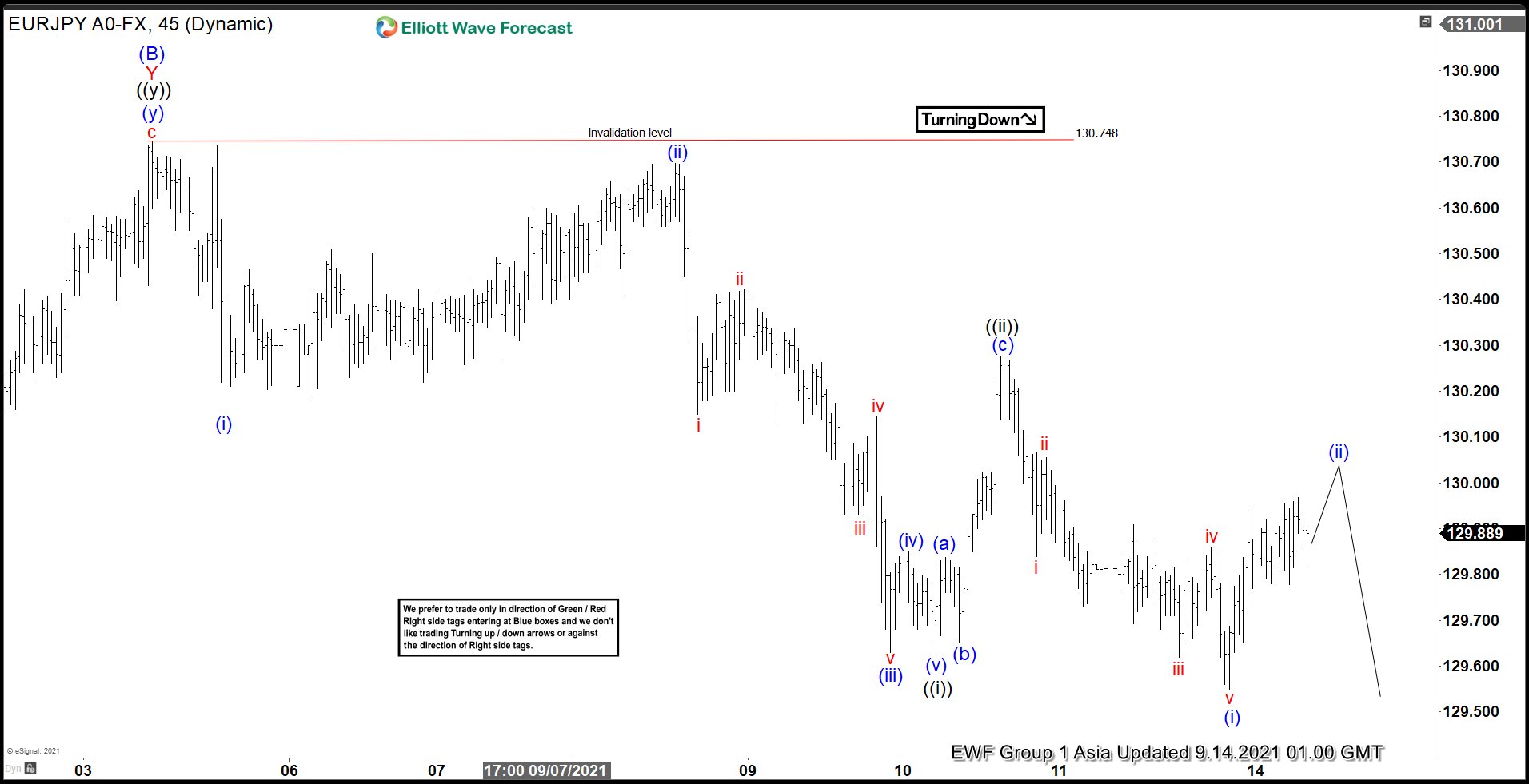

Short-term Elliott wave view in EURJPY suggests rally to 130.75 ended wave (B). Pair has turned lower in wave (C) but it still needs to break the previous wave (A) low at 127.9 on August 19 to rule out a double correction. Down from wave (B), decline is in progress as a 5 waves impulsive structure. First leg wave (i) ended at 130.16, and rally in wave (ii) ended at 130.698.

Pair resumes lower in wave (iii) towards 129.63, rally in wave (iv) ended at 129.85, and final leg lower wave (v) ended at 129.63. This completed wave ((i)) in higher degree. Correction in wave ((ii)) then ended at 130.27 as a zigzag structure. Pair has resumed lower in wave ((iii)). Down from wave ((ii)), wave (i) ended at 129.55 and wave (ii) correction is in progress. While rally fails below wave ((ii)) high at 130.27, and more importantly below 130.75, expect pair to extend lower. Another possible alternate is that pair ended wave ((i)) at the recent 129.55 low. In the alternate scenario, current rally is in wave ((ii)) which could see larger 3 waves but still expected to fail below 130.75 for more downside. Near term, as far as pivot at 130.75 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.