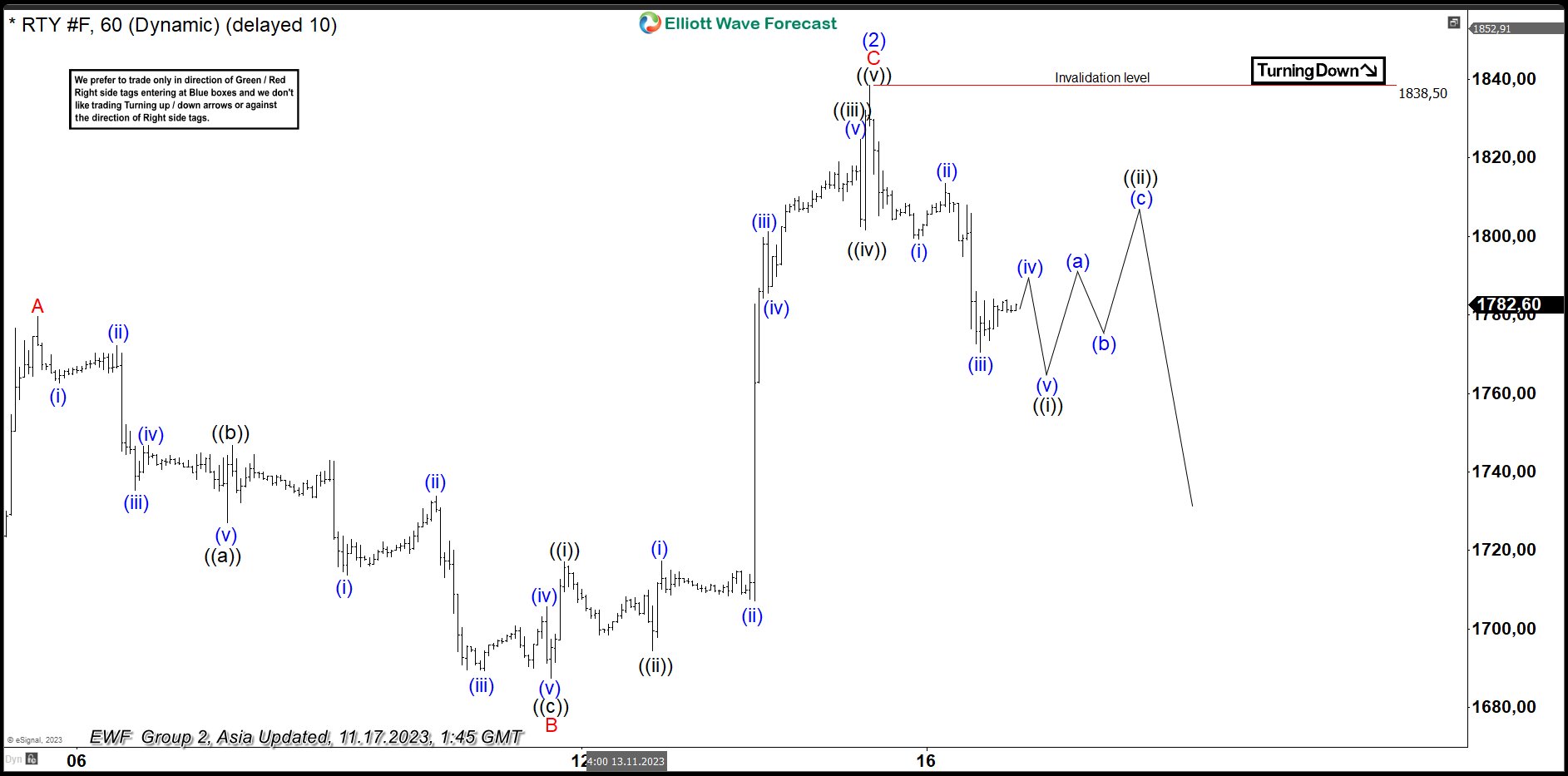

Russell 2000 Futures (RTY) rally from 10.28.2023 low has ended in 3 waves at the 100% – 161.8% Fibonacci extension. This suggests that the rally is corrective in nature. Up from 10.28.2023 low, wave A ended at 1779.6. Pullback in wave B ended at 1687.40 with internal subdivision as a zigzag Elliott Wave structure. Down from wave A, wave ((a)) ended at 1727.10 and rally in wave ((b)) ended at 1746.8. Wave ((c)) lower ended at 1687.40 and this completed wave B in higher degree.

The Index then turned higher in wave C. Up from wave B, wave ((i)) ended at 1717.10, and dips in wave ((ii)) ended at 1694.5. Index extended higher in wave ((iii)) towards 1824.80 and pullback in wave ((iv)) ended at 1801.60. Final leg wave ((v)) ended at 1838.50 which completed wave C of (2) in higher degree. The Index has turned lower in wave (3). Down from wave (2), wave (i) ended at 1799.40 and rally in wave (ii) ended at 1813.50. Index extended lower in wave (iii) towards 1770.50. Expect wave (iv) rally to be followed with wave (v) lower to end wave ((i)). Afterwards, it should rally in wave ((ii)) to correct cycle from 11.16.2023 high in 3, 7, or 11 swing before it resumes lower again.