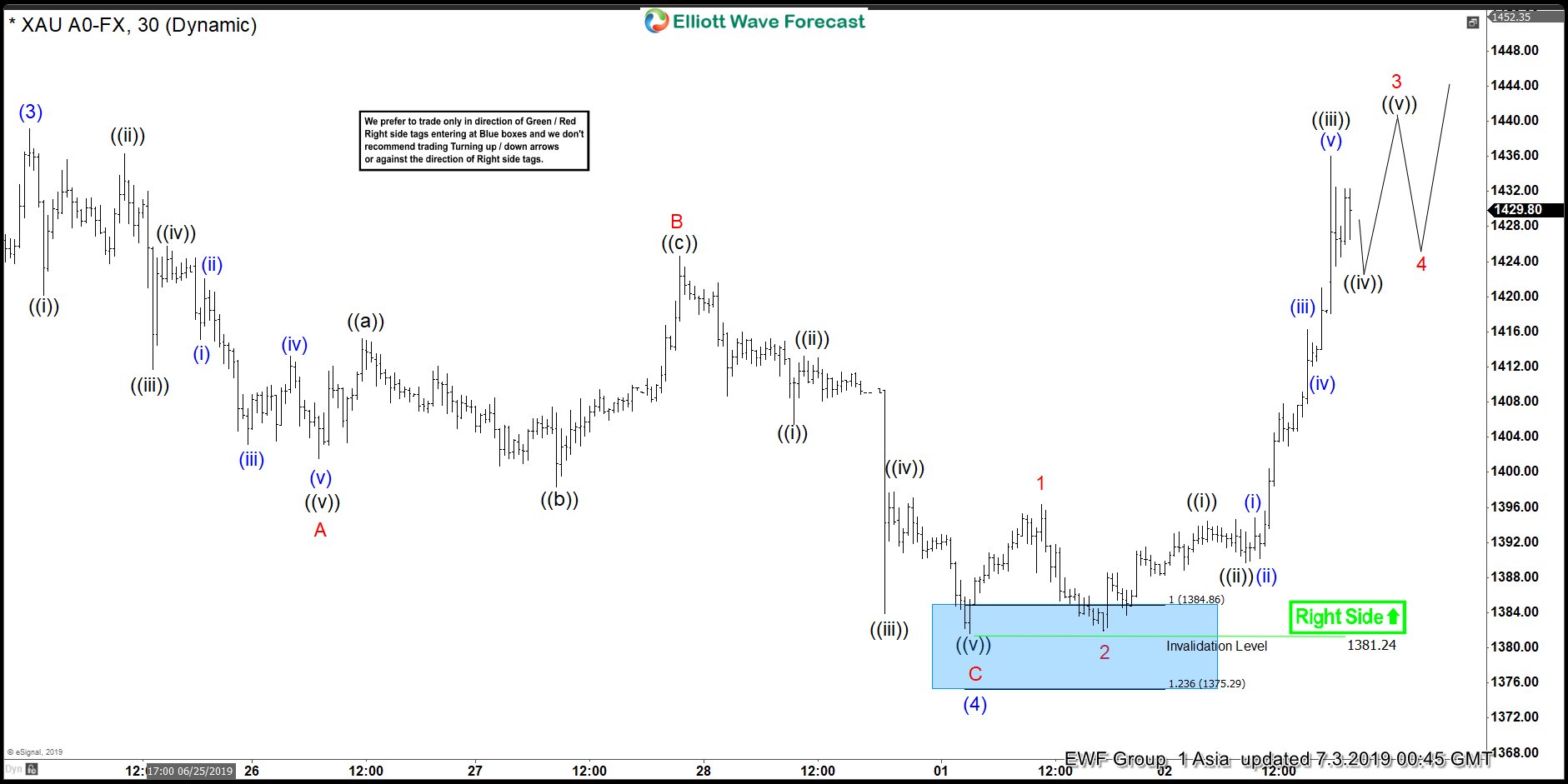

Short Term Elliott wave view in Gold suggests that the decline to $1381.42 low on July 1 ended wave (4). Above from there, the yellow metal is rallying higher as an impulse Elliott Wave structure looking for more upside within wave (5). Up from July 1 low, wave 1 ended at 1396.35 and wave 2 pullback ended at 1381.9. Wave 3 is currently in progress and also subdivides as a 5 waves impulse in lesser degree.

Wave ((i)) ended at 1394.45, wave ((ii)) ended 1389.7, wave ((iii)) ended at 1436.04, and wave ((iv)) ended at 1421.75. Expect the yellow metal to extend higher 1 more leg to end wave ((v)) of 3. Afterwards, it should pullback in wave 4 before more upside is seen. We don’t like selling Gold and expect buyers to show up in the dips in 3, 7, or 11 swing as far as pivot at 1381.4 low stays intact. Potential target to the upside is 100% extension from August 16, 2018 low. This can bring the yellow metal to 1453 – 1497 area before possibly ending the cycle and see a larger 3 waves pullback.