In the video seminar below, we discuss about various Elliott Wave structure and the Fibonacci ratio. The following excerpt comes from the opening of the video. You can skip to the video directly if you want to watch the seminar

Excerpt of the Seminar

Elliott Wave Structures are part of Elliott Wave Theory. It is a form of technical analysis to analyze financial market cycles and forecast trends. The name comes after Ralph Nelson Elliott (1871 – 1948). It is inspired by the Dow Theory and observations throughout nature. Elliott concluded that we can predict the movement of the stock market by identifying a repetitive pattern of waves.

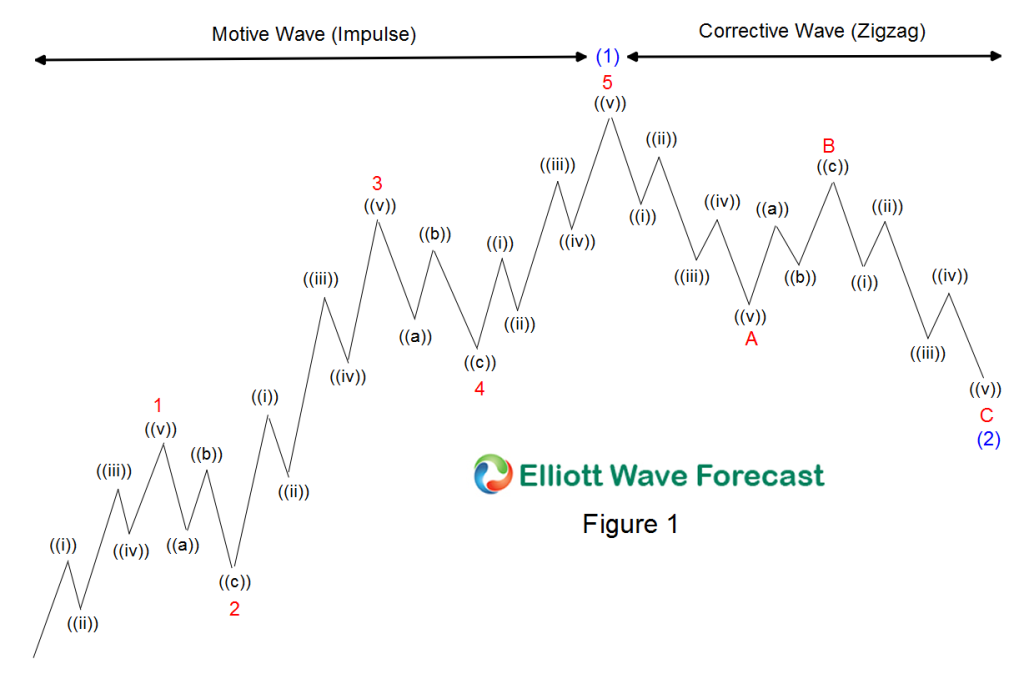

Elliott noted from his observation that movement in the direction of the trend is always in five waves. The trend move gets the label of 1, 2, 3, 4, and 5. This is also usually called motive wave. Movement against the trend is always in three waves and is also called corrective wave. Three wave corrections get the label of a, b, c.

Elliott observed the fractal nature of waves. Smaller patterns can appear within bigger patterns. In this sense, Elliott Wave structures are like a piece of broccoli. The smaller broccoli piece will look like the big piece. This information together with the Fibonacci relationships between the waves, offers the trader a level of anticipation and/or prediction when searching for and identifying trading opportunities with solid reward/risk ratios

Today’s trading environment however is different than the one in 1930s when Elliott Wave Theory came about. Today, we have computer algos and machines trading in seconds or milliseconds purely based on technical, probabilities, and statistics. In today’s environment, the biggest change is in the definition of trend and counter-trend move. Nowadays, trends can move both in 3 waves and 5 waves. In other words, trend can move in corrective structures and thus we believe that trends do not have to be in 5 waves.

This text is taken from opening slides of the Elliott Wave Structure and Fibonacci Ratio Seminar recording of which is available below.

Elliott Wave Structure & Fibonacci Ratio Seminar Recording

To learn more about Elliott Wave and our trading technique of 3, 7 or 11 swings, check out our Educational classes and sign up for a Free 14 day Trial. At EWF, we cover 52 instrument in different asset classes from forex, commodities, and indices. We provide Elliottwave forecast in 4 different time frames, Live Trading Room, 24 hour chat room, live sessions, and much more.