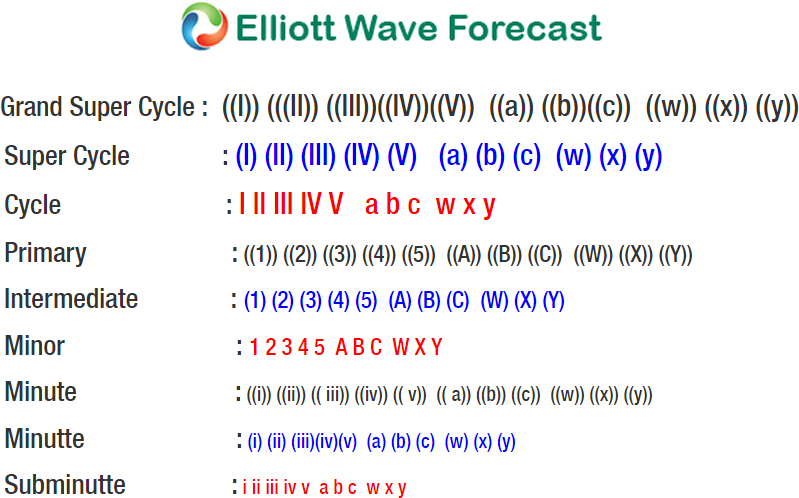

USDCAD Short Term Elliott Wave view suggests the rally from 1/31 low (1.2247) remains in progress as a triple three Elliott Wave Structure. A triple three is labelled as WXYZ and each leg in this structure is corrective, so we have 3-3-3-3-3 structure. Up from 1.2247, Intermediate wave (W) ended at 1.2689, Intermediate wave (X) ended at 1.2445, Intermediate wave (Y) ended at 1.3 and second Intermediate wave (X) is proposed complete at 1.2801. Pair still needs to break above Intermediate wave (Y) at 1.3 to add validity to this view and avoid a double correction.

Up from 1.28, the rally is unfolding as a zigzag Elliott Wave Structure where Minute wave ((a)) ended at 1.2984. A zigzag is a 5-3-5 structure and thus we could see the internal subdivision of Minute wave ((a)) unfolded as 5 waves impulse Elliott Wave structure. Minutte wave (i) of ((a)) ended at 1.2877, Minutte wave (ii) of ((a)) ended at 1.2828, Minutte wave (iii) of ((a)) ended at 1.2947, Minutte wave (iv) of ((a)) ended at 1.2914, and Minutte wave (v) of ((a)) ended at 1.2984. Minute wave ((b)) pullback is currently in progress to correct cycle from 3/12 low in 3, 7, or 11 swing before pair resumes higher again with potential target of 1.324 to end cycle from 1/31 low. A break above Intermediate wave (Y) at 1.3 will be the final confirmation that the next leg higher in Intermediate wave (Z) has started.