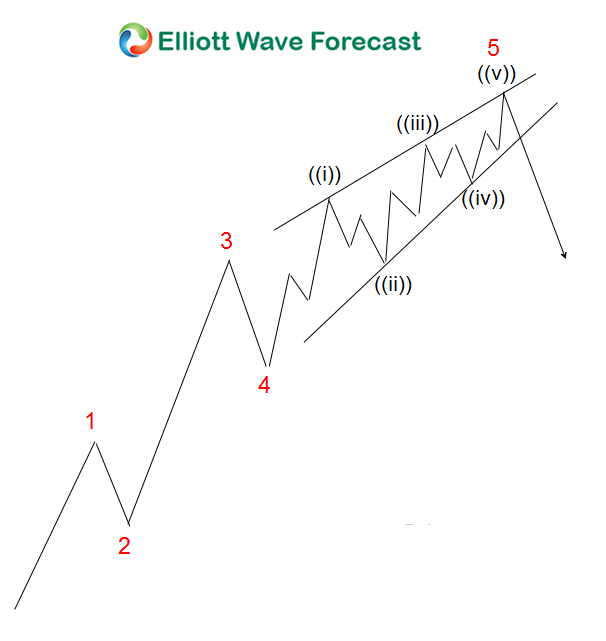

DXY Dollar Index Short Term Elliott Wave view suggests that the Index ended wave (3) at 91.01 and currently in a wave (4) which is proposed to be unfolding as a double three Elliott wave structure. Preferred view suggests rally to 92.01 completed wave W where as dip to 91.71 completed wave X as an Elliott wave FLAT. Near-term focus is on 92.32 – 92.47 area to complete wave ((a)) of Y before we get a pull back in wave ((b)) to correct the cycle from 91.71 low and another push higher towards 92.71 – 93.33 area to complete wave (4). From this area, DXY should resume the decline for new lows below 91.01 or pull back in larger 3 waves at least. We don’t like buying the Dollar Index and expect sellers to appear in 92.71 – 93.33 area for a 3 waves reaction lower at least.

DXY 1 Hour Elliott Wave Chart

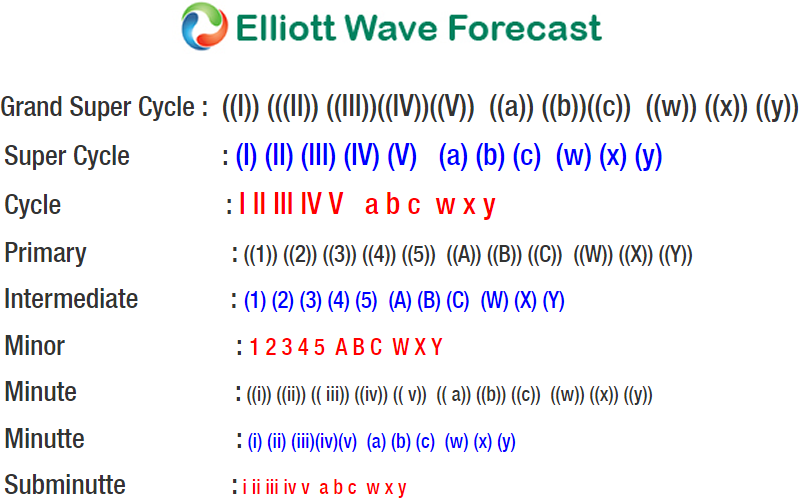

Ending Diagonal is an Elliott wave structure that typically happens inside wave 5 of an impulse or inside wave C of a zigzag. Ending Diagonal has 5 waves subdivision and each wave is further subdivided into 3 waves. Thus Ending Diagonal has the structure of 3-3-3-3-3. When Ending Diagonal happens within wave 5, the internal wave 1 of 5 and wave 4 of 5 can overlap. The Ending diagonal also often forms a wedge shape.