Russell (RTY) shows a 3 swing from July 31, 2023 high favoring further downside to reach equal legs target. It breaks below August 25 low confirming the idea. The drop from July 31 high is unfolding as a zig zag correction Elliott Wave structure. Down from July 31 high, wave A ended at 1832.80 and wave B corrective rally ended at 1934. Wave C lower is currently in progress as a 5 waves impulse structure. The Index has broken below wave A at 1832.8 confirming the next leg lower has started.

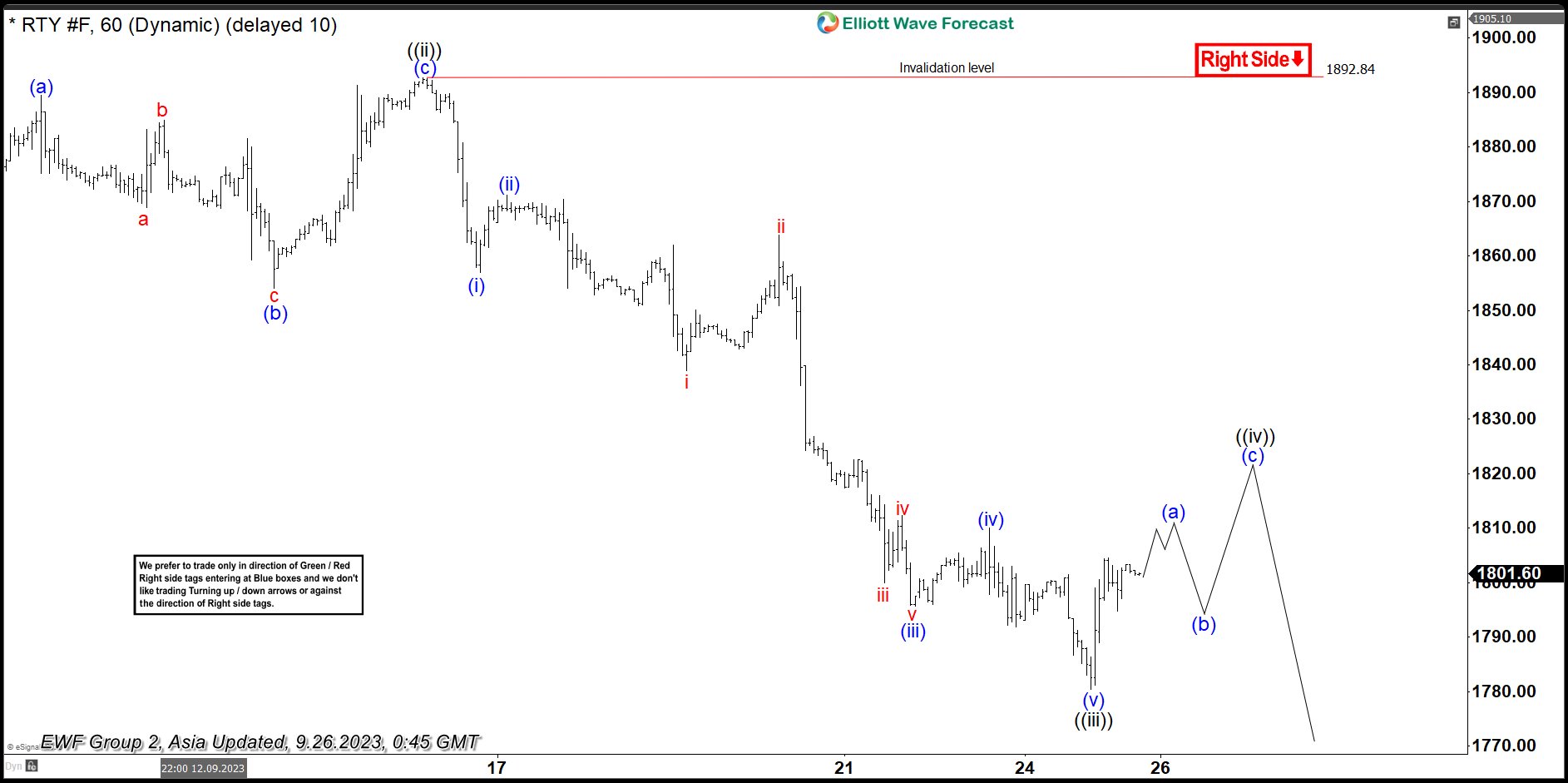

Down from wave B, wave ((i)) completed at 1849.40. A flat wave ((ii)) ended at 1892.70. The 1 hour chart below shows the wave ((ii)) starting point. Index then resumed lower in wave ((iii)) ending at 1780.40. Currently, the market is developing wave ((iv)); therefore, we expect a corrective rally in 3, 7 or 11 swing before it resumes to the downside in wave ((v)) of C. Near term, as far as pivot at 1892.84 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside. Potential target lower is 100% – 161.8% Fibonacci extension of wave A. This area comes at 1705 – 1749.