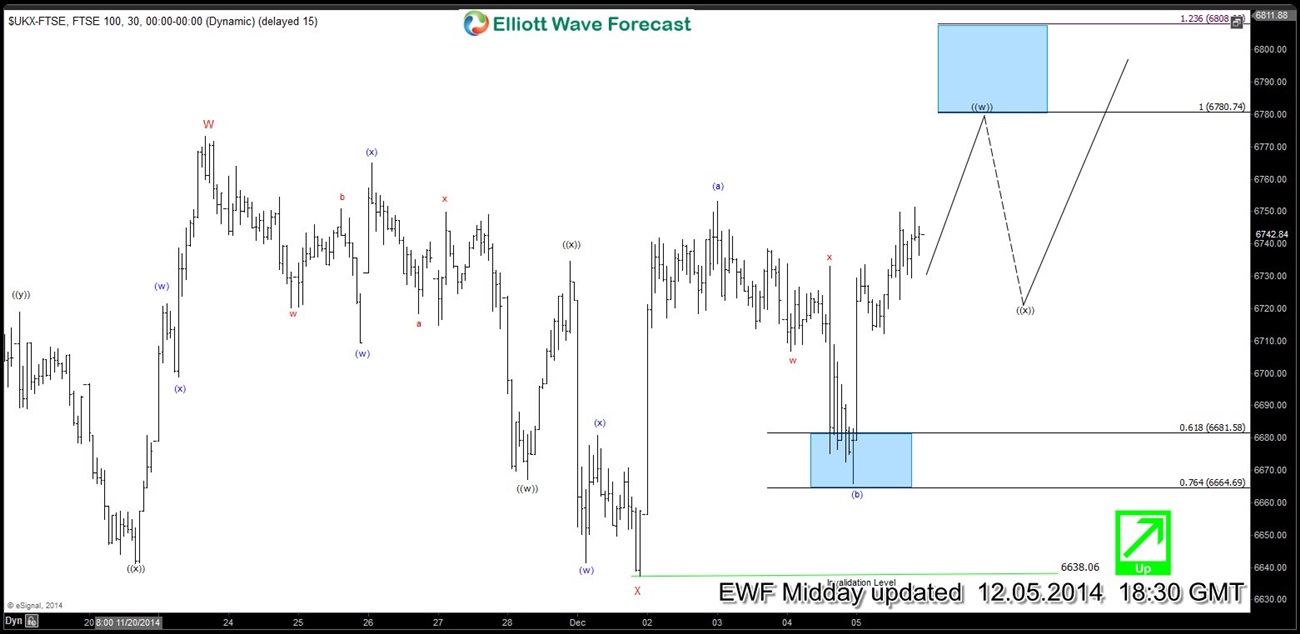

In our previous chart of the day updates posted on December 1 and December 2 , we were expecting the Index to rally and find buyers in the dips. Index pulled back in wave (b) as per preferred Elliott wave view and we think it’s over at 6665. Near-term focus is on 6780 – 6807 to complete wave (( w )) before we get a pull back in wave (( x )) to correct the rally from 6638 low and higher again. If 6807 is exceeded, then next level of interest would be 6839 which is 0.618 ext of W-X. We don’t like selling the Index and (( x )) wave pull back would present another short-term opportunity for buyers provided pivot at 6638 low kept on holding during that pull back.

We do Elliott Wave Analysis of 26 instruments in 4 time frames (Weekly, Daily, 4 Hour and 1 Hour) with 1 hour charts updated 4 times a day so clients are always in loop for the next move. Please feel free to come visit around the website and click Here to Start your Free 14 day Trial (No commitments, Cancel Anytime)