Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of SUGAR ( $SB_F ) published in members area of the website. As our members know, the commodity made Elliott Wave Flat structure against the 12.95 high and gave us forecasted decline. In further text we’re going to explain the forecast and Elliott Wave Pattern.

Before we take a look at the real market example of Expanded Flat, let’s explain the pattern in a few words.

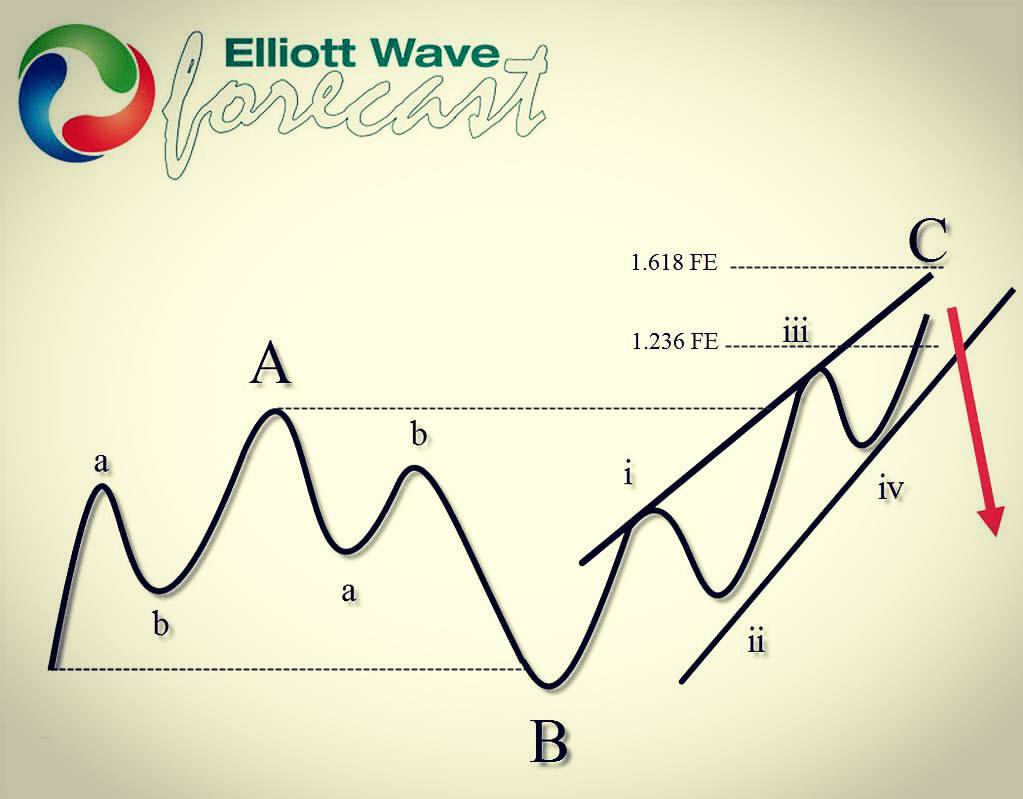

Elliott Wave Expanded Flat Pattern

Elliott Wave Expanded Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Expanded Flat Pattern wave B completes below the start point of wave A, and wave C ends above the ending point of wave A which makes it Expanded. Wave C of expanded Flat could go up to 1.618 fibs ext or extend it. That’s why FLAT Patterns are tricky to trade.

At the graphic below, we can see what Expanded Flat structure looks like.

Now let’s see what Elliott Wave Flat looks like in real market example.

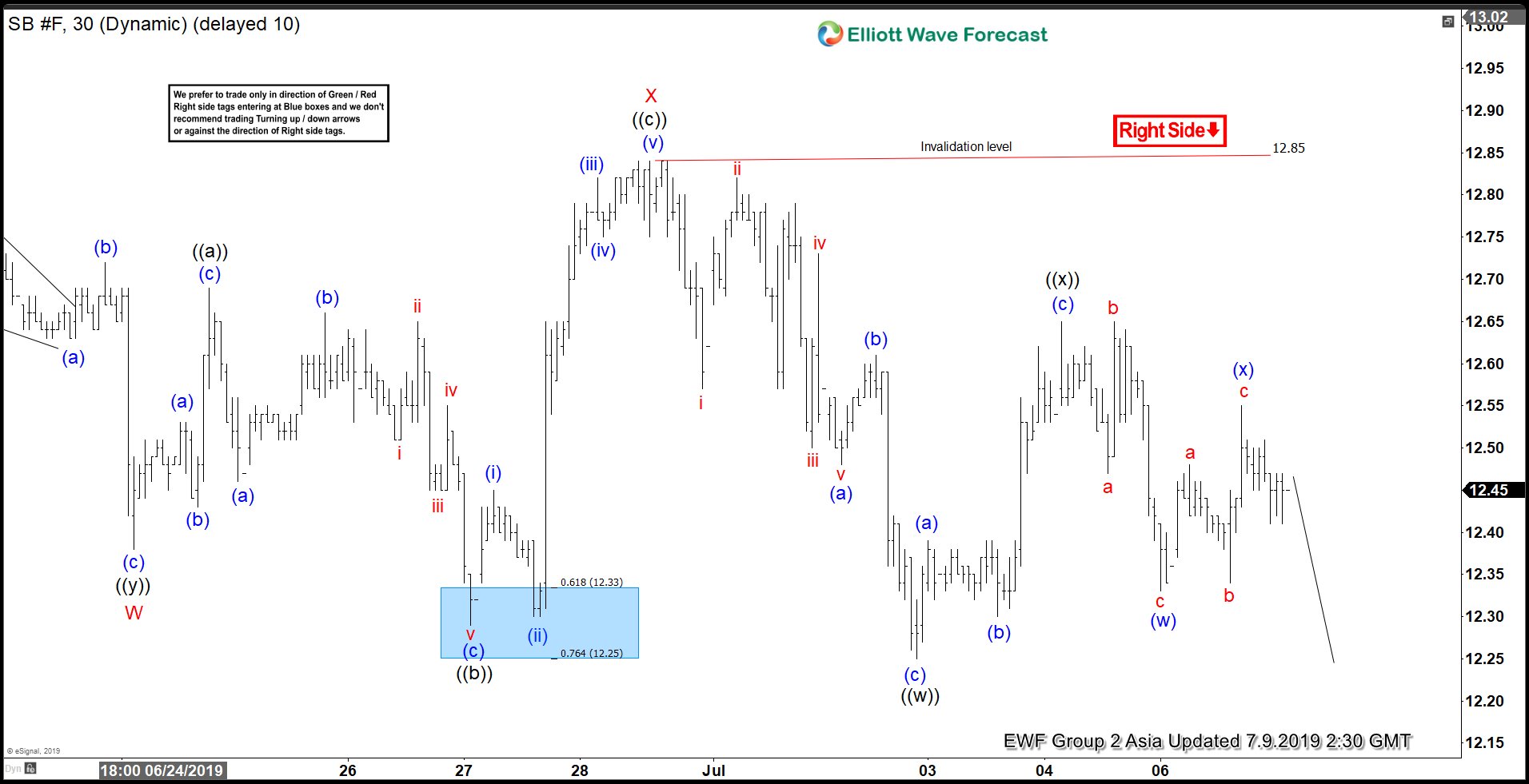

SUGAR Elliott Wave 1 Hour Chart 6.30.2019

At the chart below we can see classic example of Elliott Wave Expanded Flat Pattern. We got 3 waves up in wave ((a)) black and then another 3 waves down in ((b)) which broke starting point of wave ((a)). Then we got strong rally with impulsive structure in ((c)) leg up, that broke ending point of wave ((a)). Current view suggests recovery against the 12.95 peak is completed at 12.85 high. As far as the price stays below that level we expect further weakness in commodity. We need to see break below ((b)) black- 12.3 low to confirm next leg down is in progress.

You can learn more about Elliott Wave FLAT Patterns at our Free Elliott Wave Educational Web Page.

SUGAR Elliott Wave 1 Hour Chart 6.30.2019

12.85 high held nicely during the short term bounces and we got decline as expected. The price has made new low, confirming Y led down is in progress. As far as pivot at 12.85 high holds we can get more short term weakness as proposed on the chart.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.