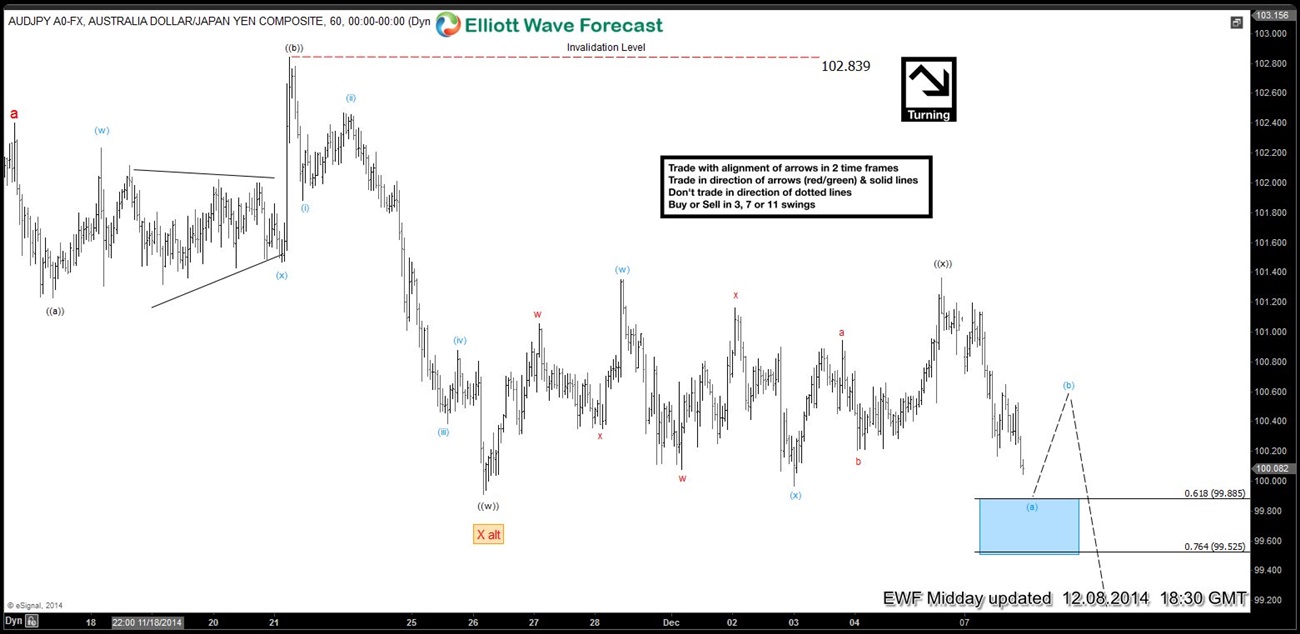

Preferred Elliott Wave view suggests price action between 102.40 (11.16) – 99.91 (11.26) was a FLAT structure and completed wave (( w)). FLAT is a 3-3-5 structure in Elliott Wave Theory and this one in particular was an Expanded FLAT. You can learn more about 3 types of FLAT structures here We have seen a 3 wave recovery to 101.36 (12.5) which we think completed wave (( x )). Pair has already made a new low below 99.91 which adds further conviction to this idea. Near-term focus is on 99.98 – 99.52 to complete wave (a) of (( y )) before we get a bounce in wave (b) and lower again toward 98.87 – 98.28 area (equal legs -1.236 ext) from where another 3 wave bounce would be expected to correct the decline from 102.40 high. Wave (b) bounce must hold below 101.36 high for this view to remain valid. If pivot at 101.36 high breaks that would suggest pair is doing a FLAT in wave (( x )) and could test 101.31 – 101.67 area before the turn lower is seen.

We do Elliott Wave Analysis of 26 instruments in 4 time frames (Weekly, Daily, 4 Hour and 1 Hour) with 1 hour charts updated 4 times a day so clients are always in loop for the next move. Please feel free to come visit around the website and click Here to Start your Free 14 day Trial (No commitments, Cancel Anytime)