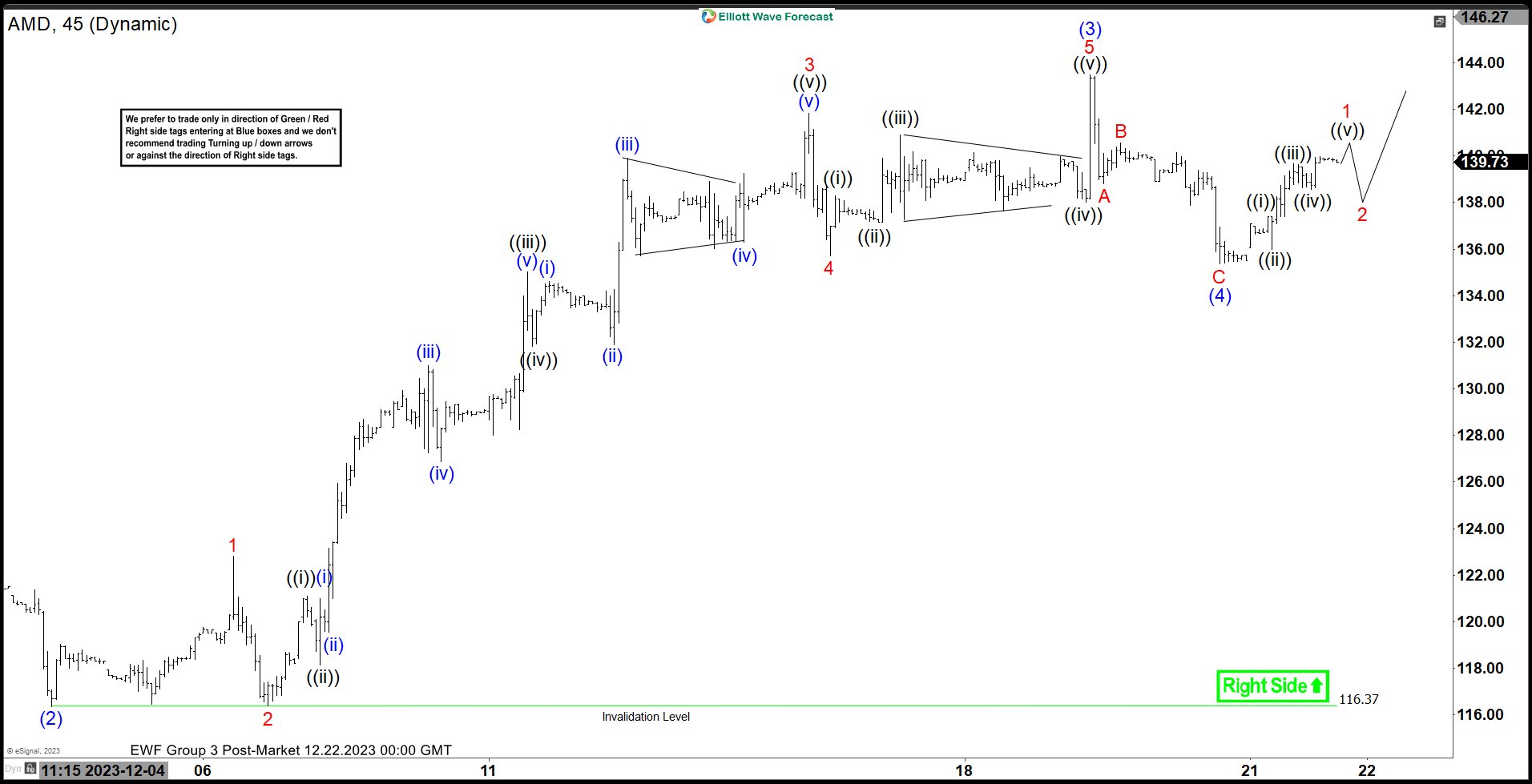

Short Term Elliott Wave View in AMD shows a bullish sequence from 10.26.2023 low favoring further upside. Up from 10.26.2023 low, wave (1) ended at 125.72 and dips in wave (2) ended at 116.37. The impulse is in progress as the 45 minutes chart below shows. Internal subdivision of wave (3) was unfolding as a 5 waves impulse Elliott Wave structure. Up from wave (2), wave 1 ended at 122.83 and pullback in wave 2 ended at 116.38. AMD then resumes higher in wave 3.

Up from wave 2, wave ((i)) ended at 121.00 and dips in wave ((ii)) ended at 118.14. The stock then resumed higher in wave ((iii)) towards 135.04 and pullback in wave ((iv)) ended at 131.83. Final leg wave ((v)) ended at 141.82 which completed wave 3. Pullback in wave 4 ended at 135.72. Wave 5 higher made a ending diagonal structure finishing at 143.47 also ended wave (3). Wave (4) correction built a zig zag structure ending at 135.37 low. As price action stays above this level, expect the AMD to extend higher in wave (5). We need to break above wave (3) to confirm that wave (5) is in progress to avoid a possible double correction in wave (4). Once the market breaks above 143.47, next area to keep an eye comes in 143.50 – 145.46 where the stock should be rejected to think that wave (5) and the impulse is completed.