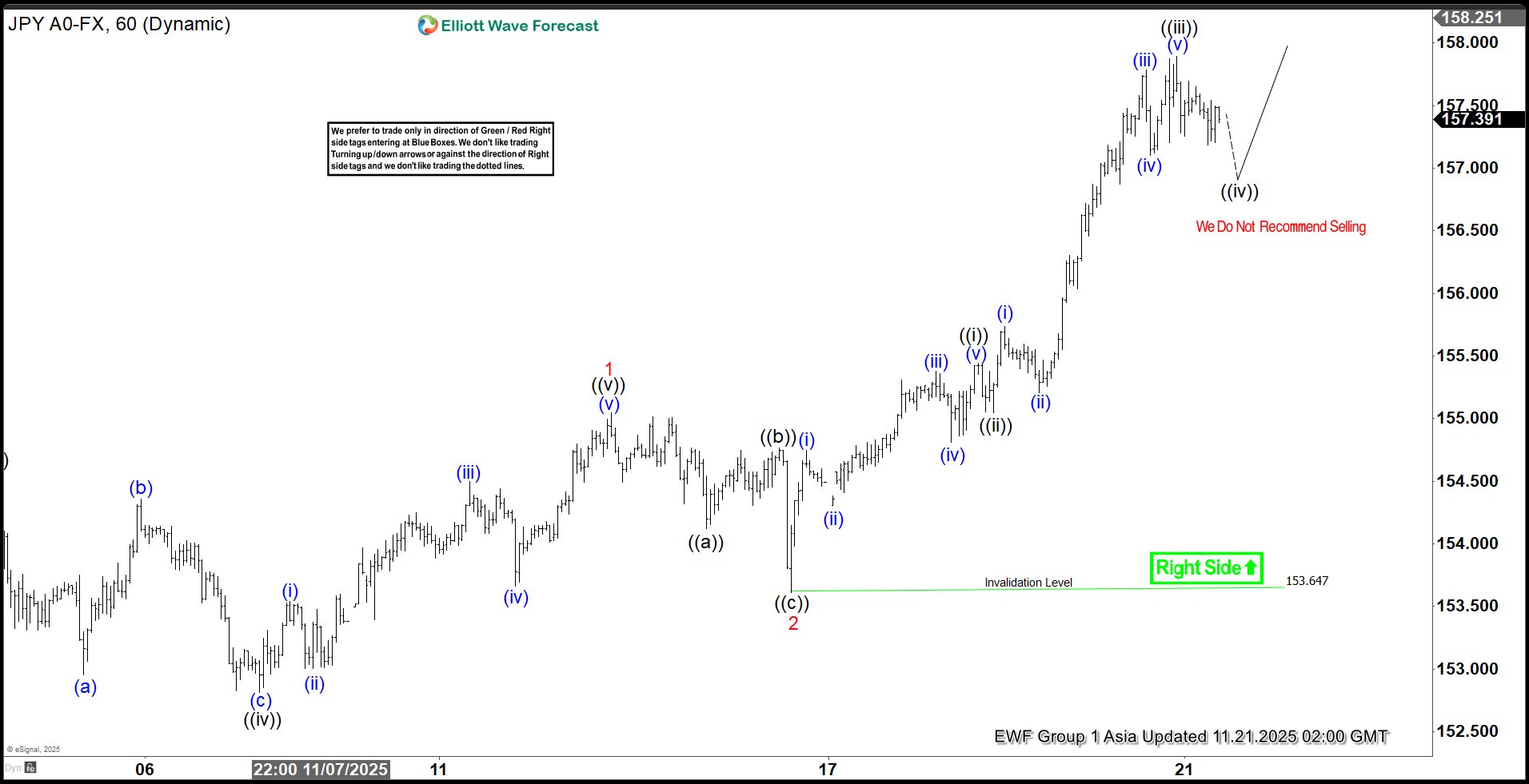

The short-term Elliott Wave outlook for USDJPY indicates that the cycle from the October 17 low remains in progress as a five-wave impulsive structure. From that low, wave 1 concluded at 155.04, followed by a corrective pullback in wave 2, which ended at 153.60, as illustrated in the accompanying one-hour chart. Subsequently, the pair resumed its upward trajectory in wave 3, unfolding with internal subdivisions that reflect a lower-degree five-wave impulse.

Within this advance, wave ((i)) completed at 155.44, while the corrective dip in wave ((ii)) found support at 155.04. The pair has since extended higher in wave ((iii)), which is progressing toward the 157.89 level. Currently, a pullback in wave ((iv)) is underway, serving to correct the cycle that began from the November 18 low. Once this retracement concludes, the pair is expected to resume its upward movement in wave ((v)).

In the near term, as long as the pivot at 153.60 remains intact, any dips should find support in either a 3-, 7-, or 11-swing corrective structure, paving the way for further gains. The next potential upside target lies within the 100% to 161.8% Fibonacci extension range measured from the October 17 low. This zone spans from 159.26 to 162.75.