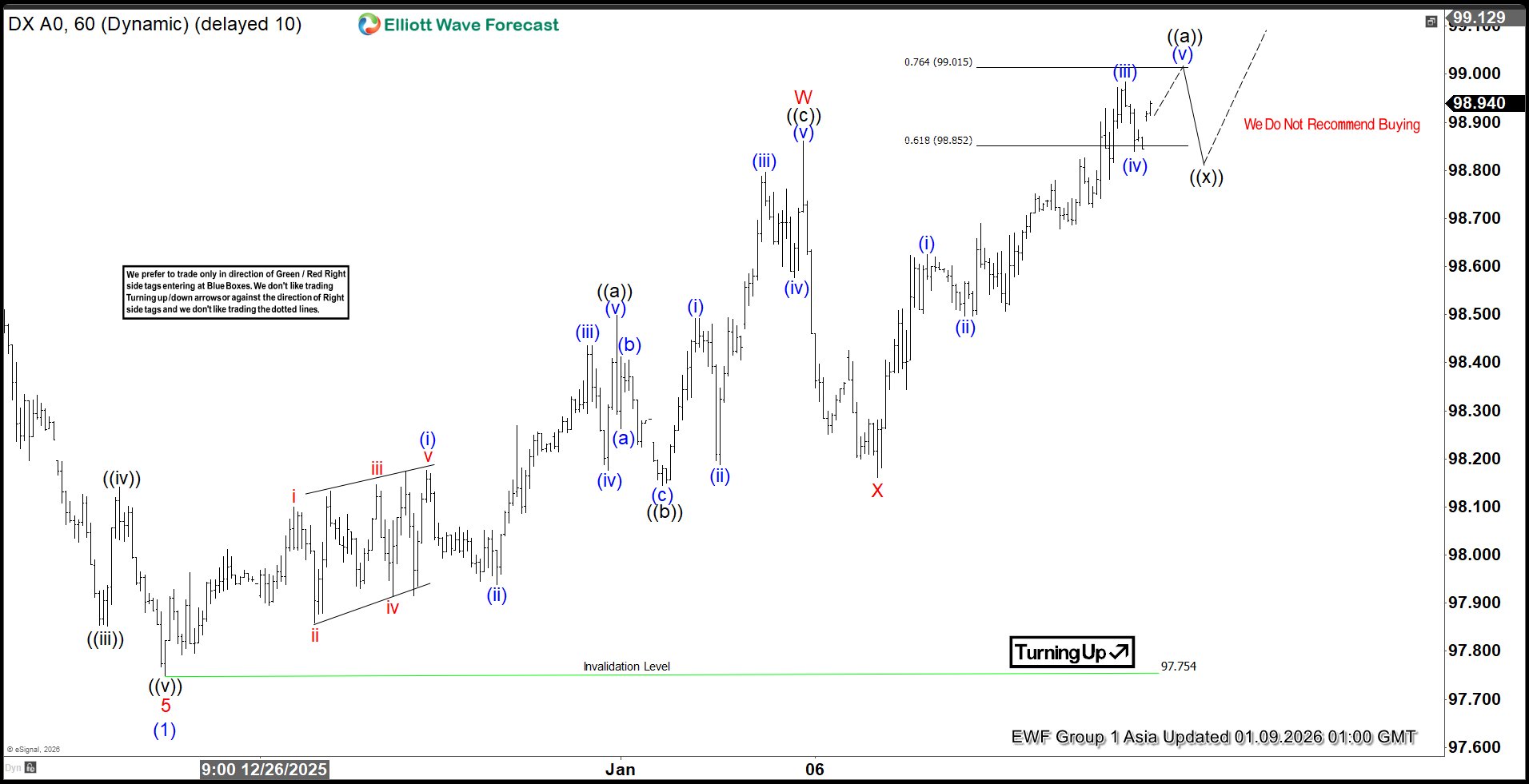

The short-term sequence from the December 24, 2025 low is unfolding as a double three Elliott Wave structure. From that low, wave ((a)) advanced to 98.5. A corrective pullback in wave ((b)) followed and ended at 98.14. Wave ((c)) then moved higher, reaching 98.86, which completed wave W at a higher degree. Afterward, wave X retraced and finished at 98.16.

From this point, the Index resumed its upward path in wave Y. This leg subdivides into another zigzag of lesser degree. Rising from wave X, the Index appears ready to extend one more push higher to complete wave ((a)). Once that advance is achieved, a corrective pullback in wave ((b)) should unfold. This correction will adjust the cycle that began from the January 6, 2025 low. Afterward, the sequence is expected to resume higher.

The potential target for the next advance is defined by the 100% to 161.8% Fibonacci extension of wave W. This zone lies between 99.2 and 100. Sellers are likely to emerge in this area, producing either renewed downside pressure or at minimum a three-wave corrective pullback.

In the near term, as long as the pivot at 97.75 remains intact, pullbacks should find support within the 3, 7, or 11 swing sequence. Traders should remain attentive to the 99.2–100 region. It represents a critical juncture for the next directional move and will likely determine whether the Index continues higher or pauses for a deeper correction.