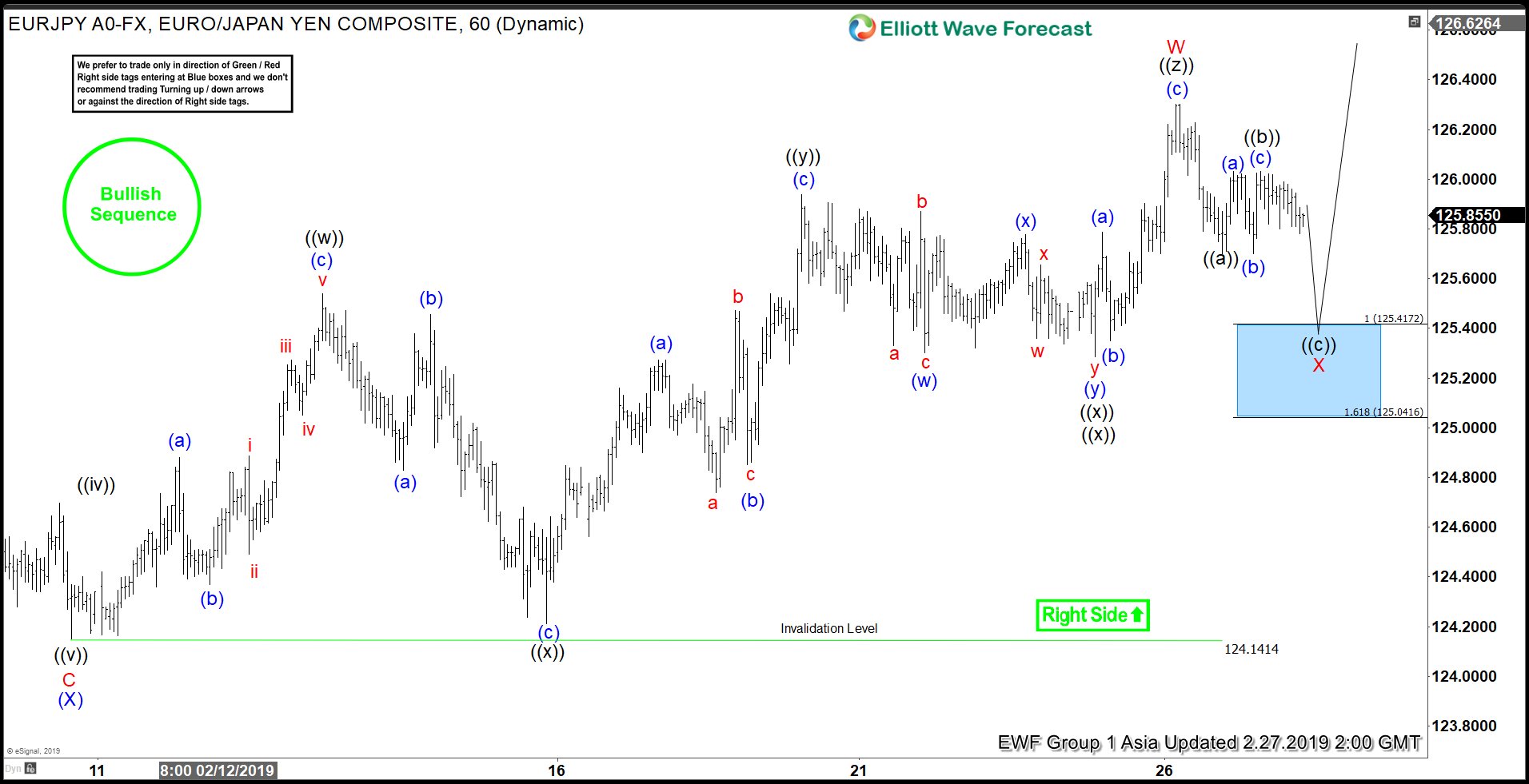

After bottoming on January 3, 2019 low, EURJPY shows a sequence of higher high and higher low. We can see from the chart below that it has a bullish sequence and right side higher stamp. This suggests that pair should resume to the upside as far as dips stay above 124.1 (the invalidation level). Rally from February 9 low (124.14) unfolded as a triple three Elliott Wave structure. Up from 124.14, wave ((w)) ended at 125.54 and pullback to 124.21 ended wave ((x)). Pair then rallied in wave ((y)) to 125.94, second wave ((x)) pullback ended at 125.28, and wave ((z)) ended at 126.3. This move ended wave W of a larger degree.

Wave X pullback is in progress to correct the rally from 124.14 low in the sequence of 3, 7, 11 swing before the rally resumes. The next extreme area in 3 swing will come at 125.04 – 125.4 where buyers can appear and pair can at least bounce in 3 waves. The internal of wave X is unfolding as a zigzag Elliott Wave structure. Down from 126.3, wave ((a)) ended at 125.7, wave ((b)) ended at 126.03, and we we expect wave ((c)) of X to end at 125.04 – 125.41. As far as pivot at 124.14, the pair can see further upside once wave X pullback is complete.