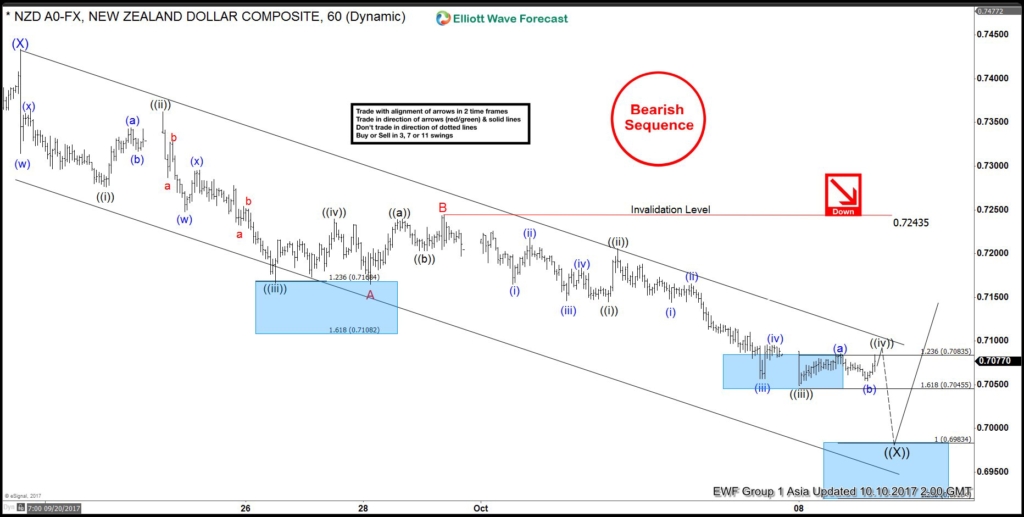

NZDUSD Short term Elliott Wave view suggests the decline from 9/20 peak remains in progress a zigzag Elliott Wave structure. Down from 9/20 high (0.7434), pair ended Minor wave A at 0.7165. Subdivision of Minor wave A unfolded as 5 waves impulse where Minute wave ((i)) of A ended at 0.7276 and bounce to 0.7362 ended Minute wave ((ii)) of A. Afterwards, decline to 0.7166 ended Minute wave ((iii)) of A and Minute wave ((iv)) of A ended at 0.7239. Minute wave ((v)) of A completed at 0.7165. Pair then bounced in Minor wave B in 3 waves and ended at 0.7243. Minor wave C is currently in progress and unfolding also as 5 waves impulse. Minute wave ((i)) ended at 0.7145, Minor wave ((ii)) ended at 0.7206, and Minute wave ((iii)) at 0.7049. While Minute wave ((iv)) bounce stays below 9/29 peak (0.7243), expect pair to extend lower towards 0.6919 – 0.6983 before ending cycle from 9/20 peak.

NZDUSD 1 Hour Elliott Wave Chart

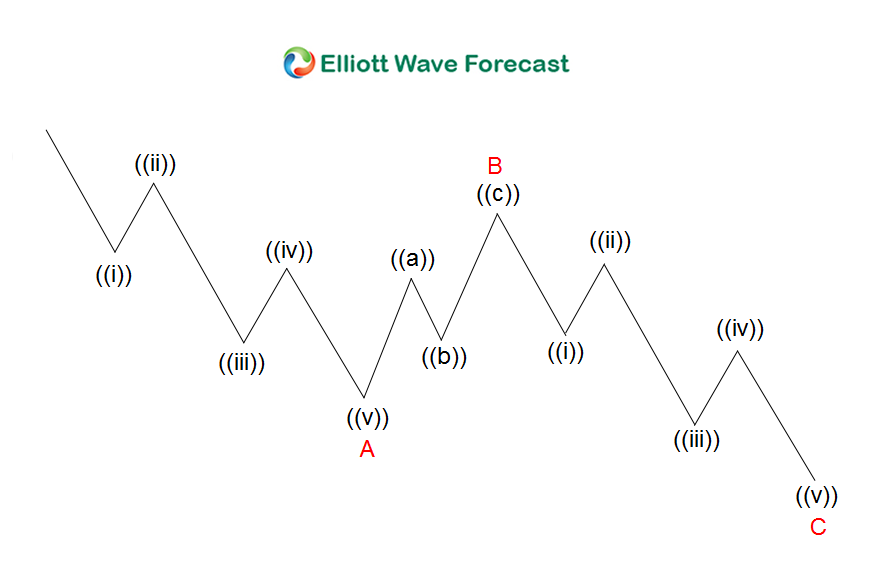

Zigzag is a 3 waves corrective pattern which is labelled as ABC. The subdivision of wave A is in 5 waves, either as impulse or diagonal. The subdivision of wave B can be any corrective structure. Finally, the subdivision of wave C is also in 5 waves, either as impulse or diagonal. Thus, zigzag has a 5-3-5 structure. Wave C typically ends at 100% – 123.6% of wave A.