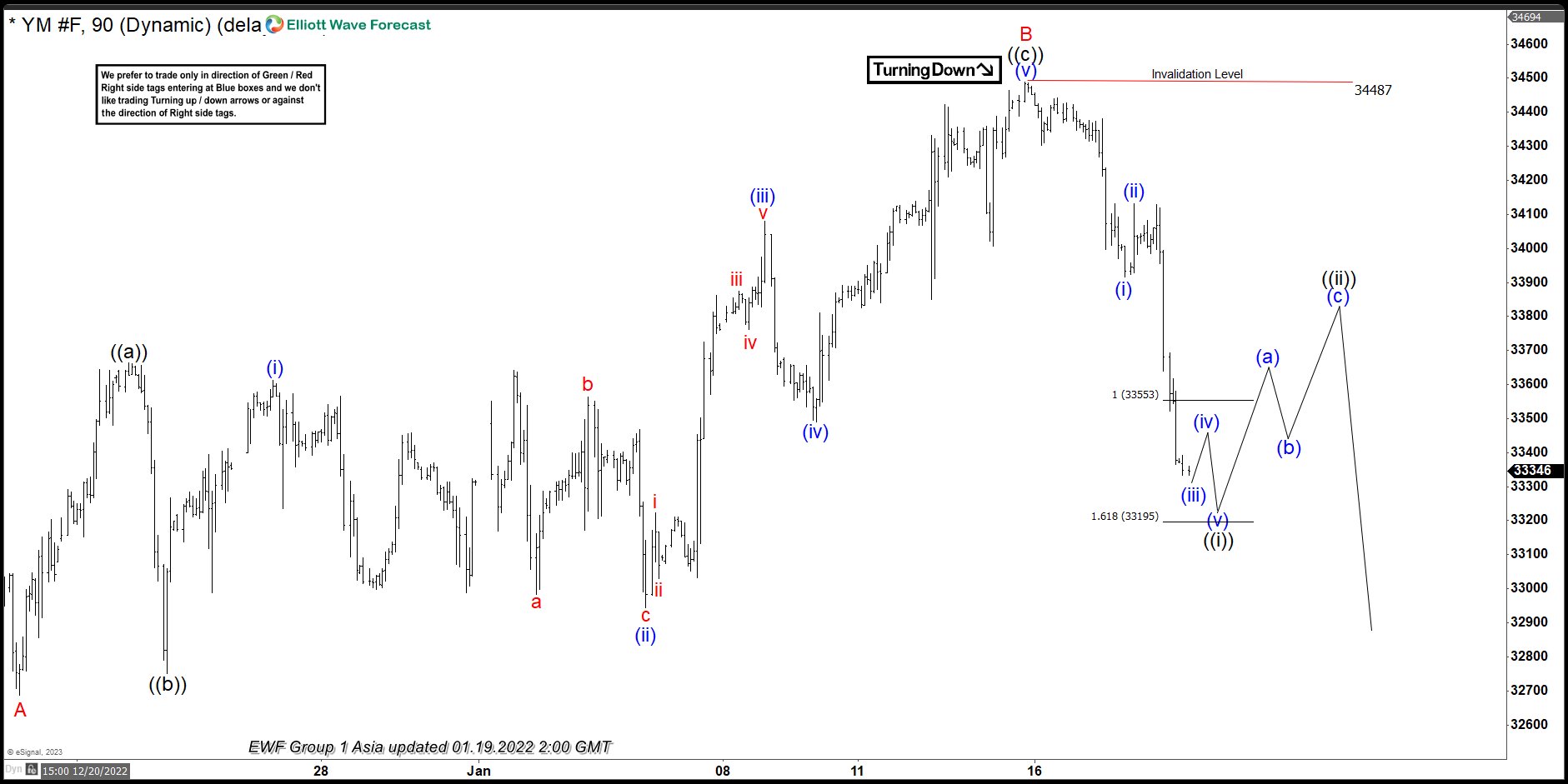

Cycle from 12.13.2022 high in Dow Futures (YM) is unfolding as a zigzag Elliott Wave structure. Down from 12.13.2022 high, wave A ended at 32686. Wave B rally ended at 34487 as the 90 minutes chart below shows. Internal subdivision of wave B unfolded as a zigzag structure in lesser degree. Up from wave A, wave ((a)) ended at 33663 and dips in wave ((b)) ended at 32750. Index then extended higher in wave ((c)) as a 5 waves diagonal. Up from wave ((b)), wave (i) ended at 33613 and dips in wave (ii) ended at 32943. Wave (iii) ended at 34080, wave (iv) ended at 33489, and final leg higher wave (v) ended at 34487 which completed wave ((c)) and B in higher degree.

Wave C lower is currently in progress as an impulse structure. The Index still needs to break below wave A at 32686 to confirm this view. Down from wave B, wave (i) ended at 33916 and rally in wave (ii) ended at 34131. Wave (iii) ended at 33318 and expect rally in wave (iv) to fail and Index to extend lower in wave (v) to complete wave ((i)). Afterwards, it should rally in wave ((ii)) to correct cycle from 1.16.2023 high before the decline resumes. Near term, as far as pivot at 34487 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside. Potential target lower is 100% – 161.8% Fibonacci extension of wave A. This area comes at 30385 – 31952 from where buyers can appear and Index can start to resume higher.