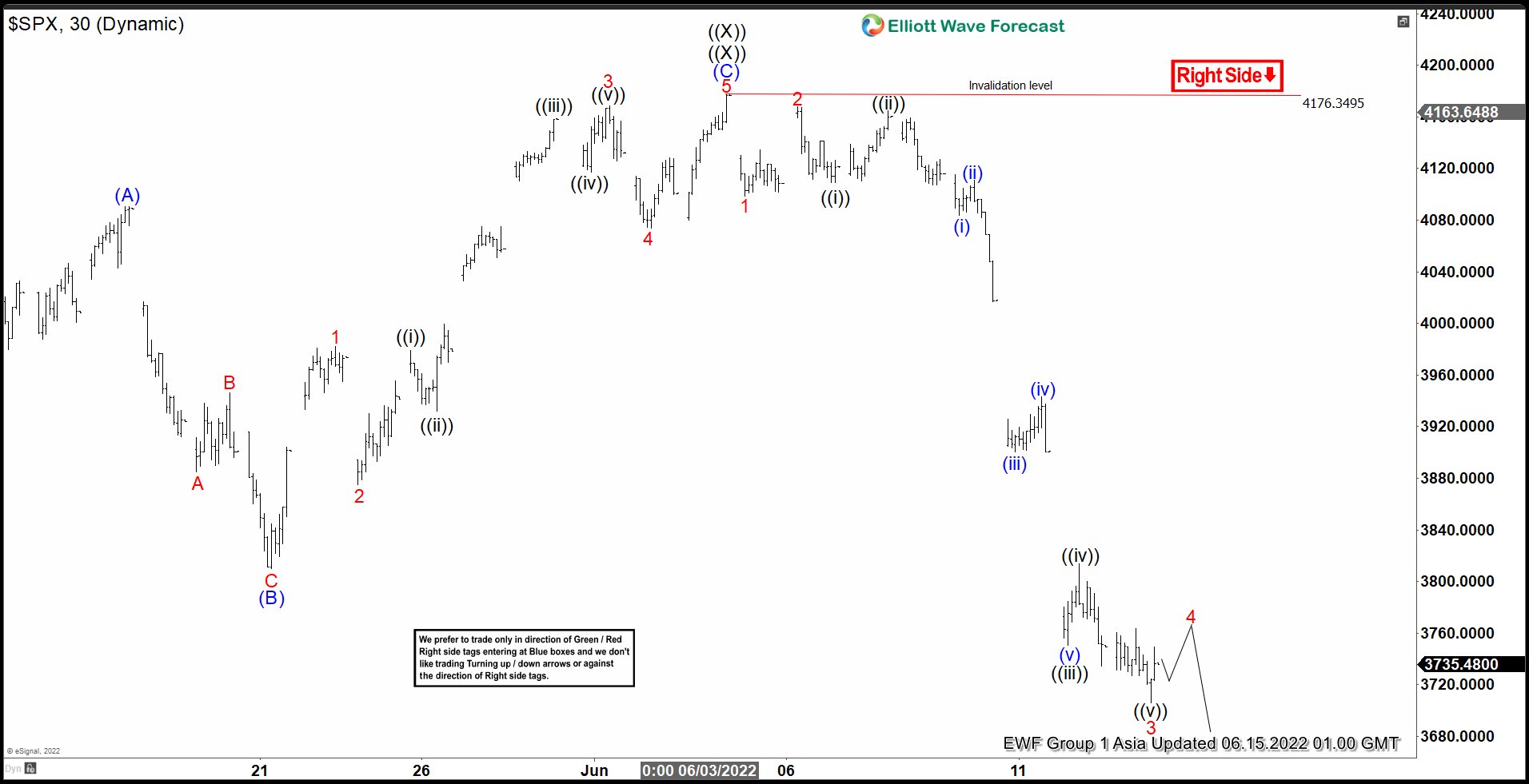

S&P 500 (SPX) broke below previous low on 5/21/2022 at 3810.32 and opens up a bearish sequence favoring further downside. The entire decline from 1/4/2022 high is unfolding as a triple three Elliott Wave structure. Triple three structure is an 11 swing corrective structure where W, Y, and Z subdivides into 3 waves. Down from 1/4/2022 high, wave ((W)) ended at 4222.62 and rally in wave ((X)) ended at 4637.3. Index then extended lower and ended wave ((Y)) at 3858.87 and rally in ((X)) ((X)) ended at 4176.35.

The 30 minutes chart below shows the decline from ((X)) ((X)) on 6/3/2022 high is in progress as an impulse Elliott Wave structure. Down from 6/3/2022, wave 1 ended at 4098.67 and rally in wave 2 ended at 4167.81. Index then extended lower in wave 3 towards 3705.68. Expect rally in wave 4 to end in 3, 7, or 11 swing and then Index can see a marginal low in wave 5 to complete wave (A). Afterwards, it should correct the entire decline from 6/3/2022 high in wave (B) before the decline resumes. Near term, as far as 6/3/2022 pivot at 4176.35 stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.