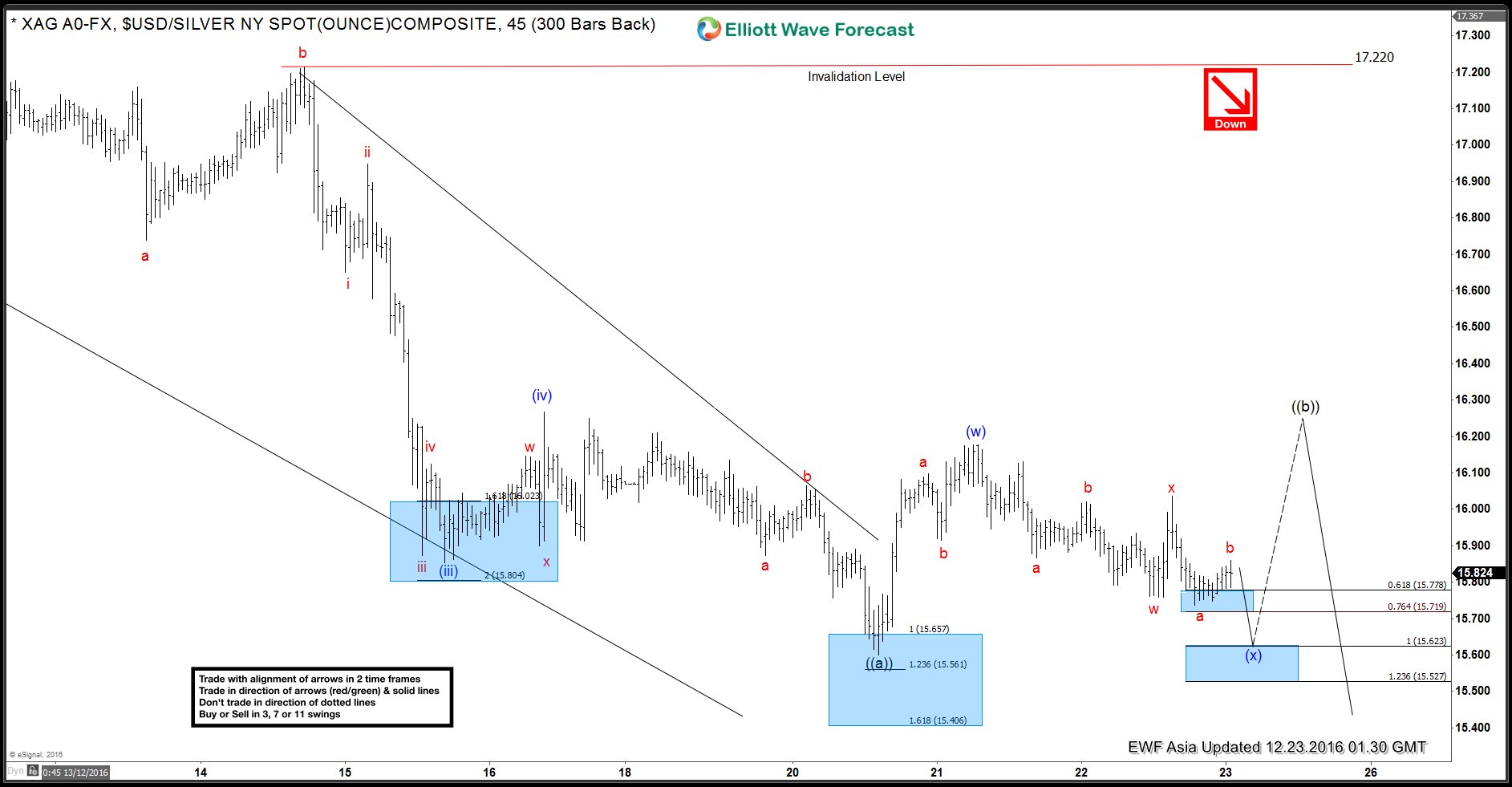

XAG (Silver) is showing an incomplete Elliott Wave sequence from 11.9.2016 peak. There are 5 swings down from 11.9.2016 peak which makes short-term sequence bearish against 12.7.2016 (17.25) peak. Decline from 18.99 – 16.14 was a 3 wave move labelled wave W followed by a 3 wave bounce to 17.25 that completed wave X. Cycle from 17.25 is proposed to be over at 15.60 and structure of this decline was a leading diagonal wave ((a)). XAG has already done 3 swings up from 15.60 low which meets minimum requirements for wave ((b)) and decline can resume from current levels. 15.60 low is the key now, as far as it holds, XAG (Silver) can do another 3 swings higher to complete 7 swings in wave ((b)) before resuming the decline in wave ((c)) towards 14.92 – 14.37 area. Break below 15.60 would suggest wave ((b)) ended already at 16.17 high and wave ((c)) lower is in progress towards above mentioned area. We don’t like buying XAG (Silver) metal and expect short-term sellers to appear after a bounce in 7 or 11 swings as far as pivot at 17.25 high remains intact in the first degree.

At Elliottwave-Forecast, we offer 24 hour coverage of 52 instruments from Monday – Friday using Elliott Wave Theory as primary tools of analysis. We provide Elliott Wave chart in 4 different time frames, up to 4 times a day update in 1 hour chart, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! With our expert team at your side to provide you with all the timely and accurate analysis, you will never be left in the dark and you can concentrate more on the actual trading and making profits. Check out our 14 day Trial to sample everything we have to offer.