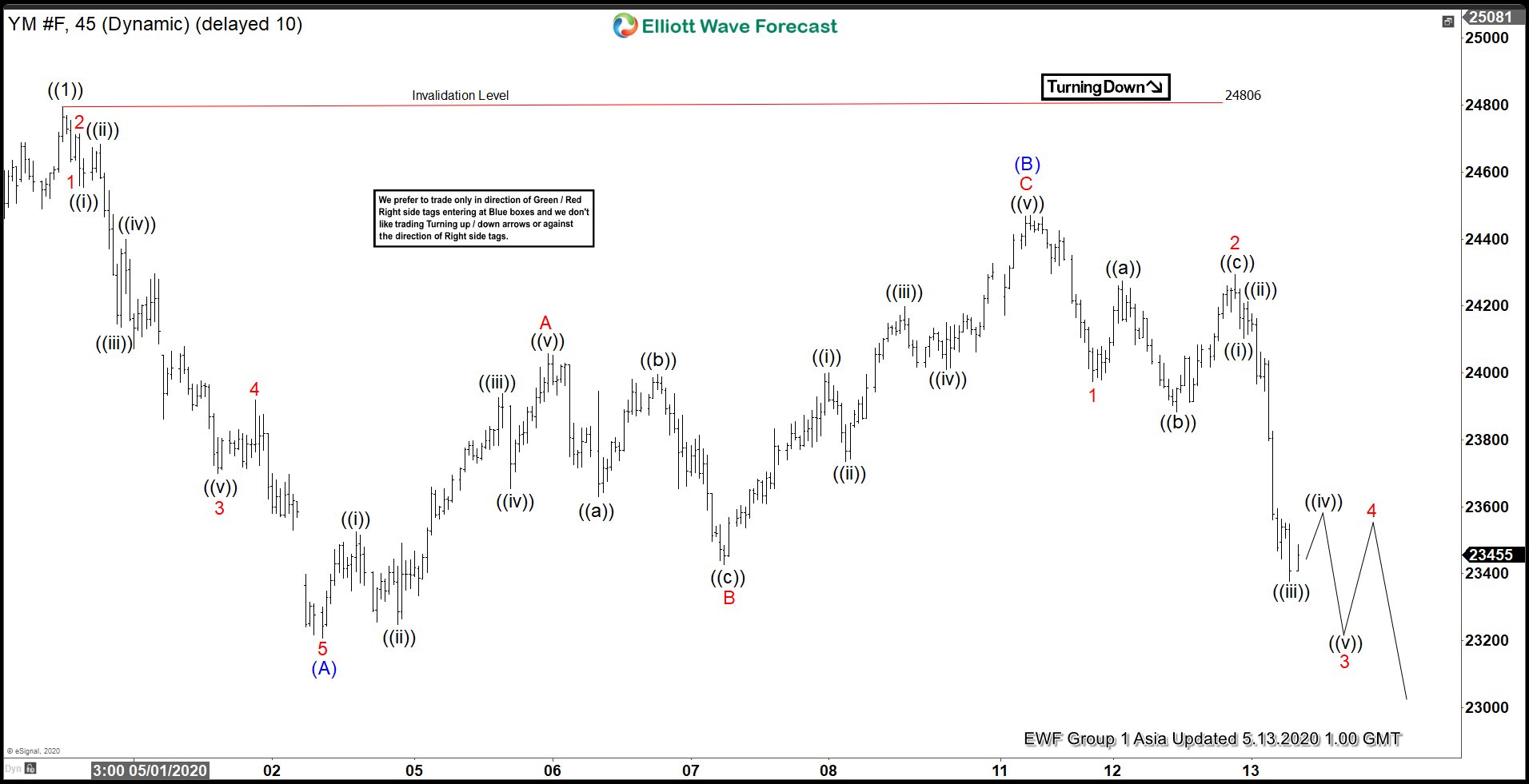

Elliott Wave View in Dow Futures (YM_F) suggests the rally from 3.23.2020 low ended wave ((1)) at 24806 as an impulse structure. Up from 3.23.2020 low, wave (1) ended at 22545 and wave (2) dips ended at 20500. Index then extended higher in wave (3) towards 24327 and wave (4) pullback ended at 22814. Finally wave (5) higher ended at 24806. This final move also completed wave ((1)) in higher degree and ended cycle from 3.23.2020 low. The 30 minutes chart below shows where wave ((1)) ended at 24806.

Index is currently correcting cycle from 3.23.2020 low within wave ((2)). The decline is unfolding as a zigzag structure where wave (A) ended at 23208, bounce in wave (B) ended at 24471, and wave (C) remains in progress. Internal of wave (A) unfolded as 5 waves where wave 1 ended at 24630, wave 2 ended at 24713, wave 3 ended at 23699, wave 4 ended at 23918, and wave 5 ended at 23208. Bounce in wave (B) took the form of a zigzag where wave A ended at 24057, wave B ended at 23428, and wave C ended at 24471.

Down from wave B at 24471, wave 1 ended at 23973 and bounce in wave 2 ended at 24293. Near term, while bounce stays below 24806, expect the Index to extend lower in wave C. Potential target lower is 100% – 123.6% Fibonacci extension of (A)-(B) which comes at 21952 – 23919.