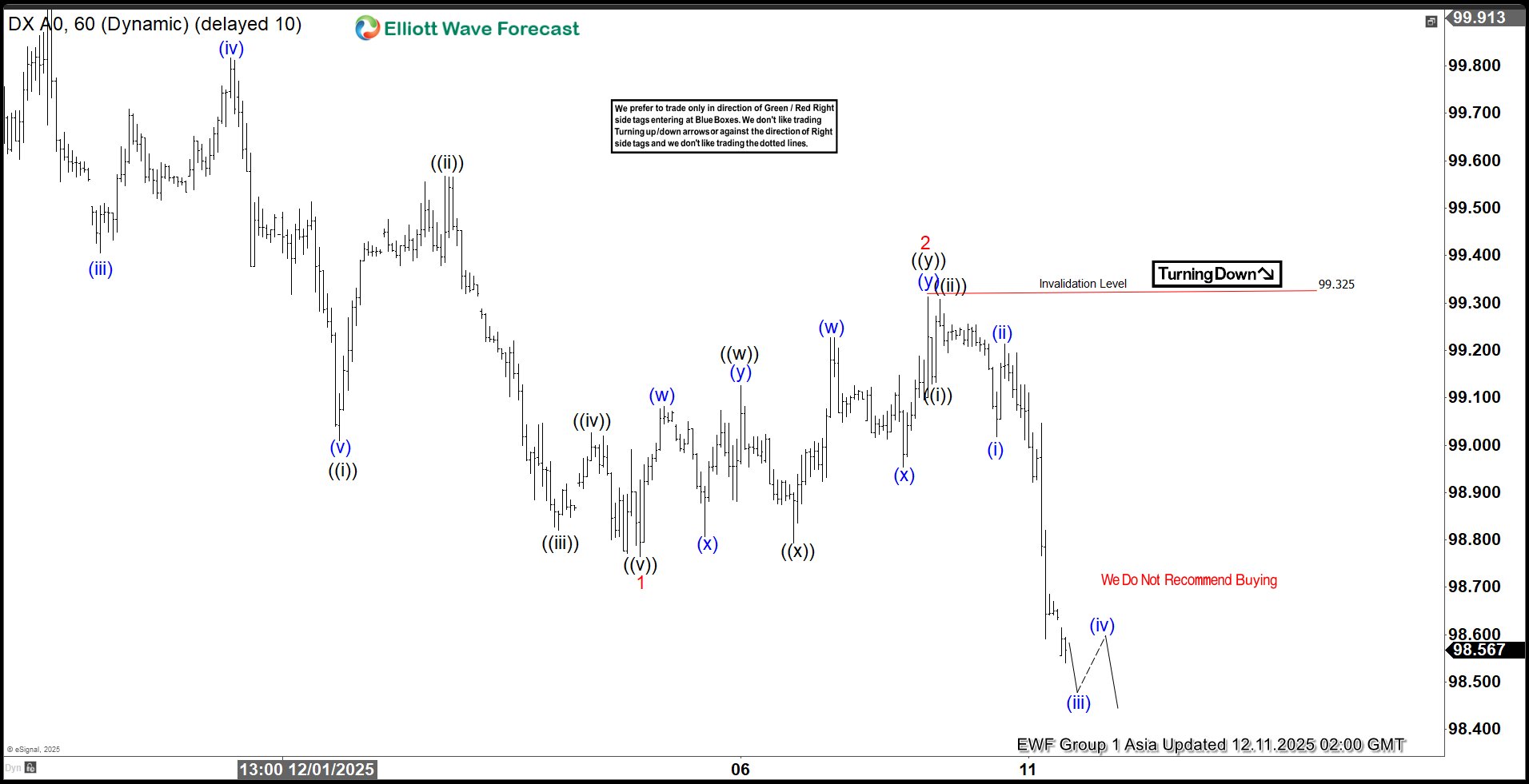

The Dollar Index (DXY) has broken decisively below the December 4 low at 98.76, establishing a clear bearish sequence from the November 21 peak. This structural decline favors continued downside momentum. The immediate target is the 100% Fibonacci extension measured from the November 21 peak, which projects toward 97.7. From that peak, wave ((i)) concluded at 99, followed by a corrective rally in wave ((ii)) that terminated at 99.56. The Index then extended lower in wave ((iii)) toward 98.82, while the subsequent rally in wave ((iv)) ended at 99.02. The final leg, wave ((v)), reached 98.76, thereby completing wave 1 of a higher degree cycle.

Following this initial decline, the Index staged a corrective advance in wave 2, unfolding as a double three Elliott Wave structure. From the termination of wave 1, wave ((w)) ended at 99.12, while the pullback in wave ((x)) concluded at 98.79. A final push higher in wave ((y)) reached 99.32, completing wave 2 in higher degree. With this correction finished, the Index has resumed its downward trajectory in wave 3. From the wave 2 high, wave ((i)) ended at 99.13, and the rally in wave ((ii)) terminated at 99.3. In the near term, as long as the pivot at 99.32 remains intact, rallies are expected to fail. The decline should continue to unfold in sequences of 3, 7, or 11 swings, reinforcing the bearish outlook and favoring further downside pressure toward the projected Fibonacci target.