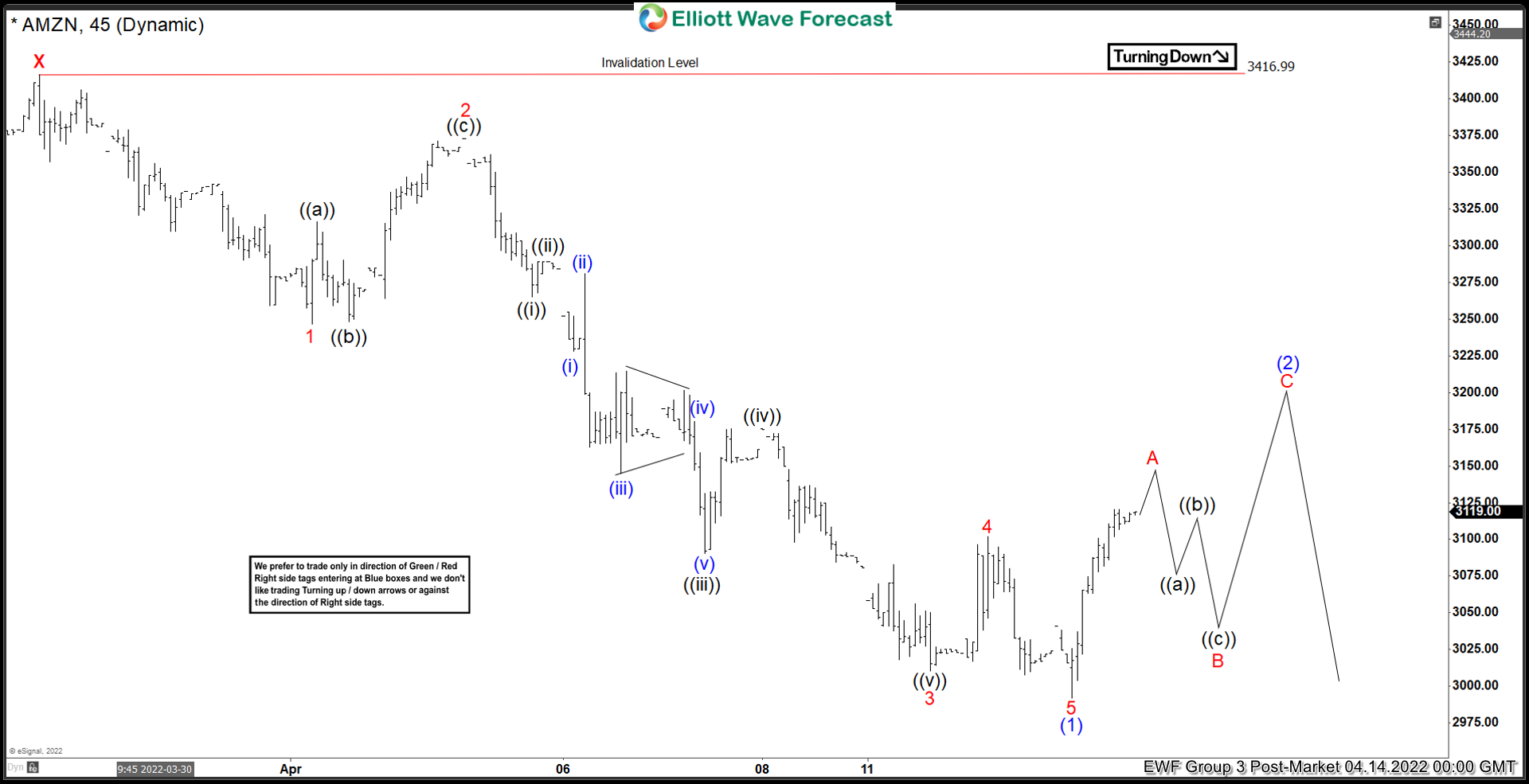

Short term Elliott Wave view in Amazon (ticker: AMZN) suggests the rally to 3417 ended wave x. Wave y lower is in progress with internal subdivision as a zigzag ((A))-((B))-((C)) Elliott Wave structure. The stock is currently within wave ((A)) as an impulse where wave (1) of ((A)) ended at 2992. Down from wave x, wave 1 ended at 3246.39 and rally in wave 2 ended at 3373. The stock then resumed lower in wave 3 with internal subdivision as an impulse in lesser degree. Down from wave 2, wave ((i)) ended at 3265.32 and wave ((ii)) ended at 3289. Wave ((iii)) ended at 3090.23, rally in wave ((iv)) ended at 3175.25 and final leg lower wave ((v)) ended at 3010.69. This completed wave 3 in higher degree. Rally in wave 4 ended at 3102 and wave 5 lower ended at 2992 which completed wave (1) in higher degree.

Wave (2) rally is now in progress to correct the decline from March 29, 2022 peak before the stock resumes lower. Internal subdivision of wave (2) is in progress as a zigzag Elliott Wave structure. Up from wave (1), wave A is expected to complete soon, then it should pullback in wave B before the stock turns higher in wave C to end wave (2). As far as pivot at 3416 high remains intact, expect rally to fail in the sequence of 3, 7, or 11 swing for further downside.