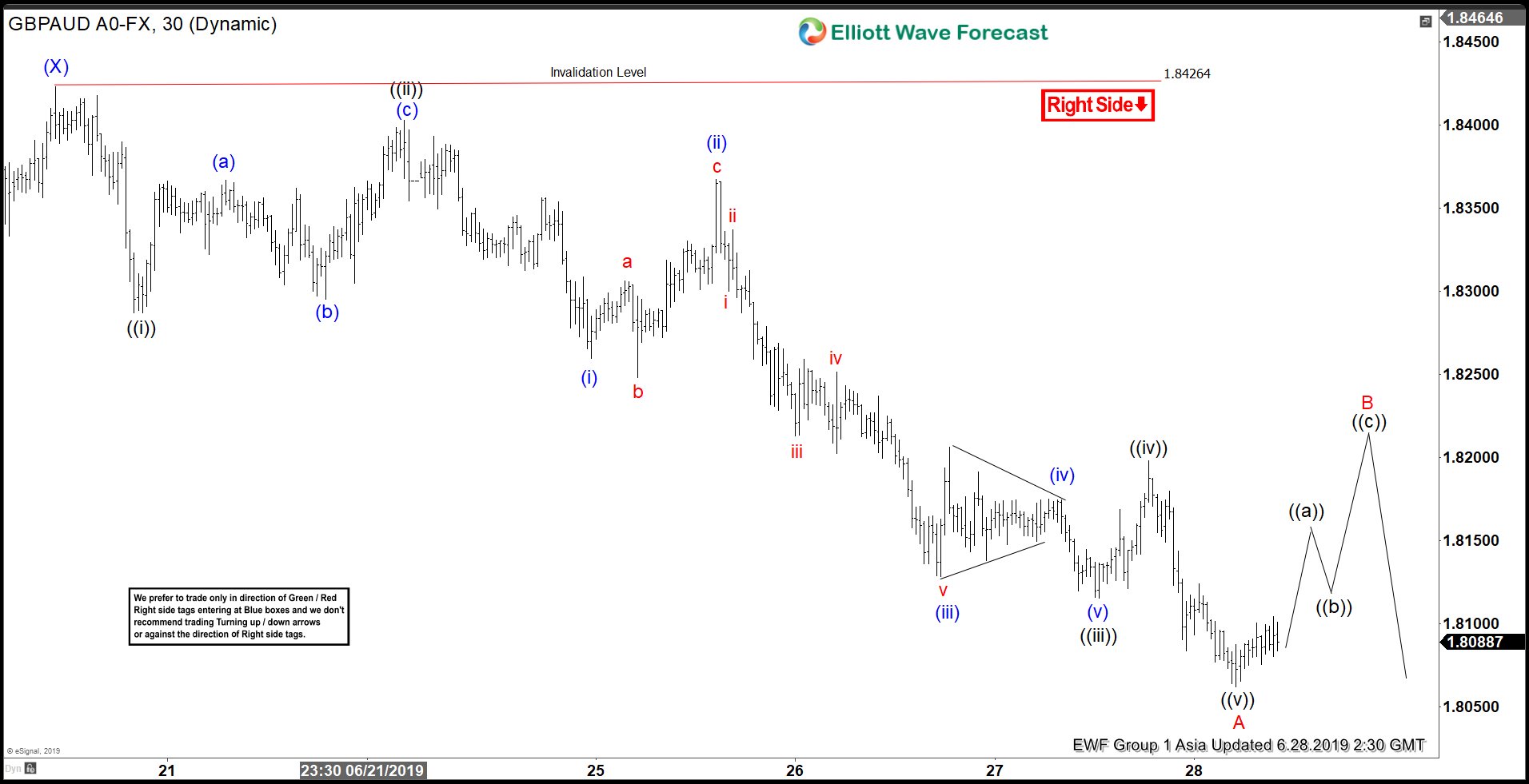

Short term Elliott Wave view on GBPAUD suggests the rally to 1.8426 ended wave (X) on June 20. The decline from there is unfolding as a zigzag Elliott Wave structure. A zigzag is an ABC structure which subdivides in 5-3-5. The decline from June 20 high (1.8426) to June 28 low (1.8062) ended wave A of this zigzag. The internal of wave A subdivides as an impulse Elliott Wave structure. Wave ((i)) of A ended at 1.8287 and wave ((ii)) of A ended at 1.8403. Pair then resumes lower in wave ((iii)) of A to 1.8115, wave ((iv)) of A ended at 1.8198, and wave ((v)) of A is proposed complete at 1.8062.

At this stage, there’s not enough separation from the low and pair still can make marginal low. If pair breaks below 1.8062, then the 5 waves move lower from June 20 high remains in progress. Otherwise, pair can start to see wave B bounce to correct cycle from June 20 high before the decline resumes. We don’t like buying the pair and expect rally to fail in 3, 7, or 11 swing as far as pivot at 1.842 high stays intact.