Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL . As our members know recently we got pull back that was unfolding as Elliott Wave Double Three Pattern. We expected OIL to find buyers there and trade higher due to incomplete bullish sequences in the cycle from the December 2018 low. In the following article, we’re going to explain the Elliott wave structure and Forecast.

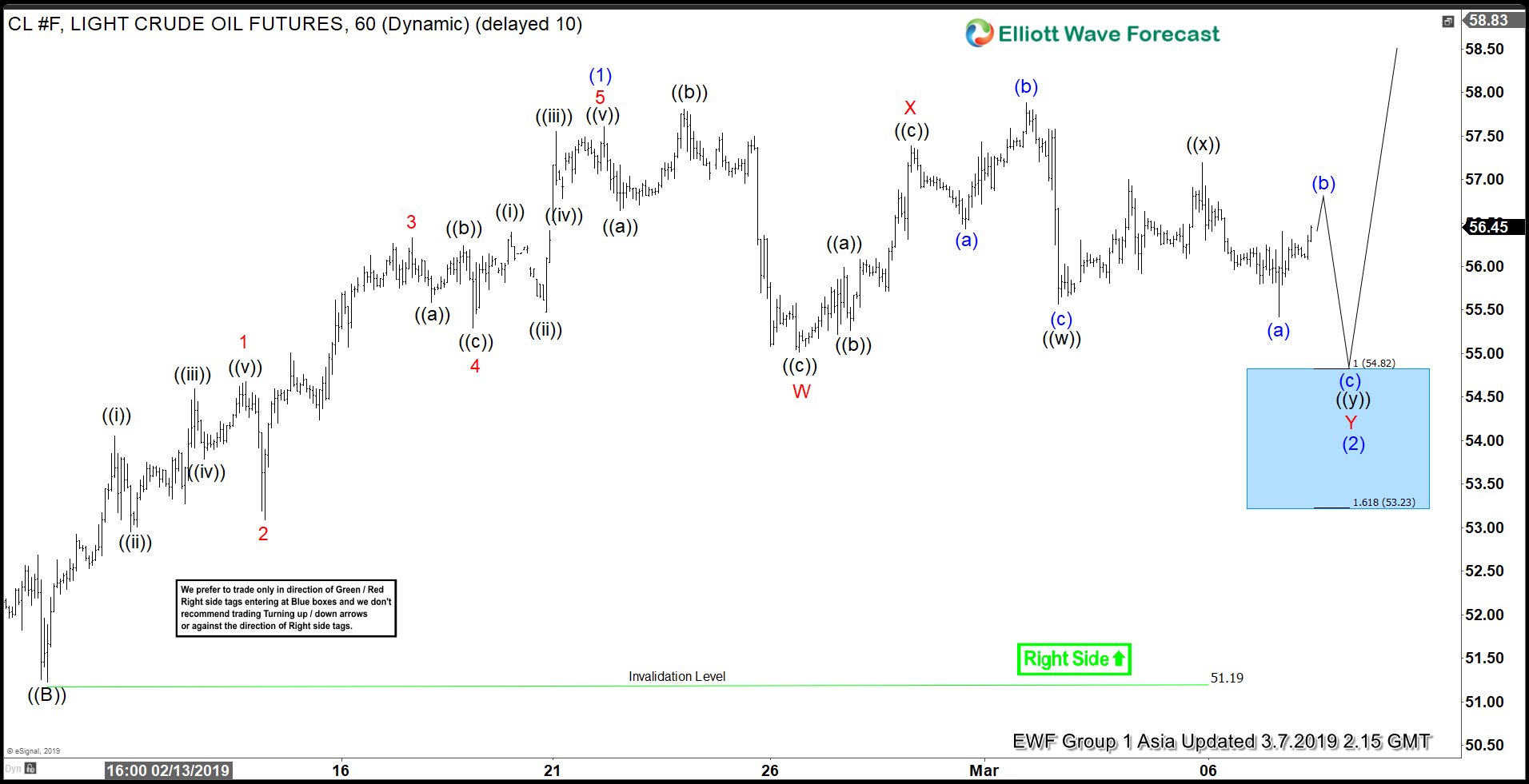

OIL 1 Hour Elliott Wave Analysis 3.7.2019

As we can see on the chart below , OIL ended cycle from the 51.19 low and now correcting it. Pull back is unfolding as Double Three – 7 swings structure, labeled as WXY red. As of right now we see pull back incomplete. We are still in Y red leg, when first leg of Y red has unfolded as Irregular Flat, labeled as ((w)) black . Chart is calling for potentially another leg lower toward the blue box area : 54.82-53.23 ( buyers zone). Consequently , we don’t recommend selling OIL and favor the long side from the marked Blue Box area.

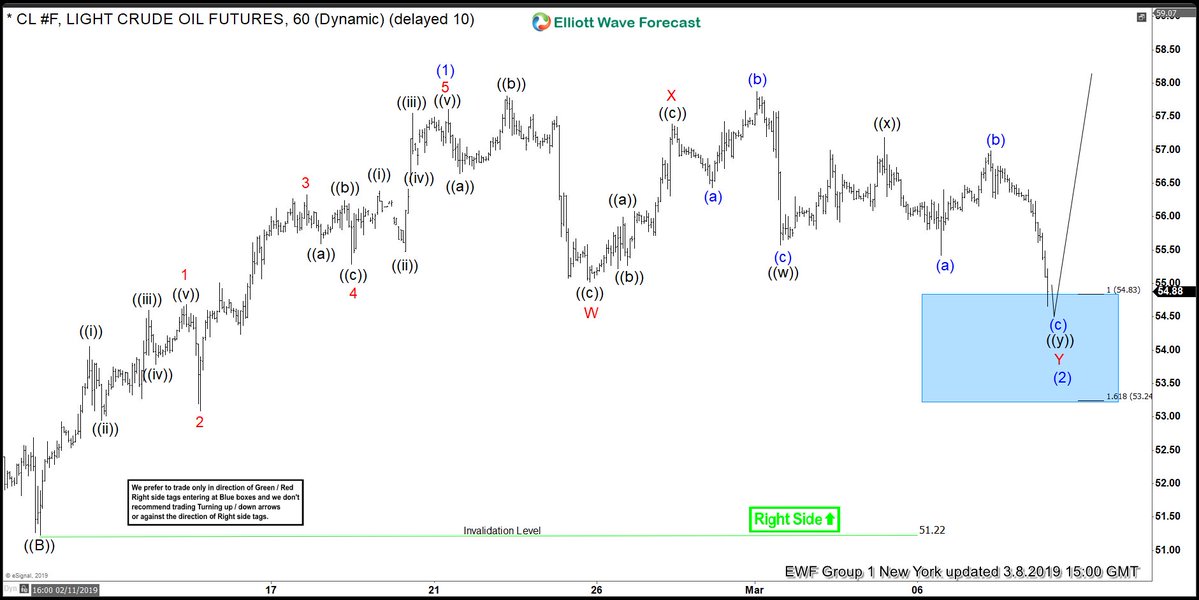

OIL 1 Hour Elliott Wave Analysis 3.8.2019

Eventually OIL has made leg lower as expected. The price has reached proposed Blue Box area at 54.82-53.23 . Now we expect buyers to appear at blue area for proposed rally or 3 wave bounce alternatively. As our members know, Blue Boxes are no enemy areas , giving us 85% chance to get a bounce. As OIL is trading with the incomplete December’s cycle , we expected buyers to appear there at the Blue Box for further rally or wave bounce alternatively.

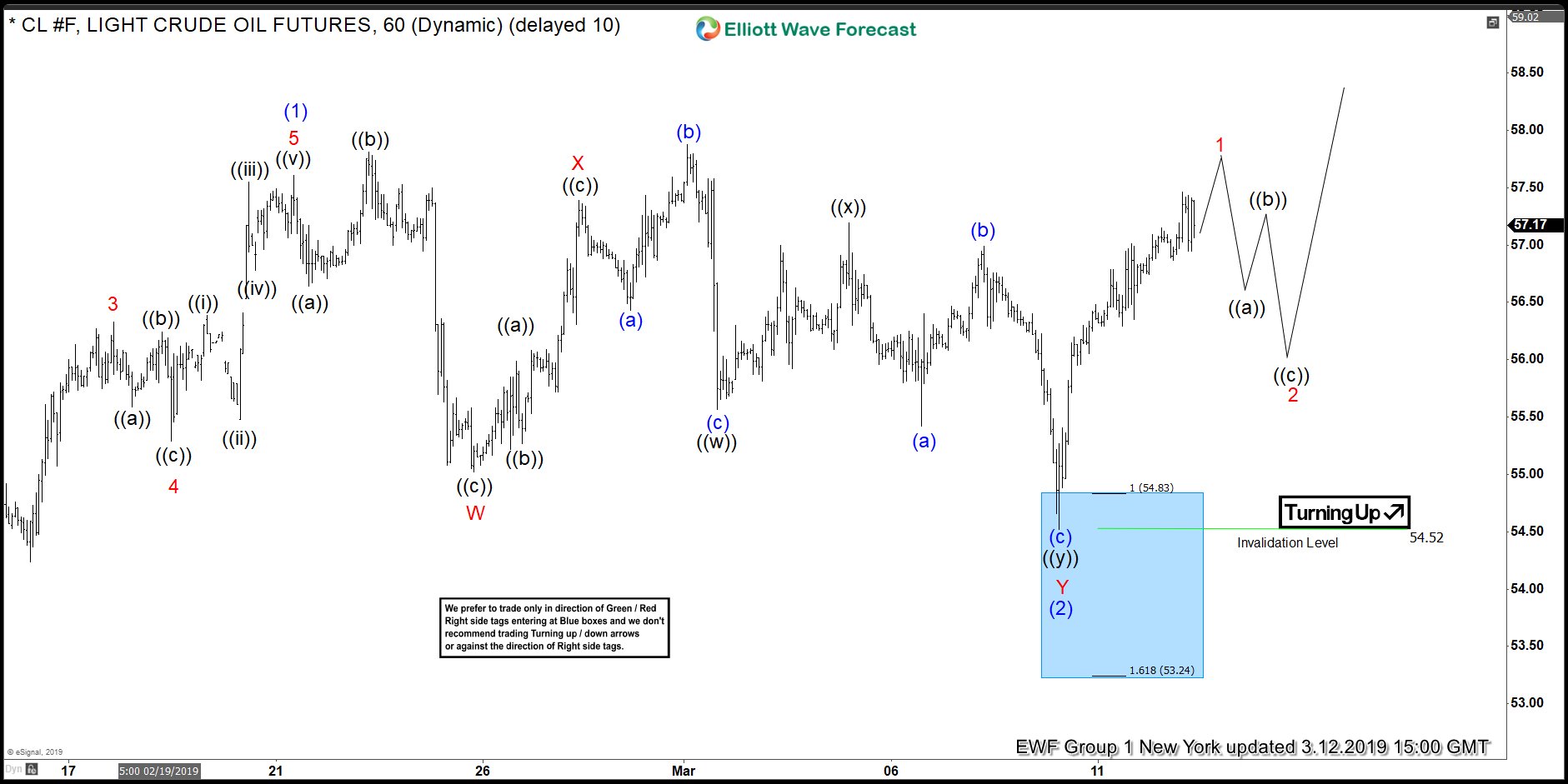

OIL 1 Hour Elliott Wave Analysis 3.12.2019

OIL has found buyers at the blue box area as expected. Short term pull back ended at 54.52 low and we got nice bounce. Any longs from Blue Box areas are should be risk free. Now, we need to see break above March’s peak to confirming next leg is in progress. If not already long we would rather avoid chasing strength at this stage. Once we got proposed break higher OIL can be bought again in short term dips in 3,7,11 swings against the 54.52 low.

Note: Market is dynamic and presented view could have changed in the mean time. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !