Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is the world’s largest dedicated independent (pure-play) semiconductor foundry and it’s located in the Hsinchu Science and Industrial Park in Hsinchu, Taiwan.

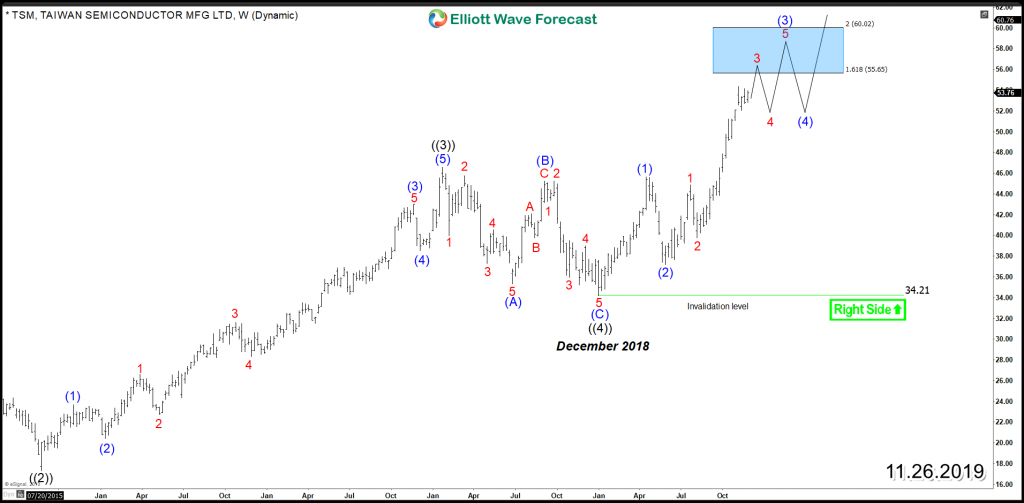

In 2018, TSM spent the year in a corrective structure after it ended the 5 waves advance from 2015 low. The stock did correction unfolded as 3 waves Zigzag Structure which ended in December 2018 low at $34.2 then it turned higher from there breaking to new all time highs.

Up from $34.2 low, TSM initiated an impulsive rally with an incomplete sequence suggesting further upside to be seen for the stock as it’s still trading within the 3rd wave higher which is usually the strongest wave within a bullish cycle. The current rally can see further extension higher toward extreme area $55 – $60 from where a 3 waves pullback takes place before the stock resume higher. Consequently, buyers are expected to remain in control and continue looking to buy during pullbacks in 3 or 7 swing as long as 20018 cycle remain in progress.

TSM Weekly Chart

Get more insights about the Semiconductor Sector and learn how to trade our blue boxes using the 3, 7 or 11 swings sequence by trying out our services 14 days . You will get access to our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.