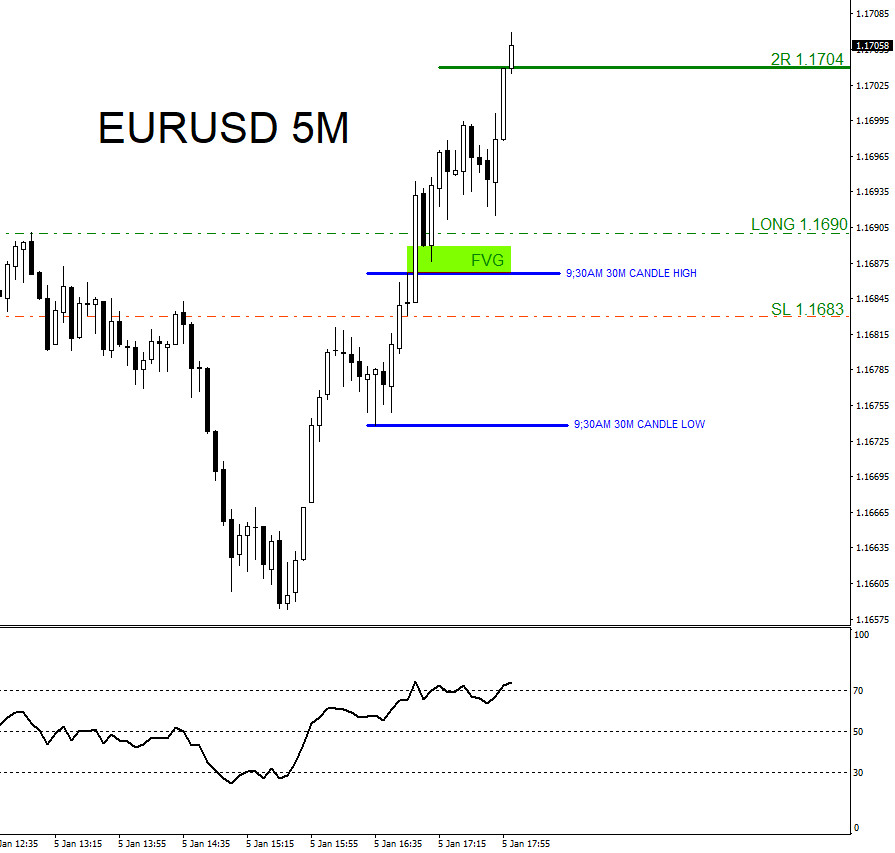

Traders can use the 9:30AM New York open 30 minute candle to determine which direction to trade. The EURUSD pair broke strongly above the 9:30AM 30 minute candle and formed a 3 candle FVG/Fair Value Gap pattern signalling only buy opportunities. When price made a pullback lower into the bullish FVG (Green box) I entered the buy trade at 1.1690 with a tight 7 pip stop loss at 1.1683 targeting the 2R level at 1.1704.

EURUSD 5 Minute Chart January 5 2026

EURUSD moves higher and hits 2R target at 1.1704 from 1.1690 and I closed the buy trade for +14 pips (+2% gain risking 1% on every trade)

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days !!! Just click here –> 14 day trial