Note: If you prefer videos, the same analysis is available in video format at our video blog.

Below is Daily and Weekly Elliott Wave analysis on $AUD/CAD, a pair that is not part of the 42 instrument currently covered by EWF, but the same Elliott Wave Principle and technique are applied to analyze the pair. After reading the analysis below, if you are interested to learn more about Elliott Wave or how we can help you, feel free to check us out and join 14 days trial (free 14 days trial promotion until the end of May 2015).

Weekly Outlook

Decline to 0.775 ended a grand super cycle wave ((x)). Rally from this level took the form of an expanded flat ((A))-((B))-((C)) where wave ((A)) ended at 1.0548, wave ((B)) ended at 0.7155, and wave ((C)) ended in 5 waves at 1.0783. This multi-year sequence of the expanded flat completed wave w, the first leg of the rally from 0.775.

Wave x pullback is currently in progress to correct wave w rally, and this pullback is unfolding in the form of a double corrective structure ((W))-((X))-((Y)) where wave ((W)) ended at 0.9205, wave ((X)) ended at 1.034, and wave ((Y)) is in progress towards 0.833 – 0.8719 area. As far as wave w high at 1.0783 stays intact, the pair is expected to resume lower to complete wave x pullback towards 0.833 -0.8719 area.

From the area above, as far as wave ((B)) pivot at 0.71468 holds in the pullback, a new cycle is expected to start and bring the pair to a new high above 1.0783, or at minimum 3 waves higher to correct the decline from 1.0783 per Elliott Wave hedging idea.

Weekly Summary: In the weekly time frame, we are looking for a multi-month decline towards 0.833 – 0.8719 to complete wave x pullback, then a new bullish cycle should begin once wave x pullback is complete as far as pivot at 0.71468 stays intact. This new bullish cycle can bring the pair to a new high above 1.0783 ultimately or at minimum 3 waves higher to correct the decline from 1.0783.

Daily Outlook

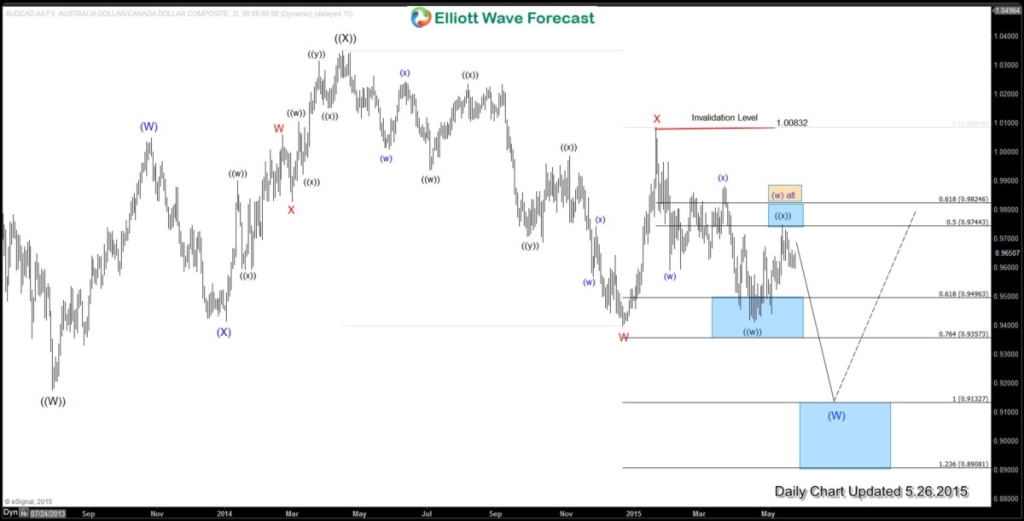

As previously stated in the weekly commentary, wave x pullback from 1.0783 took the form of a double corrective structure ((W))-((X))-((Y)) where wave ((W)) ended at 0.9205, wave ((X)) ended at 1.034, and wave ((Y)) is currently in progress towards 0.833 – 0.8719 area.

From the daily chart above, we can see the decline from wave ((X)) at 1.034 is unfolding in the form of a double corrective structure W-X-Y where wave W ended at 0.9398, wave X ended at 1.00832, and wave Y is currently in progress towards 0.8908 – 0.9132 to complete wave (W).

Wave Y lower is further subdivided in the form of a double corrective structure where the first leg wave ((w)) ended at 0.942, the bounce in wave ((x)) ended at 0.9748, and wave ((y)) is currently in progress lower towards 0.8908 – 0.9132 to complete wave (W). Once wave (W) is complete, the pair is expected to bounce in wave (X) before lower again towards the eventual weekly target of wave x at 0.833 -0.8719.

Daily Summary: In the daily time frame, as far as 1.00832 pivot stays intact, we are looking for the pair to continue lower first towards 0.8998 – 0.9132 to complete wave (W). From this area, the pair should then bounce in wave (X) before lower again towards the eventual weekly target of 0.833 – 0.8719

We hope you enjoy reading the analysis. At EWF we offer professional-grade forecast and 24 hour coverage of 42 instruments from Monday – Friday using Elliott Wave Theory as primary tools of analysis. We provide Elliott Wave chart in 4 different time frames, up to 4 times a day update in 1 hour chart, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! With our expert team at your side to provide you with all the timely and accurate analysis, you will never be left in the dark and you can concentrate more on the actual trading and making profits. Click for 14 day Trial

Good luck trading.

Hendra Lau of the Elliottwave-Forecast.com Team