Below is an Elliott Wave analysis video on NZDCAD. The pair is currently correcting the rally from 8/24/2015 low and could see more downside short term before the rally resumes to new high or at least bounce in 3 waves.

If you enjoy this analysis, feel free to try our service –> 14 days FREE trial and get access to Elliottwave charts for 52 instrument in 4 time frames, live sessions, live trading room, 24 hour chat room, and more.

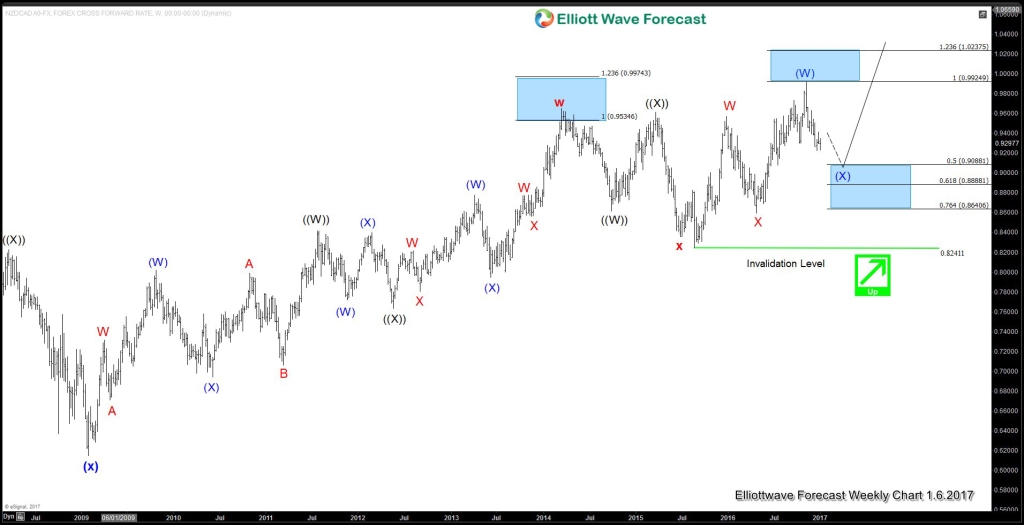

Weekly Chart

NZDCAD is showing a bullish sequence in the weekly time frame with the break above the previous peak at 3/17/2014, suggesting that further upside to a new high is favored. Pair is currently correcting the rally from 8/24/2015 low (0.824) in wave (X) before the next bullish leg starts, as far as pivot at 8/24/2015 low (0.824) is holding. If pivot at 0.824 fails (which is not anticipated), then pair is doing a FLAT correction from 3/17/2014 and could open extension lower to 0.766 – 0.824 area before pair bounces at least in 3 waves.

Daily Chart

Daily chart suggests that wave (X) pullback is currently in progress to correct the rally from 8/24/2015 low (0.824). The structure of the pullback is unfolding as a double three where wave W ended at 0.942 and wave X ended at 0.963. Wave Y is in progress towards 0.887 – 0.908 area, then as far as pivot at 8/24/2015 low (0.824) stays intact, expect pair to resume higher or at least bounce in 3 waves.

4 Hour Chart

The 4 hour chart suggests that while pair stays below wave ((x)) at 0.941, and more importantly below wave X at 0.963, pair has scope to continue the move lower in wave (X) towards 0.9 – 0.912 area before the next bullish leg starts or at least a 3 waves bounce can be seen. We expect buyers to appear in the 0.9 – 0.912 area for either a new bullish cycle or at least a 3 waves bounce. Ideally pullback stays above 0.88 (1.618 ext).