Hello fellow traders. In this technical blog we’re going to take a quick look at the charts of Palladium Futures published in members area of the website. As of right now Palladium is giving us nice reaction from the Weekly Blue Box area. We’re calling August 2018 cycle completed at 1577 peak and now getting deeper pull back. The price is showing incomplete swings sequences in the cycle from the 1577.07 peak suggesting further separation lower . Break of 03/28 low has opened possibility for further extension downside. Consequently the commodity is now targeting 1137.8 area. In further text we’re going to explain the Elliott Wave structure and forecast.

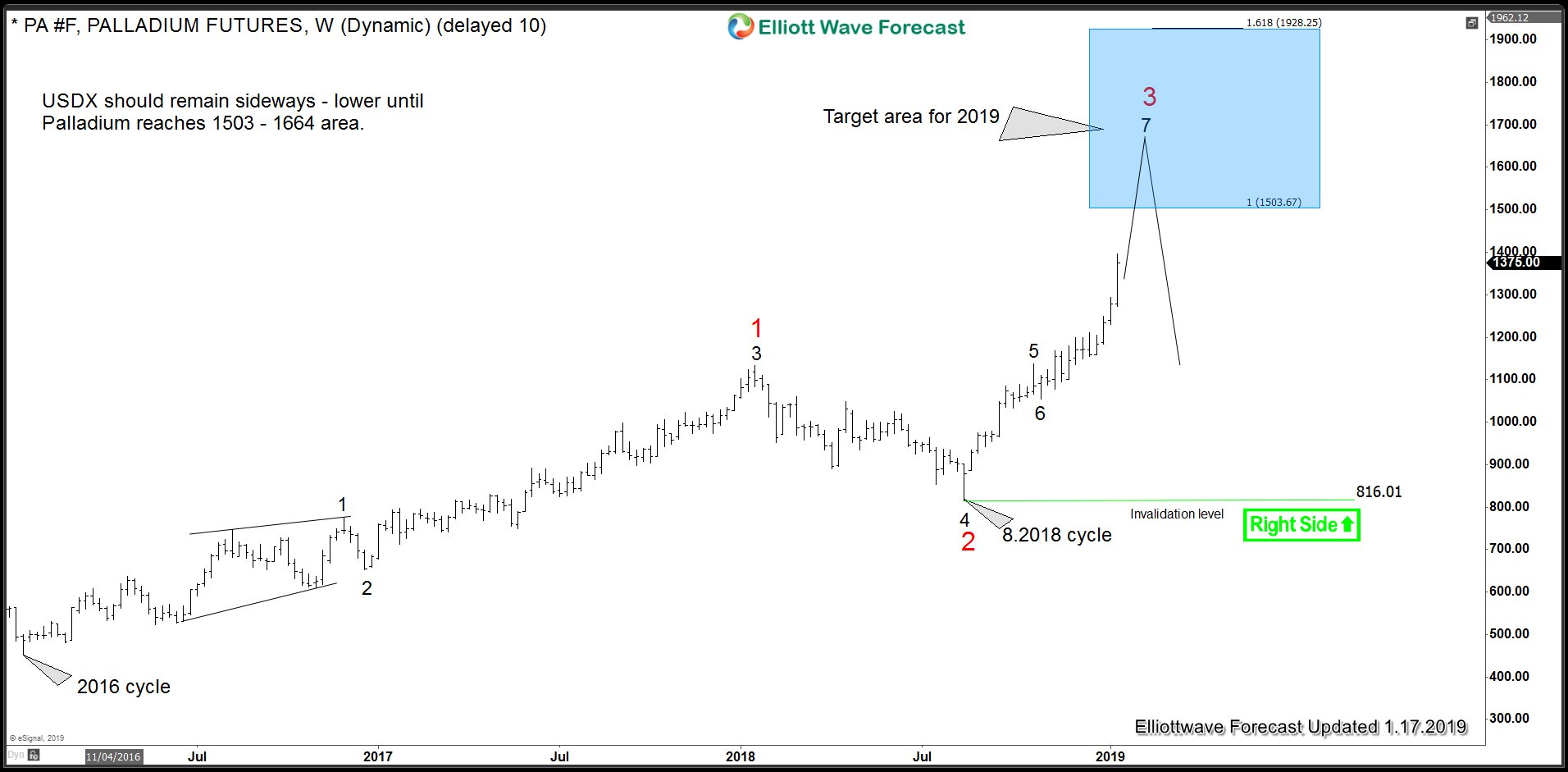

Palladium Elliott Wave Weekly Chart 1.17.2019

In the yearly forecast, we were looking for a August 2018 cycle to end in blue box (1503 – 1664 as noted on the chart) and a reaction lower to take place. We were looking fora larger pull back that will correct the cycle from the 816.01 low at least. As our members know, Blue Boxes are no enemy areas , giving us 85% chance to get a reaction.

Eventually Palladium reached proposed blue box in weekly chart and August 2018 cycle ended at 1577.07 high.

Now,let’s take a loot at the short term price structures.

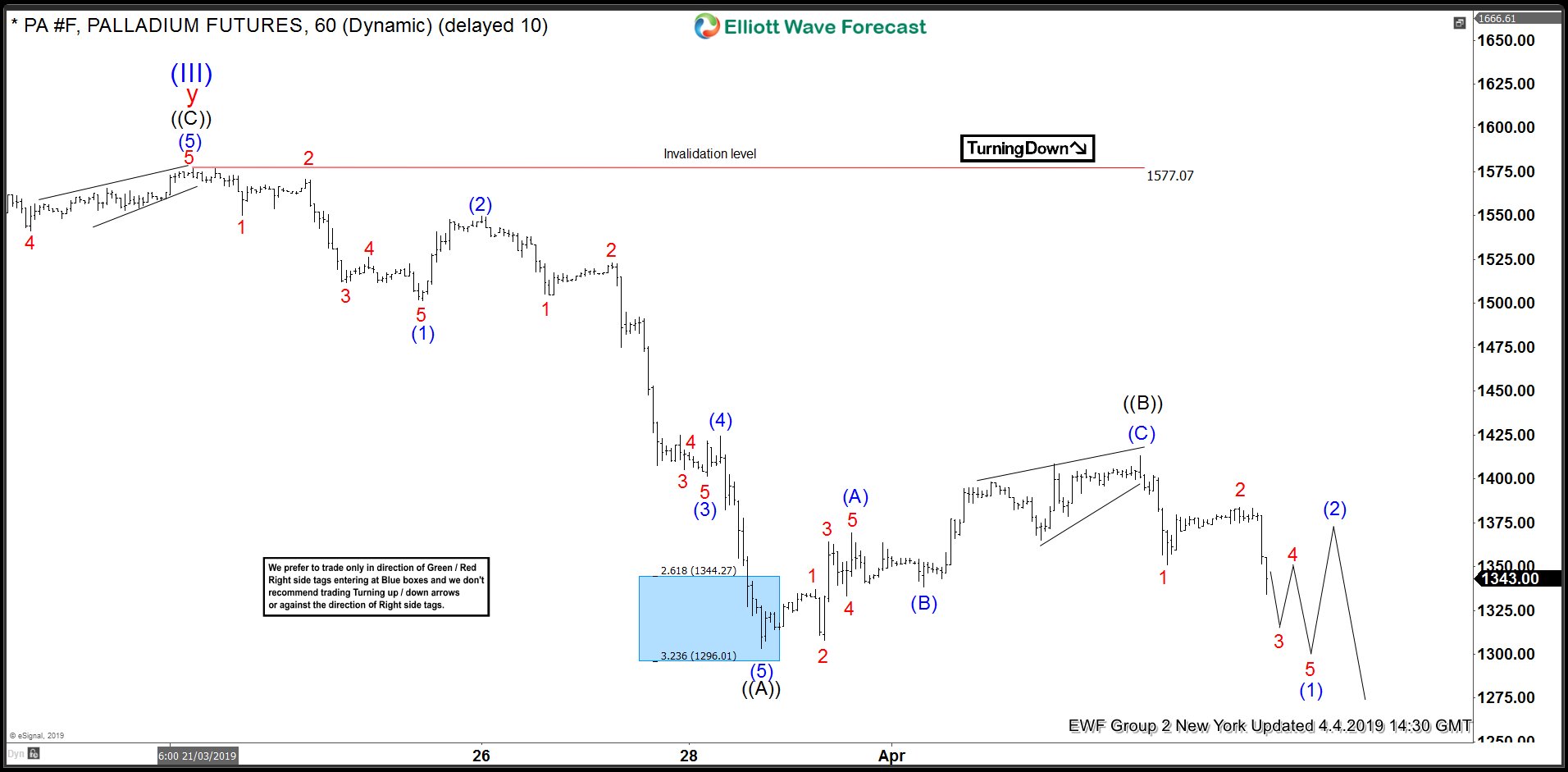

Palladium Elliott Wave 1 Hour Chart 4.4.2019

The price ended short term cycle from the 1577.07 peak as 5 waves structure, labeled as wave ((A)) black. We ended clear 3 waves bounce against the 1577.07 high, hence short term recovery can be counted completed as ((B)) black. Now we need to see break below wave ((A)) – 03/28 low to get confirmation next leg down ((C)) is in progress.

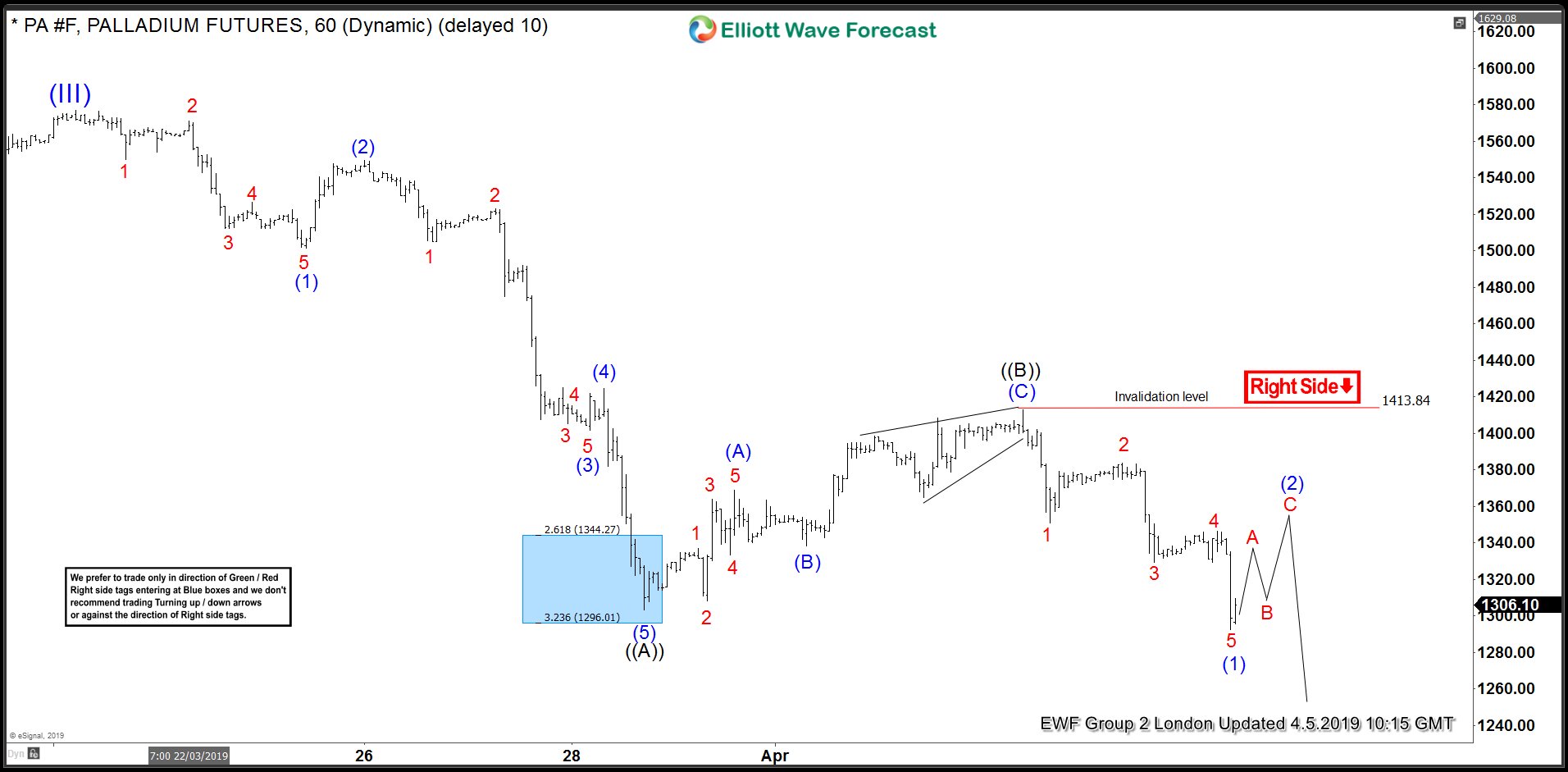

Palladium Elliott Wave 1 Hour Chart 4.5.2019

The price has broken 03/28 low. Consequently , the commodity is now showing lower low sequences down from the 1577.07 peak. Palladium became bearish against the 1413.84 pivot. Seems like we are ending 5 waves down from the mentioned peak most likely. Consequently we are calling for further weakness. We expect short term bounce to correct the cycle from the 1413.84 high before further decline takes place. Proposed bounce should ideally reach 50-61.8 % Fibonacci Retracement area.

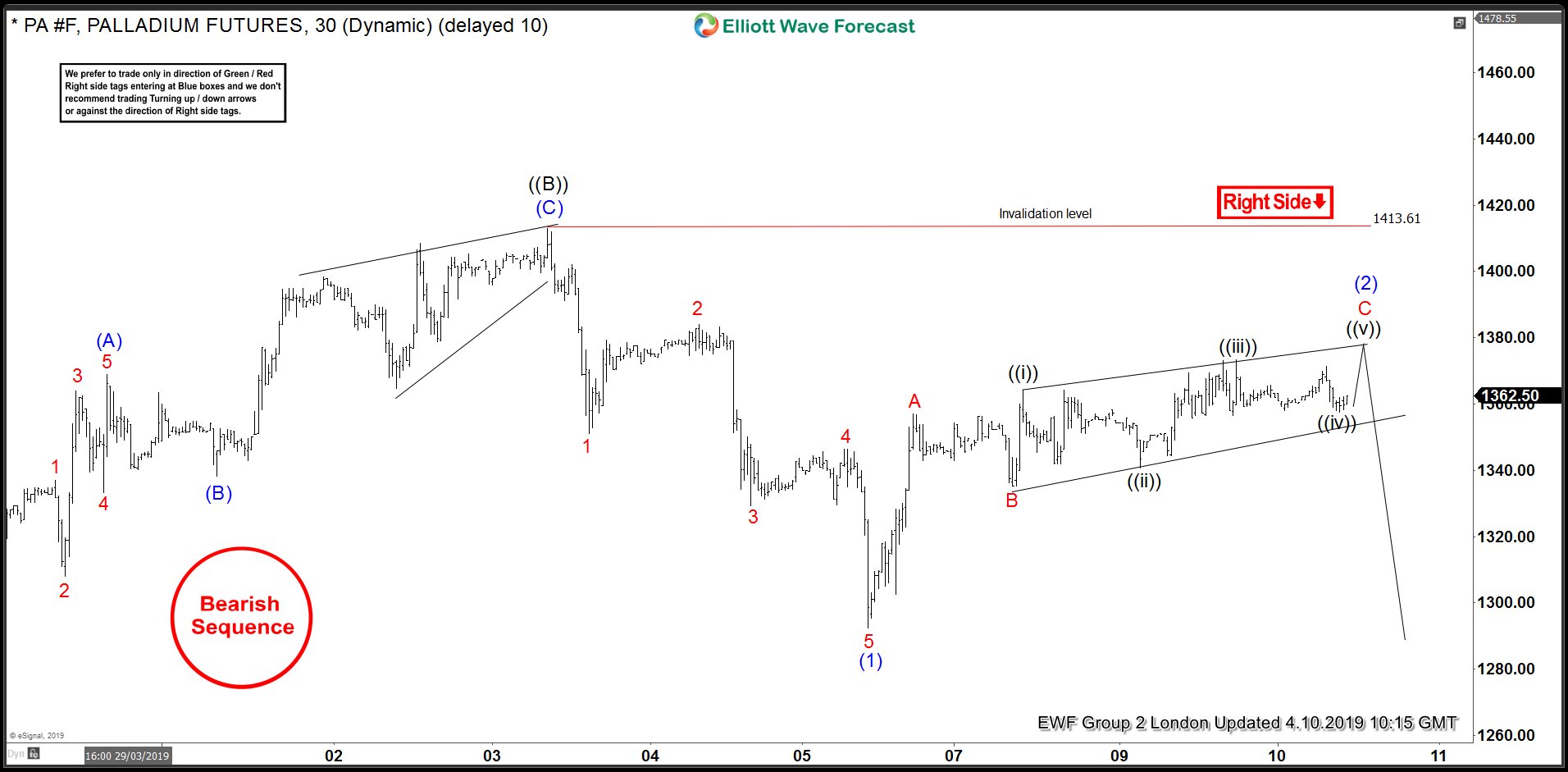

Palladium Elliott Wave 1 Hour Chart 4.10.2019

Finally we got proposed bounce. The price is correcting the cycle from the 1413.6 high, when recovery is labeled as ABC red Zig Zag Pattern. As of right now we can still be in C red that can be unfolding as ending diagonal. As far as the price stays above bottom wedge line, we can get another short term high in wave ((v)) of C . We don’t recommend buying Palladium and favor the short side against the 1413.61 peak. Alternatively if 1413.61 pivot gives up, we can be doing Irregular Flat against the 1577.07 peak toward 1402-1469 area.

Keep in mind market is very dynamic and proposed view could have ended in the mean time. You can check most recent updates in the Membersip Area of the Website . Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !