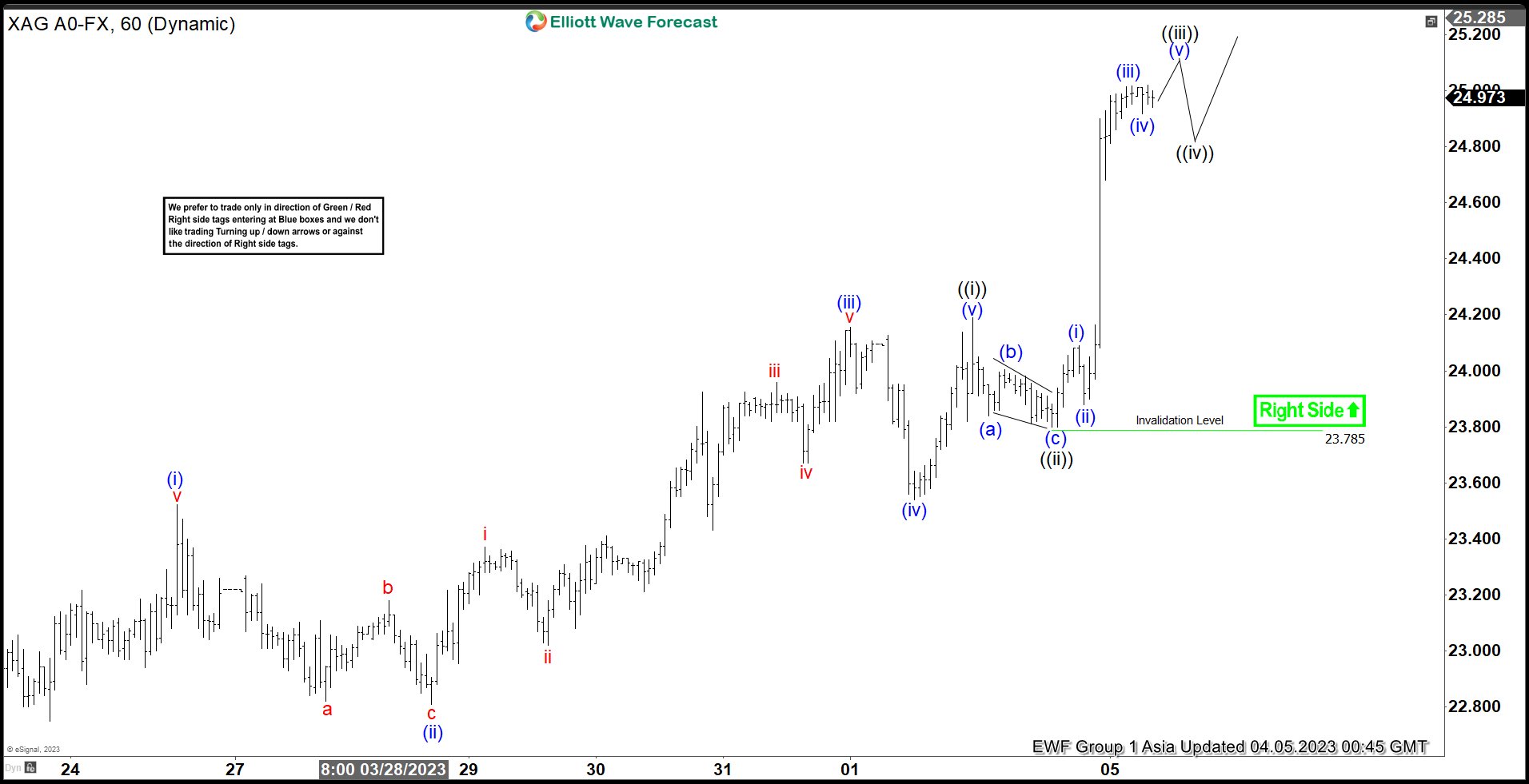

Silver (XAGUSD) broke above the previous peak on 2.2.2023 high ($24.62). As a result, it now shows a bullish sequence from 9.1.2022 low favoring further upside. A 100% – 161.8% Fibonacci extension from 9.1.2022 low targets 26.91 – 31.23. Near term, cycle from 3.10.2023 low is in progress as a 5 waves nesting impulse Elliott Wave structure. Up from 3.10.2023 low, wave 1 ended at 22.71 and pullback in wave 2 ended at 22.12. The metal has resumed higher in wave 3 which subdivides into another 5 waves in lesser degree.

Up from wave 2, the 1 hour chart below shows wave (i) ended at 23.52 and wave (ii) ended at 22.8. Wave (iii) ended at 24.15, wave (iv) ended at 23.54, and wave (v) ended at 24.19 which completed wave ((i)). Pullback in wave ((ii)) ended at 23.78. The metal extends higher in wave ((iii)) and expected to complete soon. Afterwards, it should pullback in wave ((iv)) in 3, 7, or 11 swing before it resumes higher. Near term, as far as pivot at 23.78 low stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.