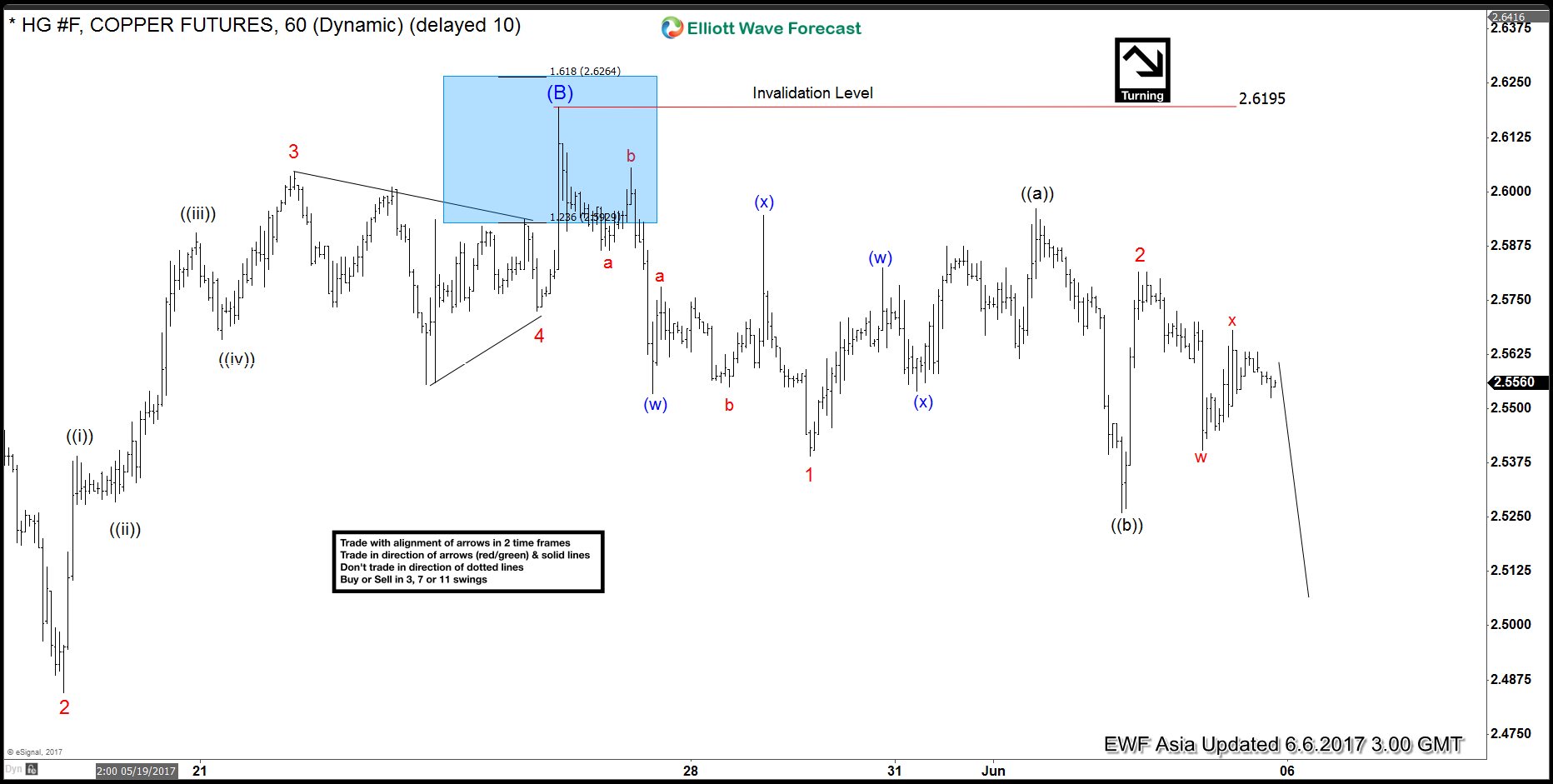

HG#F (Copper) is showing 5 swings incomplete sequence from 2/13/2017 high, preferred Elliott wave view suggests rally to 2.619 completed 6th swing as a FLAT in wave (B) and metal has now resumed the decline in 7th swing. Decline from 2.619 is so far corrective so wave (C) is expected to take the form of an Ending diagonal where wave 1 ended at 2.539 and wave 2 ended at 2.581 as a FLAT. Near-term focus is on 2.526 – 2.500 area to complete 3 waves from wave 2 peak, this area can result in a bounce in 3 waves again which should fail below 2.581 high and more importantly below 2.619 high for extension lower towards 2.376 – 2.2716 area to complete 7 swings from 2/13/2017 high.

HG#F (Copper) Elliott Wave View: Extension lower

Commodities

Related Articles

CommoditiesNews

Gold (XAUUSD) Signals Wave C Breakout

Gold has completed a 7-swing corrective decline in wave B at 4838 and has since...

CommoditiesNews

CL #F Elliott Wave Analysis: Extending Lower Toward 60.50

Elliott Wave Crude Oil Futures CL #F have turned lower in a corrective zigzag pattern...

CommoditiesNews

Gold (XAUUSD) Elliott Wave Outlook: Eyeing 5610 Retest

Gold (XAUUSD) reached an all-time high of $5610.8 on 29 January 2026, marking the completion...