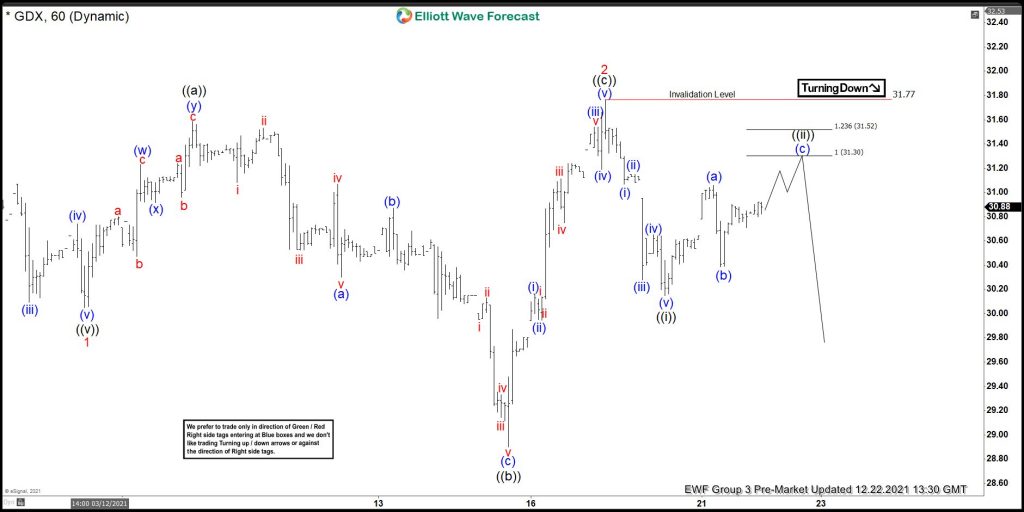

The Elliott wave view in GDX suggests that the main cycle from the August 20, 2020 peak is showing an incomplete sequence. Favoring more downside to happen based on sequence towards $24.80- $21.36 area lower before a turn back higher happens. While the short-term cycle suggests that the decline to $30.05 low ended wave 1 of (C) in 5 waves lower. Up from there, GDX did an expanded flat correction in wave 2 bounce.

While an initial 3 swing bounce ended wave ((a)) at a $31.59 high. Down from there, wave ((b)) also ended in 3 swings at $28.90 low. Then the bounce in ((c)) leg unfolded in 5 wave impulse sequence. In which, wave (i) ended at $30.16 high, wave (ii) ended at $29.95 low, wave (iii) ended at $31.54, wave (iv) ended at $31.19 low, and wave (v) ended at $31.77 high. Thus ended wave 2 as an expanded flat correction.

Below from there, GDX declined in 5 waves lower & ended small wave ((i)) of 3 at $30.15 low. And now doing a 3 swing bounce in wave ((ii)), which can see $31.30- $31.52 area before turning lower again. Near-term, as far as bounces fail below $31.77 high then ETF is expected to fail lower looking for more downside. Alternatively, if it breaks above $31.77 high then it can even see $33.01- $34.77 area higher before seeing sellers again.