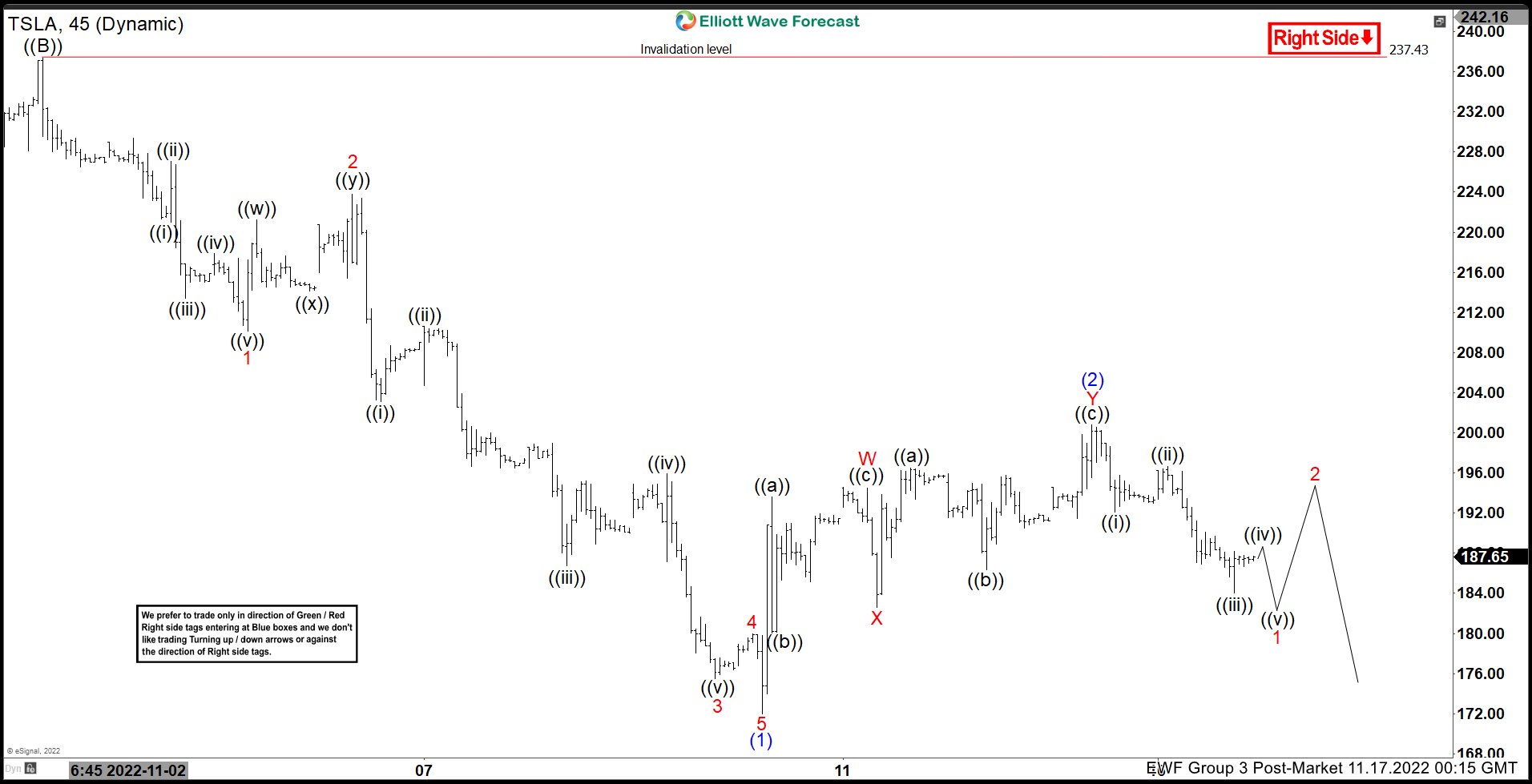

Short term Elliott Wave view in TESLA (ticker: TSLA) suggests the decline from 8.16.2022 high is unfolding as a zigzag Elliott Wave structure. Down from 8.17.2022 high, wave ((A)) ended at 198.33 and wave ((B)) rally ended at 237.43. The stock extends lower in wave ((C)) and the internal subdivision is in the form of a 5 waves impulse Elliott Wave structure.

Down from wave ((B)), wave 1 ended at 210.09 and rally in wave 2 ended at 223.71. Tesla then extends lower in wave 3 towards 175.39 and wave 4 rally ended at 180.01. Final leg lower wave 5 ended at 171.91 which completed wave (1) in higher degree. Wave (2) rally is completed as a double correction structure. Up from wave (1), wave W ended at 194.52, and pullback in wave X ended at 182.50. Wave Y bounce finished at 200.93 and the whole structure of wave (2). Wave (3) has already started and TSLA should continue to the downside as far as pivot at 200.93 high remains intact. Near term, it needs one more low to complete an impulse as wave 1. Then, it should see 3 corrective swings higher as wave 2 before turning lower again.