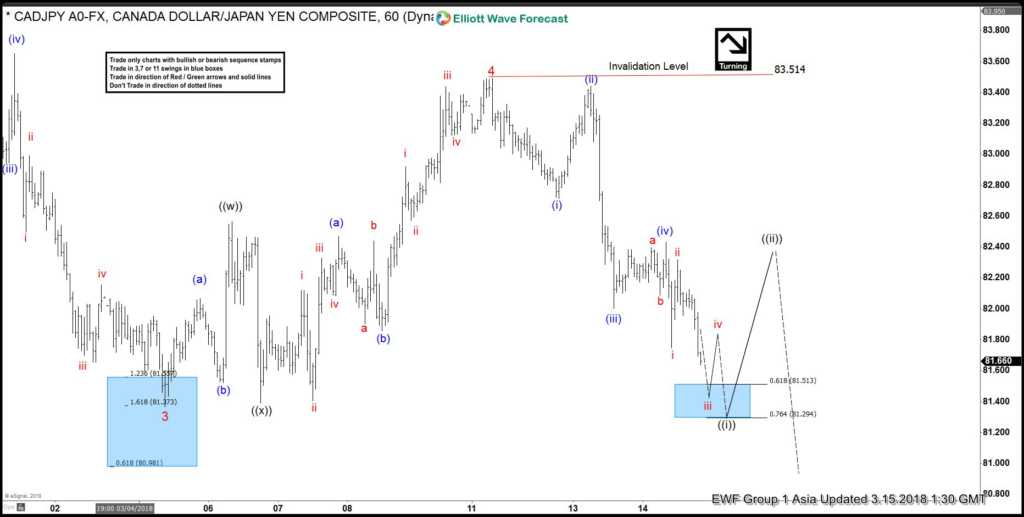

$CADJPY Elliott Wave view suggests that the decline from 1.5.2018 high (91.58) is unfolding as a 5 waves impulse Elliott Wave structure. Minor wave 3 of this impulsive move ended at 81.36 on 3.5.2018 and Minor wave 4 ended at 83.51 on 3.12.2018. While bounces stay below 83.51, pair now has scope to extend lower to finish Minor wave 5. However, in order to add validity to this view and to avoid a double correction in Minor wave 4, pair still needs to break below Minor wave 3 at 81.36 as final confirmation.

Minor wave 5 is currently in progress and subdivided also as a 5 waves impulse Elliott Wave structure. Down from 83.51, Minutte wave (i) ended at 82.71, Minutte wave (ii) ended at 83.44, Minutte wave (iii) ended at 82, and Minutte wave (iv) ended at 82.43. Near term focus is on 81.29 – 81.51 to end Minutte wave (v) and this will also end Minute wave ((i)) of a larger degree. Pair should then bounce in Minute wave ((ii)) in 3, 7, or 11 swing to correct cycle from 3/12/2018 high before the decline resumes. We don’t like buying the pair.

CADJPY 1 Hour Elliott Wave Chart

We provide precise forecasts with up-to-date analysis for 78 instruments. These include Forex, Commodities, World Indices, Stocks, ETFs and Bitcoin. Our clients also have immediate access to Market Overview, Sequences Report, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. In addition, we also provide Daily & Weekend Technical Videos, Live Screen Sharing Sessions, Live Trading Rooms and Chat room where clients get live updates and answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the markets. We believe our disciplined methodology and Right side system is pivotal for long-term success in trading