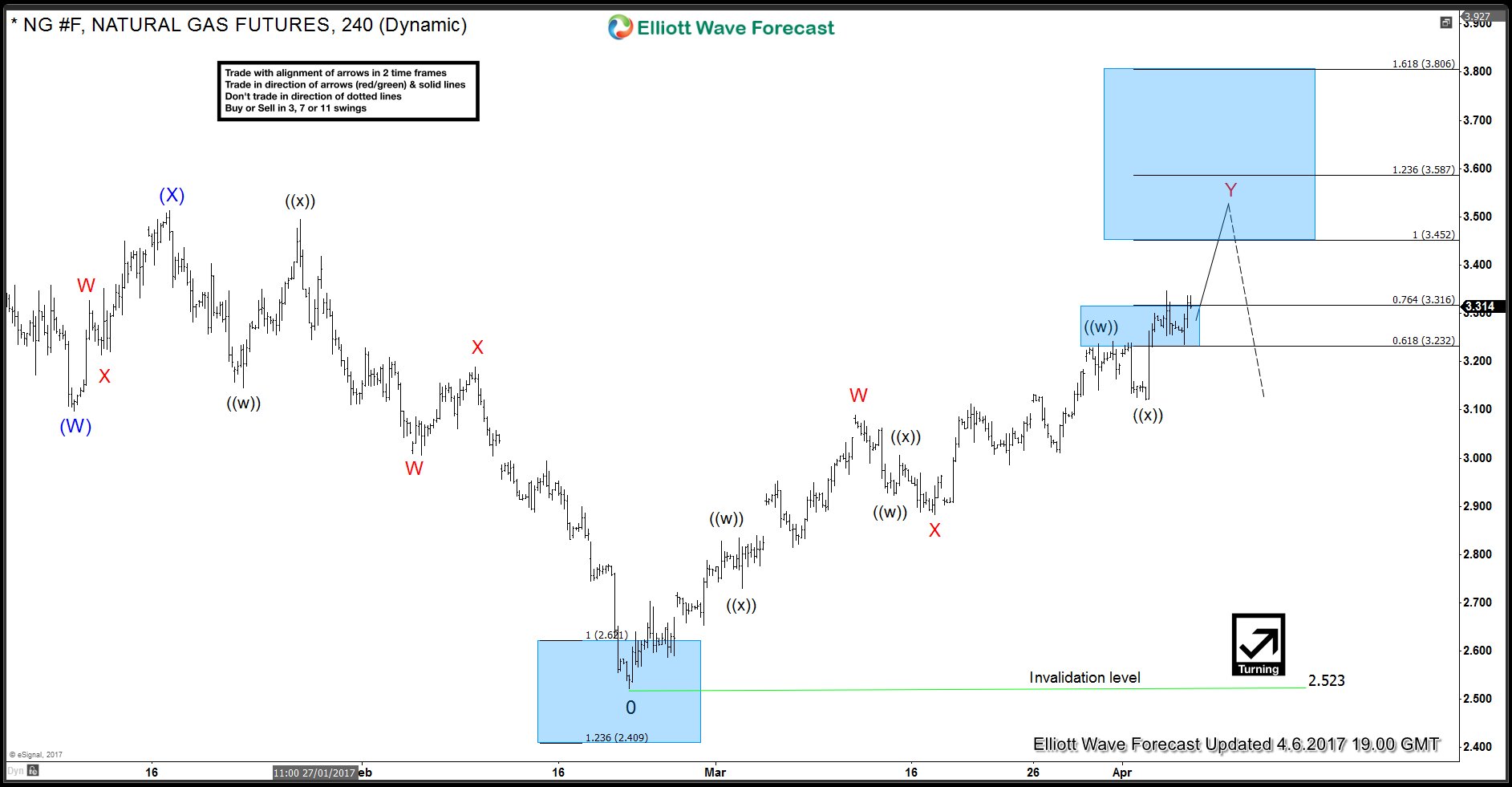

NG #F (Natural Gas) has been rallying since forming a low on 2/22 (2.523). Rally is unfolding as a WXY or double three Elliott Wave Structure where wave W completed at 3.089 and wave X completed at 2.882. Up from red X low, Natural Gas is showing 5 swings up which means the sequence is incomplete and while above black ((x)) low at 3.121, rally should continue higher towards 3.452 – 3.587 to complete 7 swings sequence from red X low. This would also complete a WXY structure from 2.523 low and then we should see a 3 wave pull back in NG #F either to correct the cycle from 2.523 low or at least from red X low.

NG #F (Natural Gas) 4 Hour Elliott Wave Chart

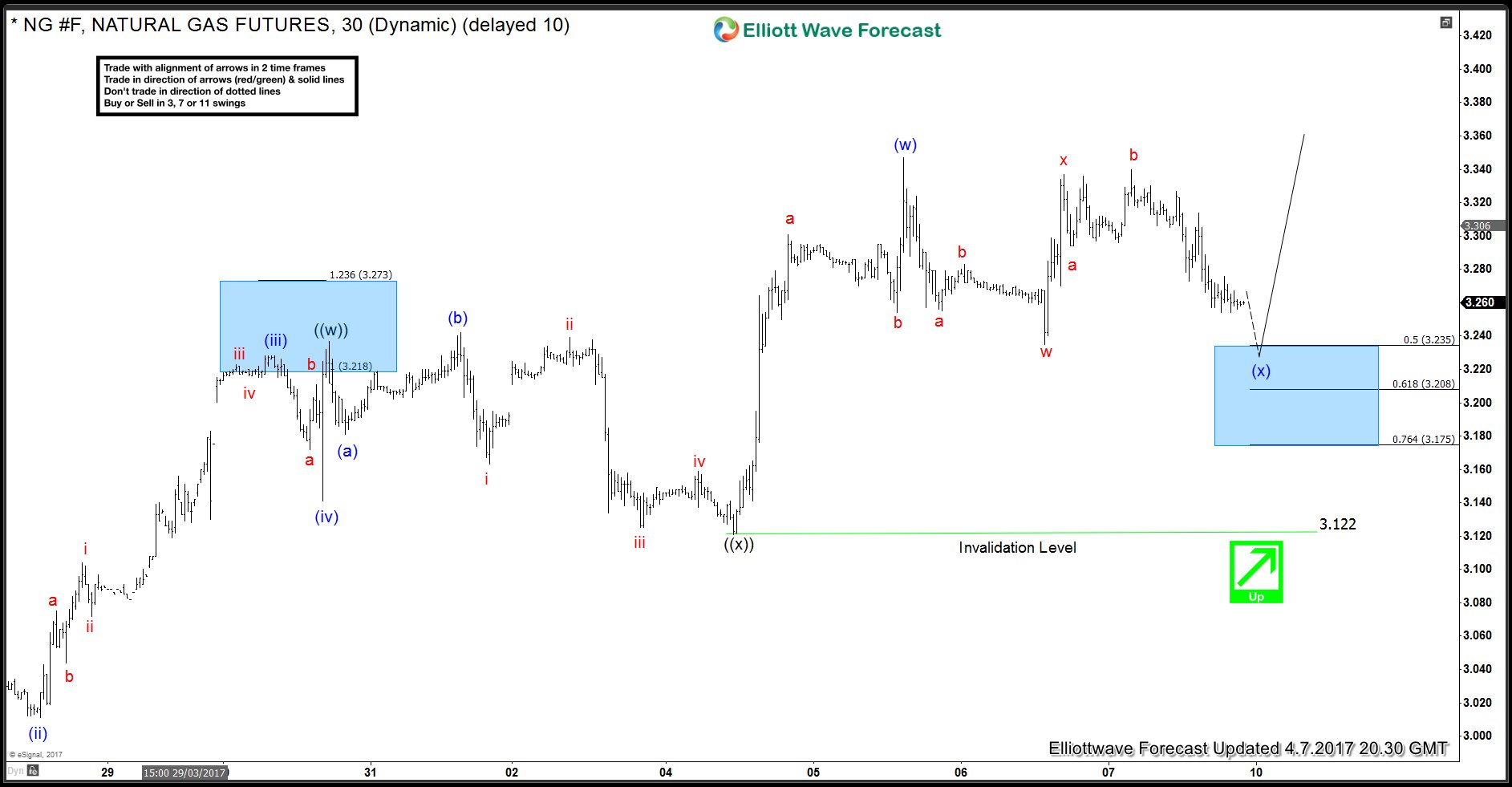

NG #F (Natural Gas) 1 Hour Elliott Wave Chart

Rally to 3.237 completed wave ((w)) which was followed by a FLAT correction to 3.121 which completed wave ((x)). Up from there, it rallied in 3 waves to 3.347 to complete wave (w) and then did a 3 wave pull back to 3.235. Since then, price has been unable to break higher and after a failed test of 3.347 peak, we have seen another dip and a double three Elliott wave correction in wave (x) now seems more likely towards 3.235 – 3.208 area which is 50 – 61.8 Fibonacci retracement area of the rally from 3.122 low. From this area and as far as pivot at 3.122 low remains intact, we can expect Natural Gas to turn higher again and reach the target between 3.45 – 3.587 are from where a larger 3 wave pull back can be seen at least to correct the cycle from 3/17 (2.882) low if not from 2/22 (2.523) low.