Hello Fellow Traders. Another instruments we have traded lately is EURJPY. As our members know, EURJPY has been correcting the cycle from the June 2016 low ( 109.187). We knew that price will find buyers as soon as it reaches extremes per Elliott Wave hedging strategy. We recommended members to wait for extremes to be reached before buying the dips again in the pair. In further text we’re going to explain the Elliott Wave forecast and trading strategy.

EURJPY Daily Elliott Wave Analysis 5.26.2018

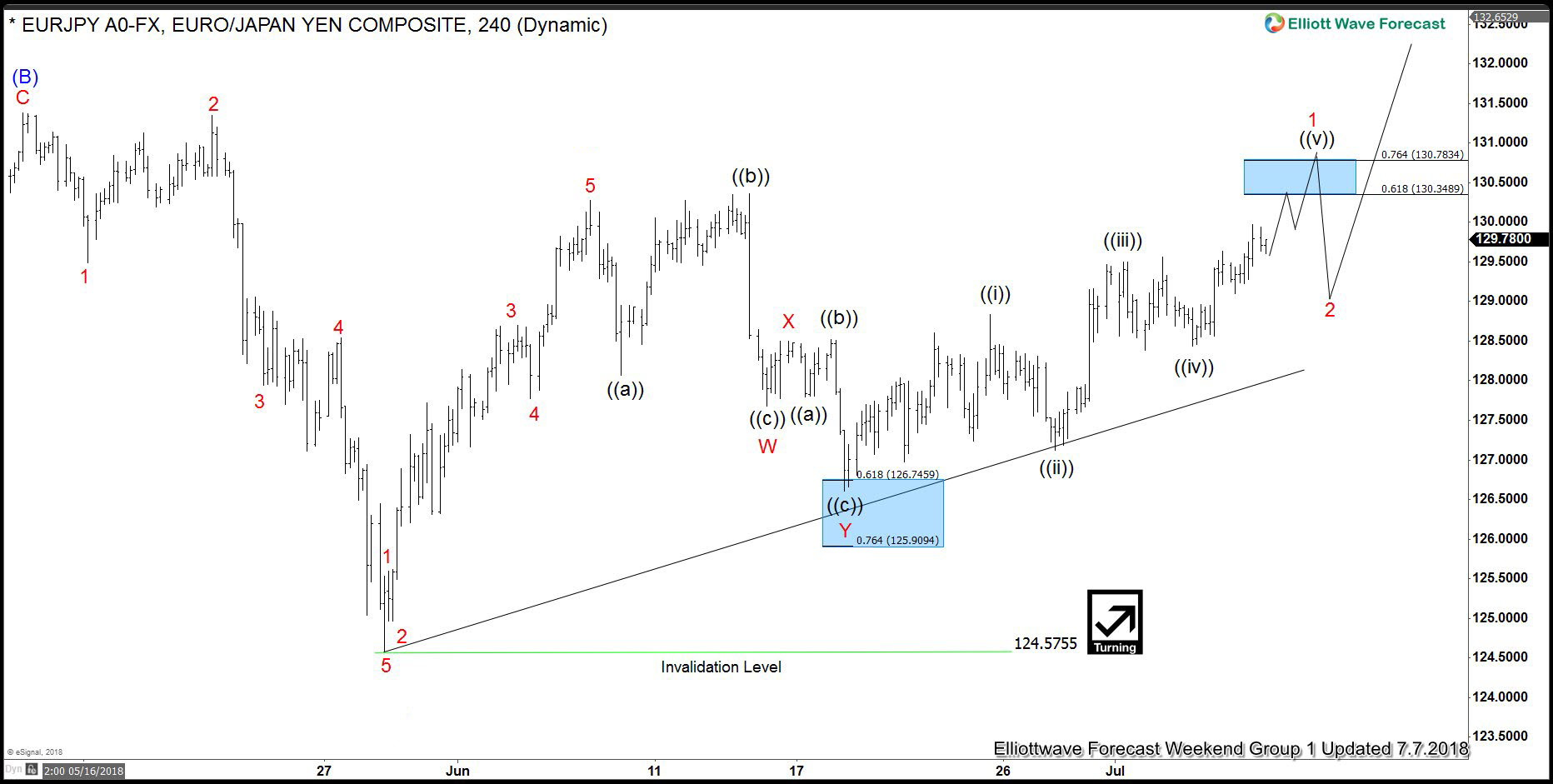

The pair is doing pull back against the 2.0072 low. Current price structure of the pull back is showing incomplete swing sequences. As far as the price stays below ((B)) peak (04/24 2018) the pair is missing a swing to complete cycle from the February peak. We’re calling for another swing down toward 125.198-123.219 . At that area buyers should ideally appear either for further rally or 3 wave bounce at least. Our trading strategy is buying the dips at 125.198-123.219 area, when invalidation level of the trade would be break below 1.618 fib extension ( 120.016). Due to Elliott Wave Hedging bounce is likely to happen and as soon as the price reaches 50 Fibs against the ((B)) peak our recommendation is to make long positions risk free –put Stop Loss at BE.

EURJPY 4 Hour Elliott Wave Analysis 3.26.2018

The price has given us forecasted leg lower and reached buying zone at 125.198-123.219 . Buyers have appeared shortly after and we’re getting nice bounce from the mentioned area. Rally has reached 61.8 Fibs against the ((B)) peak. As a result members are now enjoing profits in risk free long positions.

Recently we got break of 06/14 peak , that has given us confirmation next leg up is in progress. Next target to the upside comes at 132.36+ area.

Note: We have removed some labeling in order to protect clients’ priviliges. Keep in mind market is dynamic and presented view could have changed in the mean time. Not every chart is Trading Signal. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !