This week we saw Palladium rallying to new all time high and touching the $1700 psychological barrier. At Elliottwave-Forecast, we told our members last week that any dips should be viewed as a buying opportunity and we highlighted the area where we expected buyers to appear with a blue box. Blue boxes on our charts are high frequency areas and are expected to produce 3 waves reaction at least, we also call them no-enemy areas because in these areas, both buyers and sellers agree in the direction of next move for 3 swings at least. Let’s take a look at the chart of Palladium (PA_F) from last week where we expected it to drop towards the blue box and then turn higher from there.

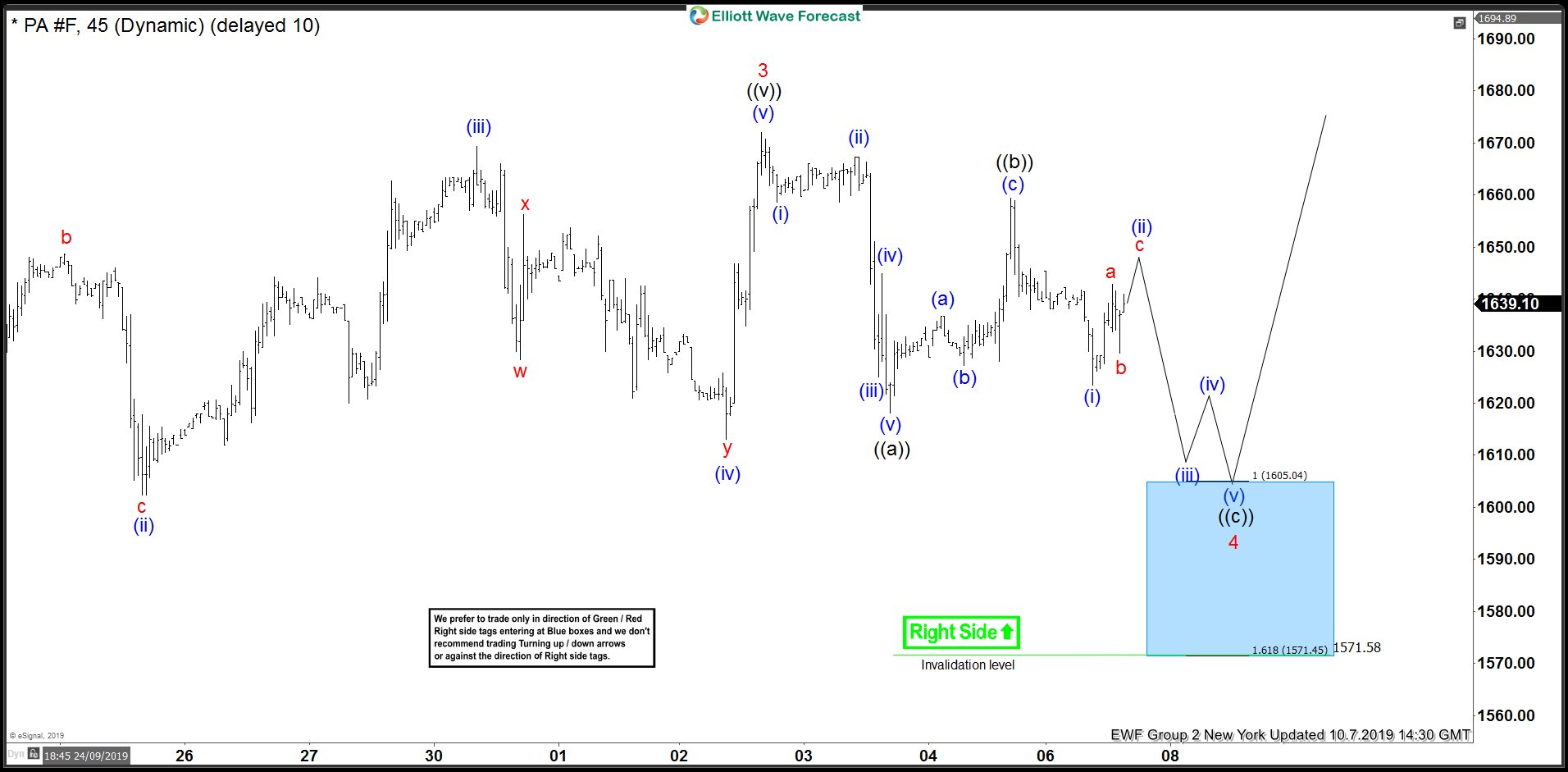

PA_F (Palladium) Elliott Wave Update 10.7.2019

In the chart below, we called red wave 3 completed at $1672.10 and decline from $1672.10 to $1618.10 was in 5 waves which we labelled as wave ((a)) of the red wave 4. Rally from $1618.10 – $1659.40 was in 3 waves which we labelled as wave ((b)) and we looked for another 5 waves lower in wave ((c)) to complete wave 4 pull back. Blue box between $1605.04 – $1571.45 was the area where we expected wave 4 to complete and buyers to appear to either resume the rally in Elliott Wave 5 or produce a 3 waves bounce at least.

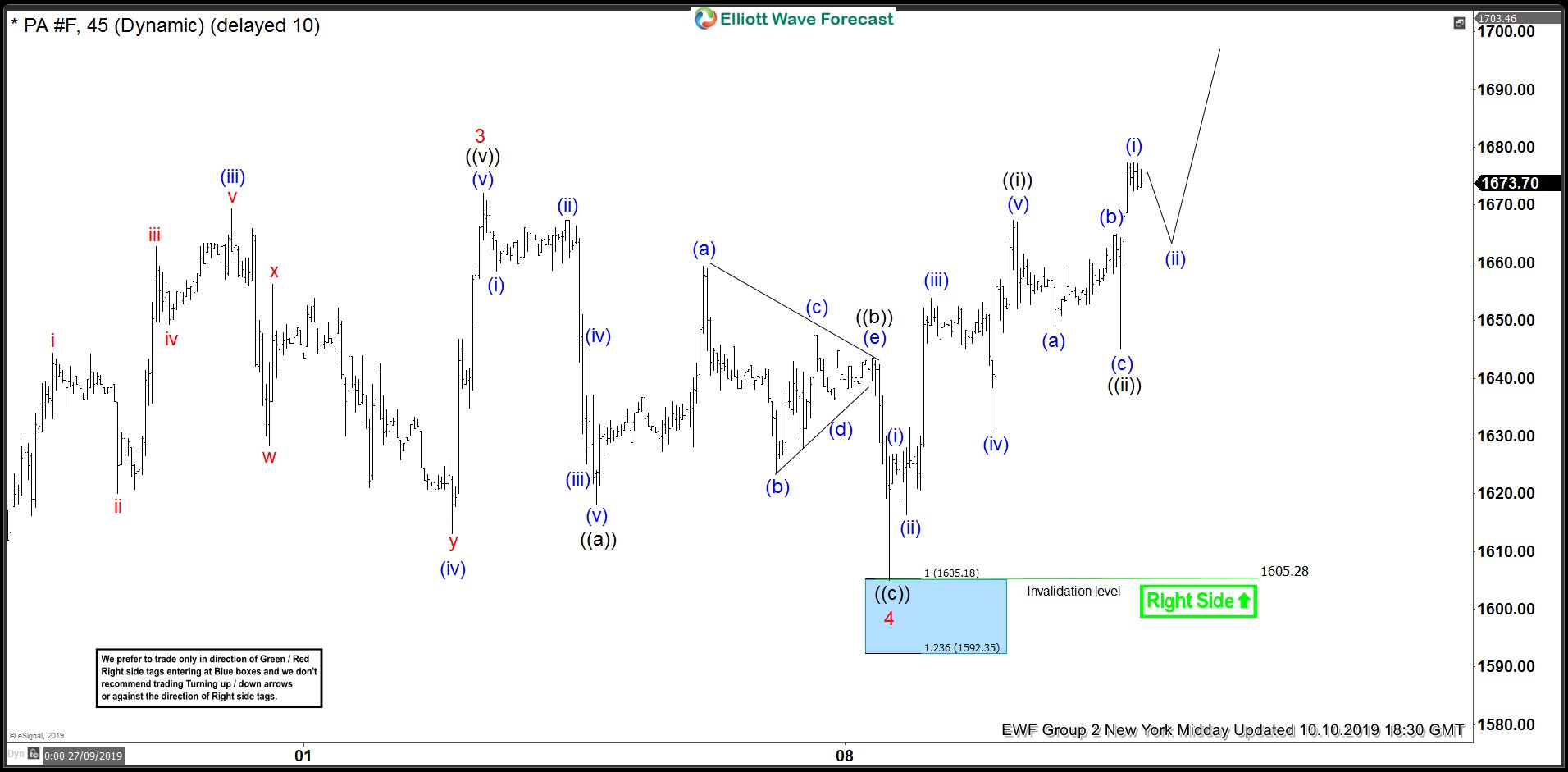

Palladium (PA_F) Elliott Wave Update 10.10.2019

In the chart below we can see that Palladium continued lower as expected toward the blue box. However, the decline from $1659.40 was not in 5 waves so we have changed the structure of wave ((b)) to a triangle. We can see that price reached the blue box around $1605 and bounced strongly. Buyers were waiting in the blue box as expected and produced the rally. Reaction higher quickly took it back above 50% Fibonacci retracement of the decline from $1659.40 peak allowing longs from blue box to eliminate risk on the trade.

We took this long in our Group 2 Live Trading Room and it already reached our target at $1687.5 which is inverse 123.6 Fibonacci extension of wave 4 drop. Below is the journal we sent to the members and also the video clip