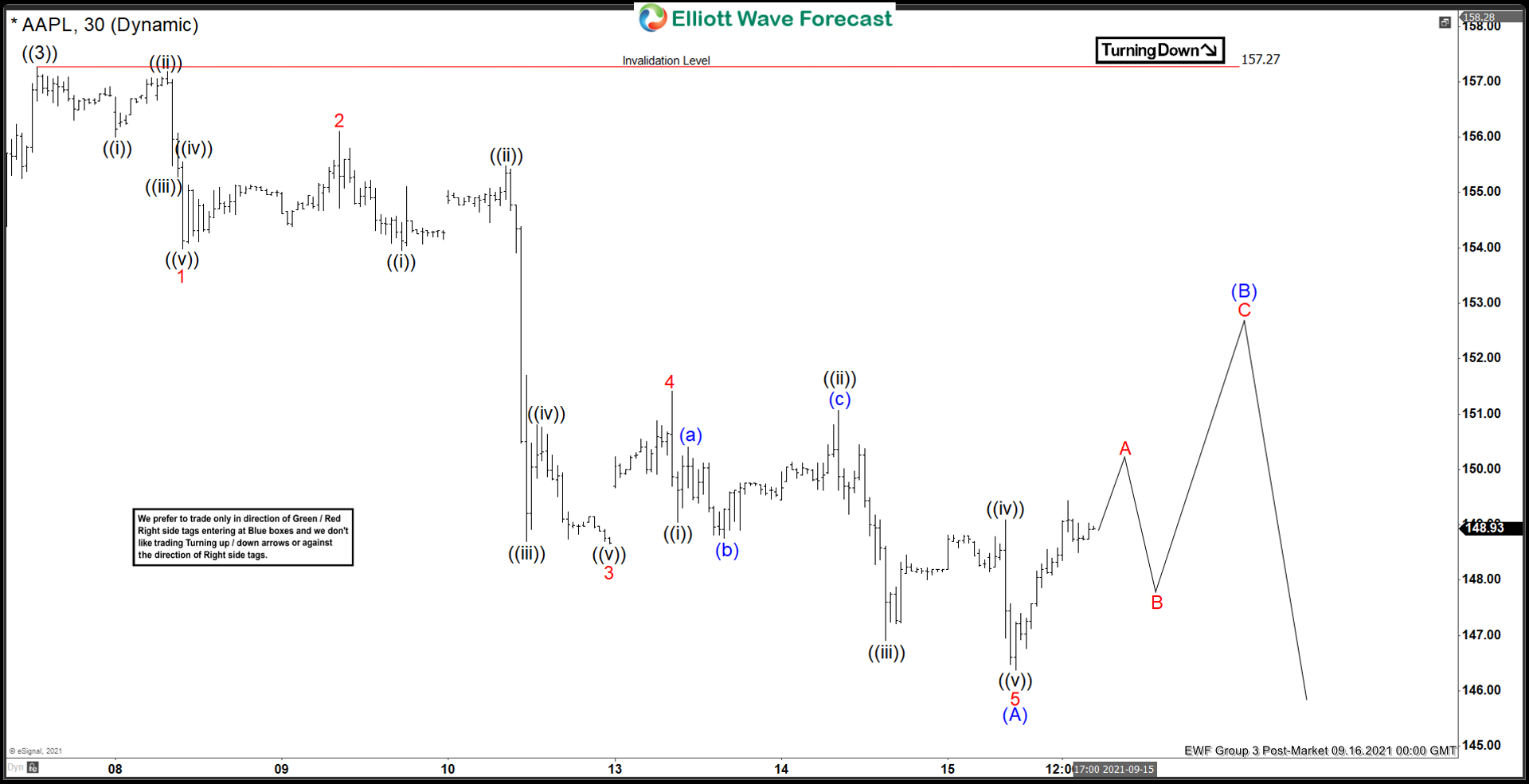

Short-term Elliott wave view in Apple (AAPL) suggests rally from March 5, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from March 5 low, wave ((1)) ended at 137.07 and pullback in wave ((2)) ended at 122.25. The stock then resumes higher in wave ((3)) towards 157.27. Pullback in wave ((4)) is currently in progress as a zigzag Elliott Wave structure.

Down from wave ((3)), wave 1 ended at 153.97 and rally in wave 2 ended at 156.11. The stock then resumes lower in wave 3 towards 148.65, wave 4 ended at 151.42, and final leg lower wave 5 ended at 146.37. This ended wave (A) in higher degree. Wave (B) rally is now in progress as a zigzag in lesser degree. Up from wave (A), expect wave A to end soon, then the stock should pullback in wave (B) before turning higher again in wave C to complete wave (B). Afterwards, expect the stock to extend lower in wave (C). Near term, as far as pivot at 157.27 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.