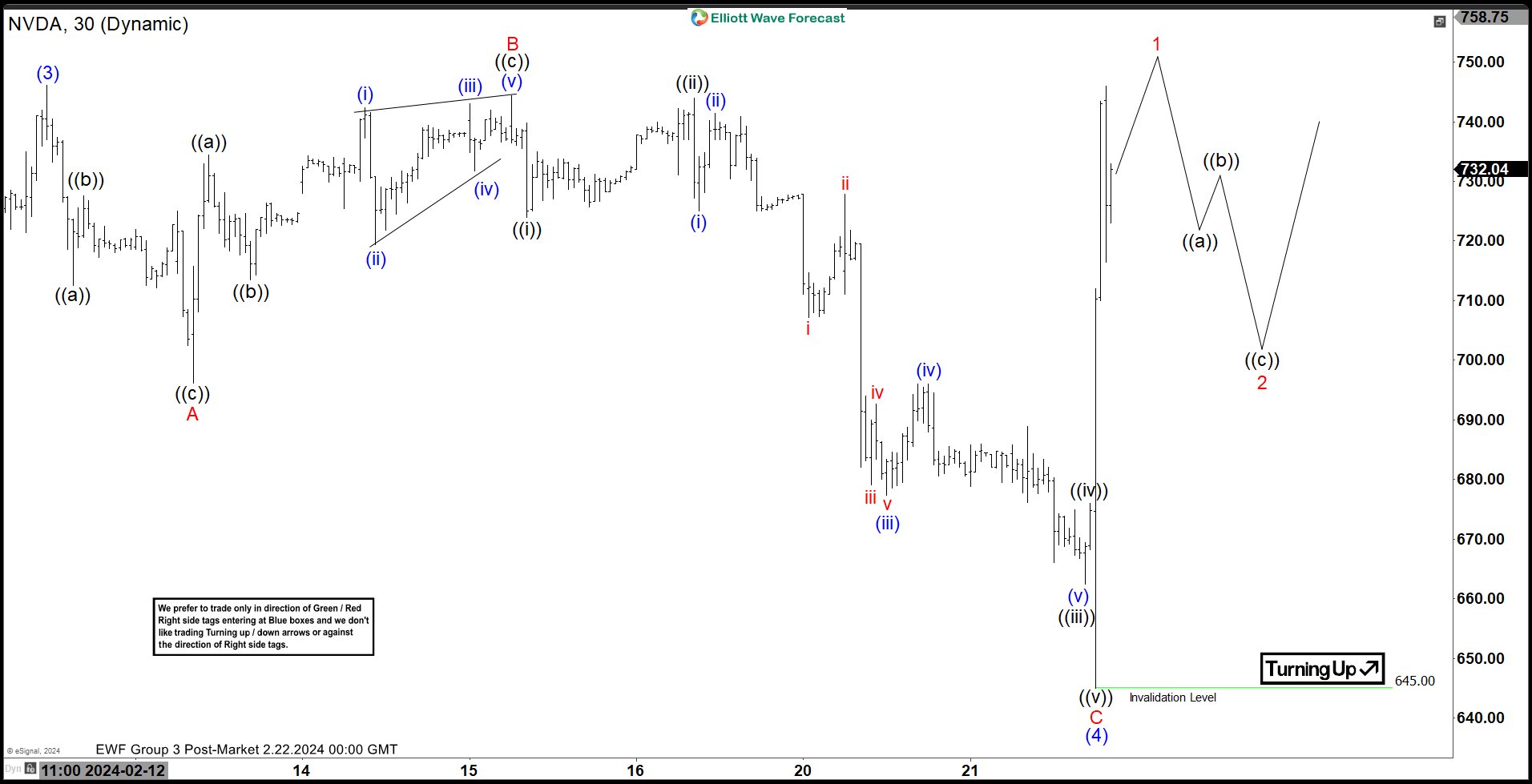

Short Term Elliott Wave View in Nvidia (NVDA) suggests that the rally from 12.4.2023 low is in progress as a 5 waves impulse. Up from 12.4.2023 low, wave (1) ended at 504.33 and pullback in wave (2) ended at 473.20. The stock rallied higher in wave (3) which ended at 746.11. Wave (4) pullback ended at 465 with internal subdivision as a flat Elliott Wave structure.

Down from wave (3), wave ((a)) ended at 712.5 and wave ((b)) ended at 727.63. Wave ((c)) lower ended at 696.20 which completed wave A in higher degree. Up from there, wave ((a)) ended at 734.5 and wave ((b)) ended at 713.50. Wave ((c)) higher ended at 744.33 which completed wave B in higher degree. The stock then turned lower in 5 waves impulse. Down from wave B, wave ((i)) ended at 724 and wave ((ii)) ended at 744.02. Wave ((iii)) lower ended at 662.48 and wave ((iv)) ended at 676.

Final leg wave ((v)) ended at 645 which completed wave C of (4). The stock has turned higher in wave (5). Up from wave (4), wave 1 of (5) should end soon, then it should pullback in wave 2 of (5) before the stock resumes higher. Near term, as far as pivot at 645 low stays intact, expect pullback to find support in 3, 7, 11 swing for further upside.