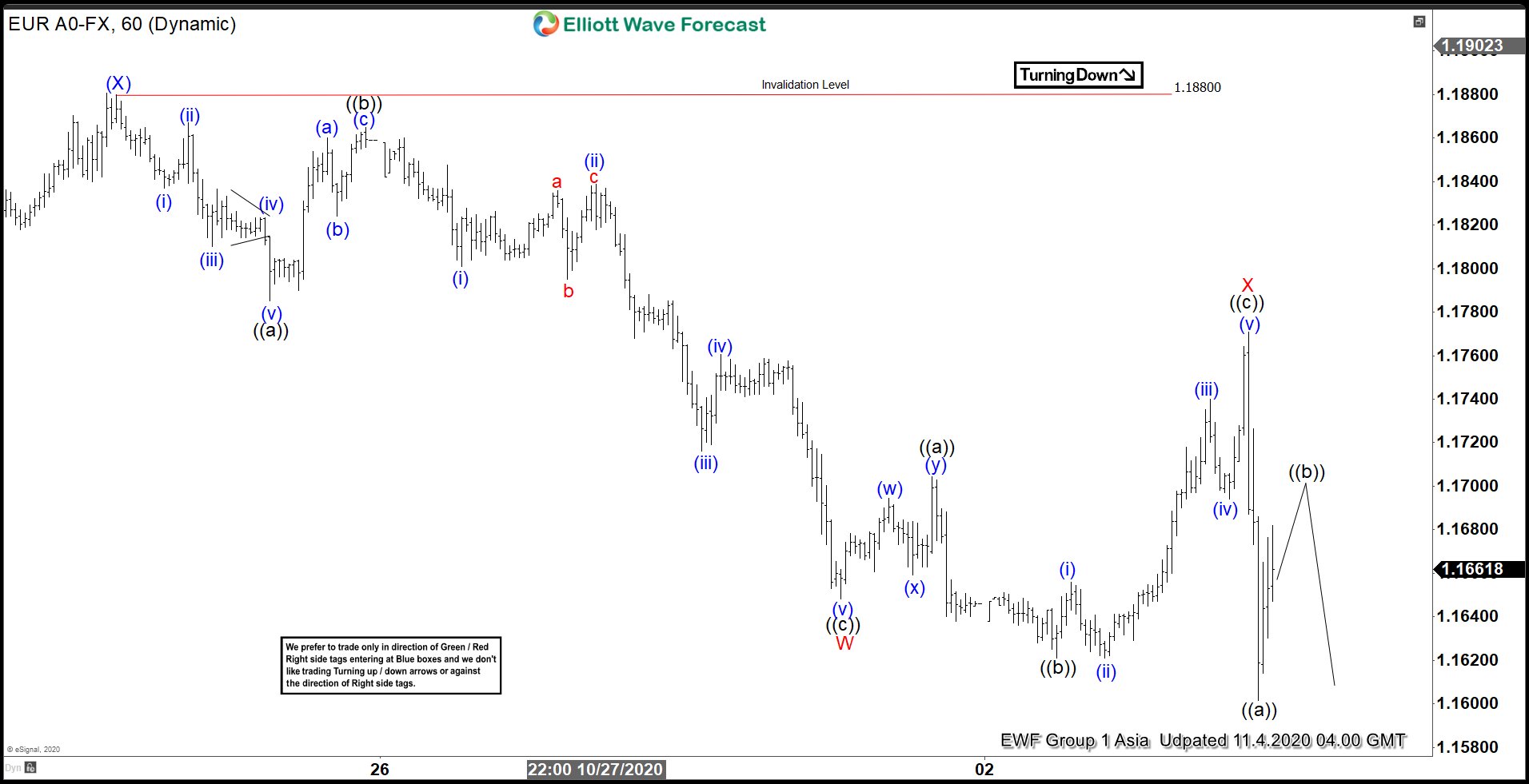

EURUSD still shows an incomplete sequence from September 1 peak and has scope for further downside. Decline from September 1 peak is unfolding as a double three Elliott Wave structure. Down from September 1 peak, wave (W) ended at 1.1611 and wave (X) bounce ended at 1.188. Wave (Y) is currently in progress as a another double three in lesser degree.

Down from wave (X) high at 1.188, wave ((a)) ended at 1.1785, wave ((b)) ended at 1.1865, and wave ((c)) ended at 1.1648. This zigzag move ended wave W in higher degree. Wave X bounce ended at 1.177 as an expanded flat where wave ((a)) ended at 1.1704, wave ((b)) ended at 1.1621, and wave ((c)) ended at 1.177. Pair has started to turn lower again in wave Y. Down from wave X at 1.177, wave ((a)) ended at 1.1601. Near term, while wave ((b)) rally fails below 1.177, expect pair to extend lower. Potential target lower in wave (Y) is 100% – 123.6% Fibonacci extension from September 1 high, which comes at 1.124 – 1.148. If pair reaches this area, buyers should appear for more upside or 3 waves bounce at least.