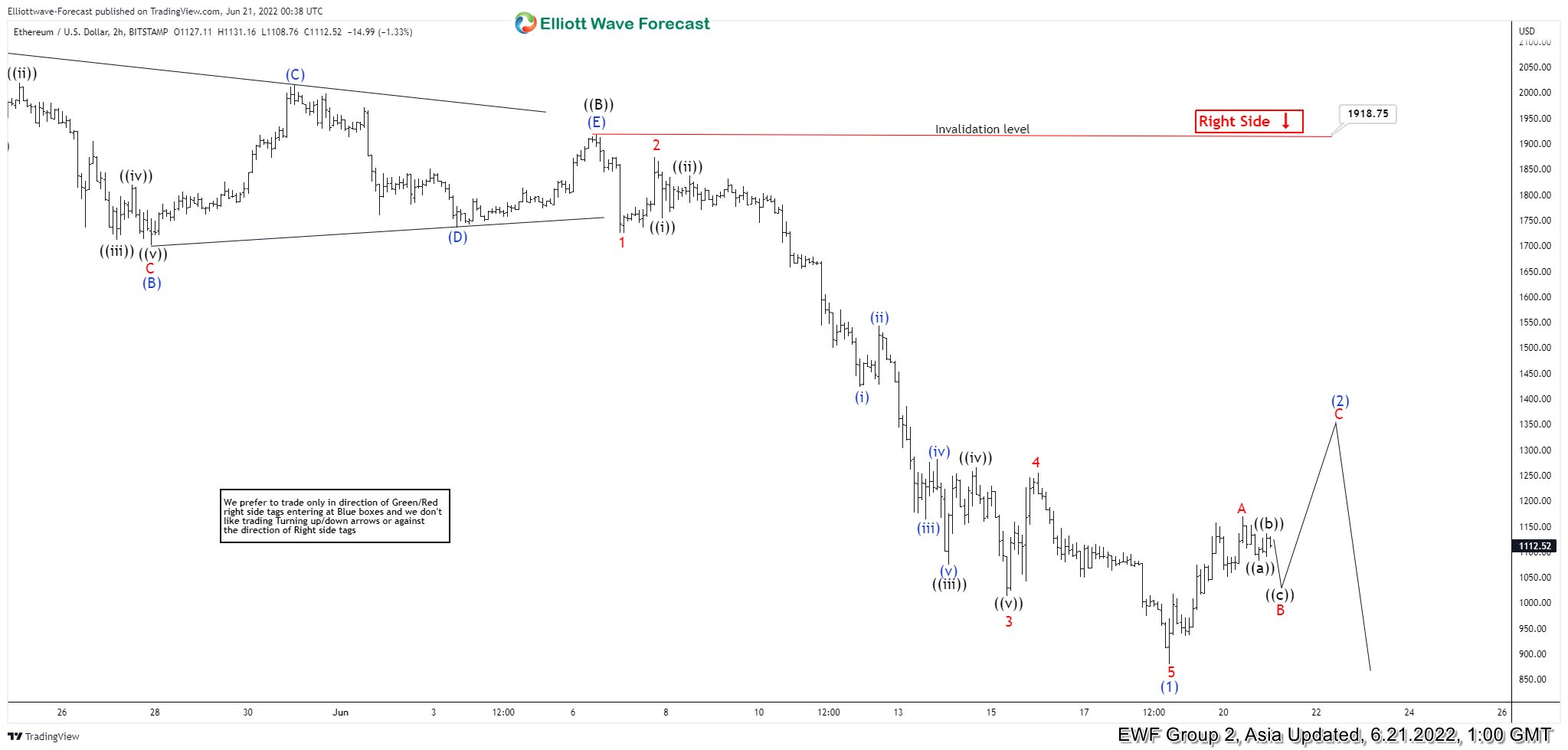

Short term Elliott Wave view in Ethereum (ETHUSD) suggests that the decline from March 28, 2022 high is unfolding as a zigzag Elliott Wave structure. Down from March 28, 2022 high, wave ((A)) ended at 1700 and wave ((B)) ended at 1918.17. Wave ((C)) lower is currently in progress as the chart below shows. Internal subdivision of wave ((C)) is unfolding as a 5 waves impulse structure. Down from wave ((B)), wave 1 ended at 1725.21 and rally in wave 2 ended at 1874.03. The crypto currency then extends lower again in wave 3 towards 1013, and rally in wave 4 ended at 1255.55. Final leg lower wave 5 ended at 880 which completed wave (1).

Wave (2) rally is now in progress as a zigzag structure to correct cycle from June 6 high before the decline resumes. Up from wave (1), wave A ended at 1169.50. Expect Ethereum to pullback in wave B then rally again in wave C before ending wave (2) and turns lower. Near term, as far as June 6 pivot high at 1918.75 stays intact, expect rally to fail in 3, 7, or 11 swing for further downside. Potential target lower is 100% – 123.6% Fibonacci extension from November 2021 high which comes at 233 – 872 area.