Nasdaq Short Term Elliott Wave view suggests that Intermediate wave (3) ended at 6429.5 and Intermediate wave (4) pullback is proposed complete at 6231.75. Subdivision of Intermediate wave (4) is unfolding as a double three Elliott wave structure where Minor wave W ended at 6283, Minor wave X ended at 6391.75, and Minor wave Y of (4) ended at 6231.75. Index still needs to break above Intermediate wave (3) at 6429.5 for this view to gain validity. Until then, we still can’t completely rule out a break below Intermediate wave (4) at 6231.75 in a double correction.

Near term, cycle from 12/5 low (6231.75) is mature and expected to complete soon with Minute wave ((w)). Index should then pullback in Minute wave ((x)) to correct cycle from 6231.75 low in 3, 7, or 11 swing before Index resumes the rally. We don’t like selling the proposed pullback.

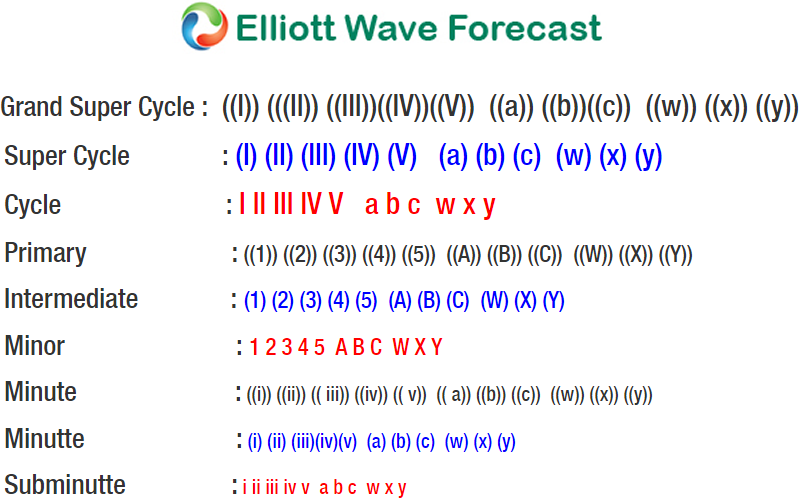

NQ_F Nasdaq 1 Hour Elliott Wave Chart

We provide precise forecasts with up-to-date analysis for 78 instruments. These include Forex, Commodities, World Indices, Stocks, ETFs and Bitcoin. Our clients also have immediate access to Market Overview, Sequences Report, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. In addition, we also provide Daily & Weekend Technical Videos, Live Screen Sharing Sessions, Live Trading Rooms and Chat room where clients get live updates and answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the markets. We believe our disciplined methodology and Right side system is pivotal for long-term success in trading