Elliott Wave FLAT structure is the corrective pattern which is often seen in the real market.

There are 3 types of Flats:

– Regular flat.

– Expanded flat

– Running flat.

In this technical blog we’re going to run through Expanded flat example.

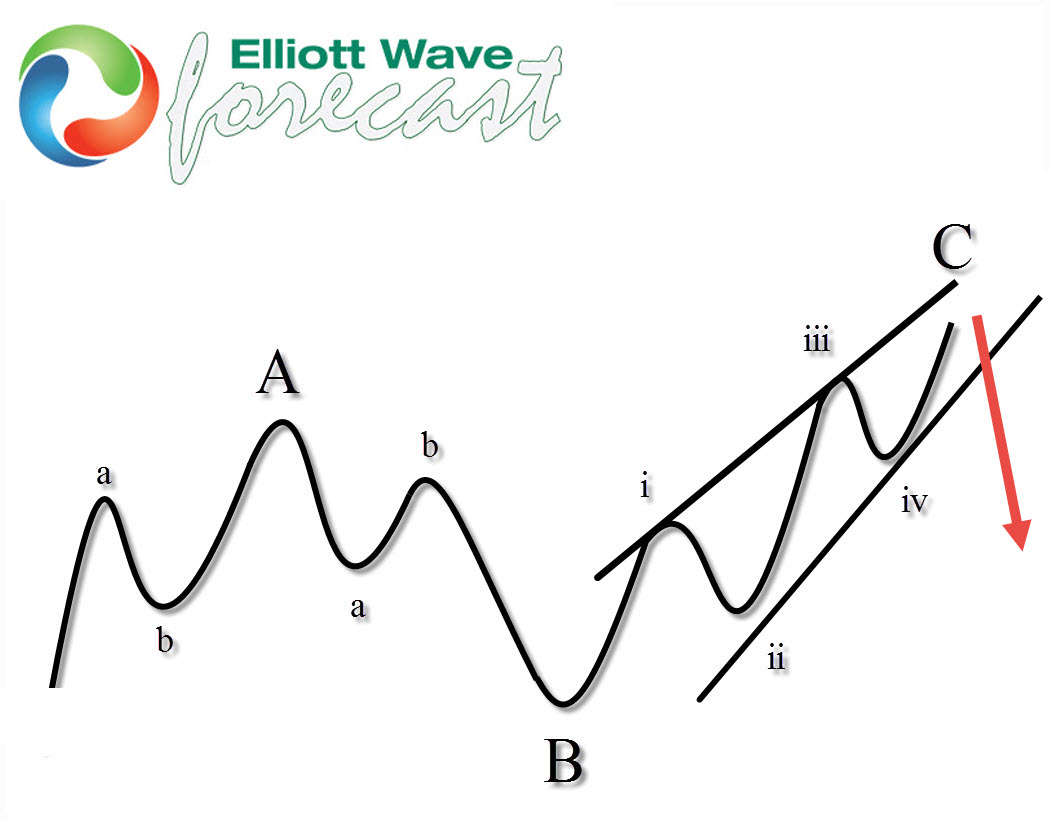

Expanded Flat is a 3 wave corrective pattern which inner subdivision is always labeled as A,B,C and it has 3,3,5 structure. That means waves A and B are always corrective structures, while wave C is 5 wave impulsive or ending diagonal pattern.

At the graphic below, we can see what Expanded Flat structure looks like. Inner structure has ABC labeling , where wave B completes below the start point of wave A, and wave C should complete above the end point of wave A (usually at 1.236-1.618 fibonacci extension A related to B )

Before we continue, short reminder: check out New EWF Free Educational blogs and Free Elliott Wave charts.

Now, let’s take a look at some real example:

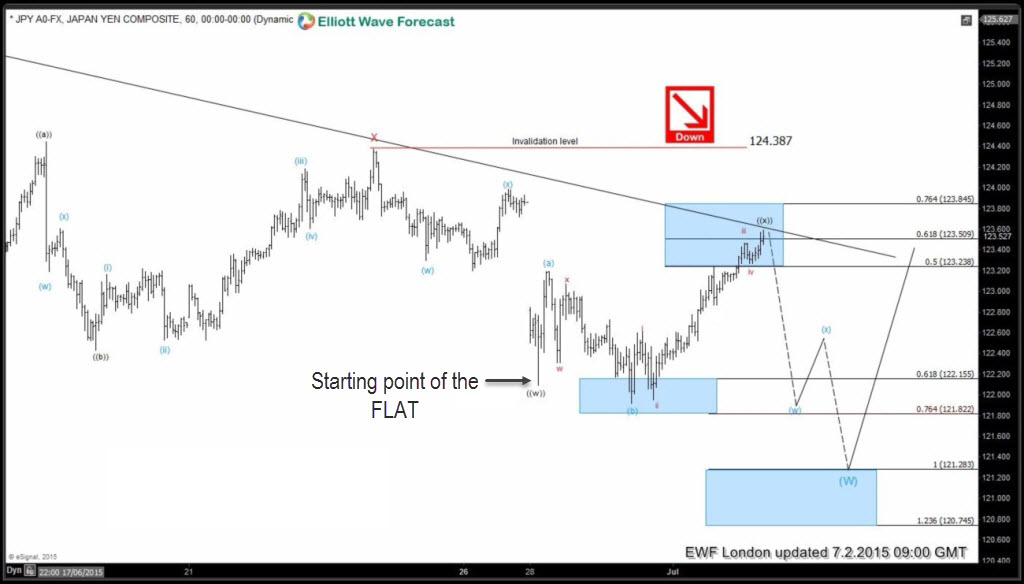

$USDJPY July.2.2015 London Update. Wave ((w)) ended at 122.09 and current price action suggests the pair is now doing wave ((x)) recovery against the 124.387 high. Wave ((x)) recovery has taken form of Expanded Flat Elliott Wave structure. As you may notice, wave (b) of ((x)) Flat has ended below start point of wave (a) and wave (c) is quite extended, it’s appraoching 1.618 fibonacci extension of (a) related to (b) which is not marked on the chart but it lies close to the marked 76.4 fibonacci retracement ( 123.845). Current Elliott Wave analysis suggests wave ((x)) is about to complete as expanded flat structure at 123.509-123.845 area.

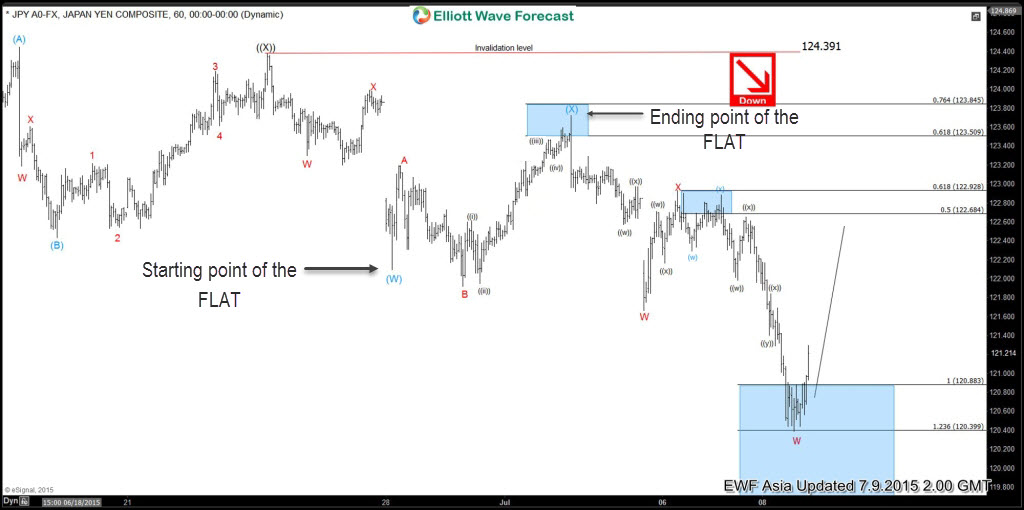

$USDJPY July.9.2015 Asia Update. A week later, as we can see, the pair did make nice decline as expected. Flat pattern ended below the 0.764 fib retracement (123.845) right at 1.618 fib extension A related to B. You can check that at your trading platform by using fibonacci expansion tool: wave C =wave A* 1.618

Proper Elliott Wave counting is crucial in order to be a successful trader. If you want to learn more on how to implement Elliott Wave Theory in your trading, feel free to join us. You will get access to Professional Elliott Wave analysis in 4 different time frames,2 live webinars by our expert analysts every day, 24 hour chat room support, market overview, daily and weekly technical videos and much more…

If you are not member yet or Elliott Wave Subscribers, just sign up here to get your Free 14 days Premium Plus Trial.

If you have any questions , feel free to contact me on twitter.

Welcome to Elliott Wave Forecast !