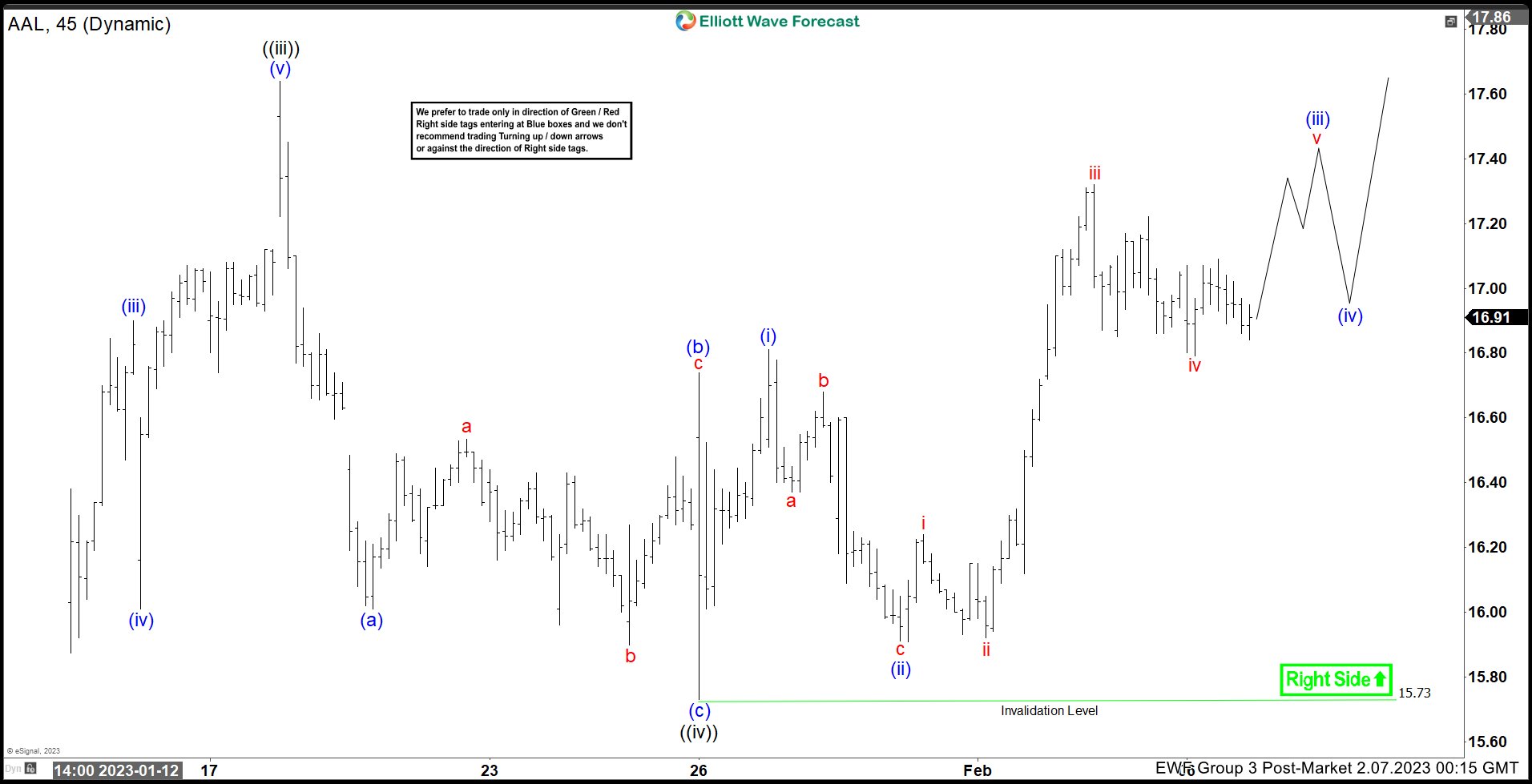

Cycle from 10.3.2022 low in American Airlines (AAL) is in progress as a 5 waves impulse Elliott Wave structure. Up from 10.3.2022 low, wave ((i)) ended at 15.18 and dips in wave ((ii)) ended at 12.23. The stock resumes higher in wave ((iii)) towards 17.64 and pullback in wave ((iv)) ended at 15.73. Internal subdivision of wave ((iv)) unfolded as a zigzag structure as the 45 minutes chart below shows. Down from wave ((iii)), wave (a) ended at 16.01, bounce in wave (b) ended at 16.74, and wave (c) lower ended at 15.73 which completed wave ((iv)).

Wave ((v)) is currently in progress but the stock still needs to break above wave ((iii)) at 17.64 to rule out a double correction. Up from wave ((iv)), wave (i) ended at 16.81 and dips in wave (ii) ended at 15.91. Stock then resumes higher in wave (iii). Up from wave (ii), wave i ended at 16.45, and dips in wave ii ended at 15.92. Stock resumes higher in wave iii towards 17.32, and pullback in wave iv ended at 16.79. Final leg higher wave v is ongoing to end wave (iii) before a pullback in wave (iv) and higher again. Near term, as far as pivot at 15.73 low stays intact, expect the stock to resume higher again.