The gaming industry is on the rise since 2020. New gaming platforms are continuously developing around the globe. Moreover, the video gaming industry is highly affected by the choice and taste of gamers. Therefore, understanding audience preference is the key to investment success in this sector. Examples of successful online games are Dota 2 and PUBG which are rising in popularity. Also, e-sports is creating new opportunities within this market. 5G stocks is a huge opportunity for investors to jump in right now to enjoy good profits in the future.

The gaming industry is continuously changing as technology evolves. New technologies like intensive graphics, 3D virtual reality, and digital publishing are giving a huge push to the industry’s growth. Additionally, mobile gaming has experienced rapid expansion and growth globally due to the increased use and adoption of inexpensive smartphones.

List of Best Gaming Stocks to Invest

| Sr. | Company Name | Symbol | Market Capitalization | Price (as on 10th January 2021) |

| 1 | Nintendo Co. Ltd | NTDOY | $ 54.85 billion | $ 58.44 |

| 2 | Zynga | ZNGA | $9.45 billion | $ 8.44 |

| 3 | Take-Two Interactive Software | TTWO | $ 16.4 billion | $ 142.99 |

| 4 | Activision Blizzard Inc | ATVI | $49.15 billion | $ 63.11 |

| 5 | Electronic Arts | EA | $36.454 billion | $ 128.9 |

| 6 | Capcom | Capcom | $ 4.76 billion | $ 11.15 |

| 7 | Sony Group Corporation | SONY | $ 154.132 billion | $ 123.17 |

| 8 | Tencent | TCEHY | $ 558.37 billion | $ 58.14 |

| 9 | Sea Ltd. | SE | $ 104.353 billion | $ 187.1 |

| 10 | Sci-Play Corp | SCPL | $ 303.52 million | $ 12/37 |

Nintendo Co. Ltd

Nintendo Co. Ltd

Nintendo is a multinational consumer electronics and software company headquartered in Kyoto, Japan. It is one of the most common and recognizable gaming companies in the world. Nintendo stayed at the top of the gaming world for many years due to its popular games Mario, Zelda, and Animal Crossing. Moreover, Nintendo also owns a huge portion of The Pokémon company which gave it exclusive rights to publish the extremely high grossing Pokémon video games. Get to know the best quantum computing stocks.

Nintendo is fairly new in the mobile gaming market. Even though currently the gaming company is performing fairly well, it is hard to predict how much it will contribute to Nintendo’s growth. Nintendo’s most recent hardware device “Nintendo Switch” has become extremely popular and has sold almost 93 million units since 2017.

For the nine months of the FY2021, Nintendo reported:

- Net Sales of $2.6 billion

- Video Game Platform contributed 95% of the total sales

- Profit of $680 million

Nintendo is a $55 billion company. Its share is trading at $58.1. During the lockdown period, the gaming stock’s price soared to $81.37. And is currently trading at a higher price as compared to the pre-pandemic levels.

Nintendo’s stock has been performing well in the last two years. The sales of its gaming consoles and mobile gaming application continue to rise. This indicates the sustainable growth of the company. Investing in value stocks is a long-term investment.

Nintendo’s stock has been performing well in the last two years. The sales of its gaming consoles and mobile gaming application continue to rise. This indicates the sustainable growth of the company. Investing in value stocks is a long-term investment.

Zynga

Zynga Inc. develops, markets, and operates social games as live services played on mobile platforms. Its most popular games include Chess with Friends, Crazy Cake Swap, Draw Something, FarmVille, Ice Age: Arctic Blast, Looney Tunes Dash, Hit It Rich, Zynga Poker, and Willy Wonka Slots. It offers free games to the audience and generates revenue by selling in-game content and by displaying ads. By using the stock signals, you can avoid hours of technical analysis to understand the market.

The company’s revenue has been consistently growing since 2018.

It is a recent quarterly report, Zynga reported:

- Revenue of $705 million

- Mobile revenue contributed 97% of the total revenue

- Net loss of $42 million

- Monthly Average Users during the quarter were 183 million

Zynga is a $6.7 billion company. Its share is currently trading around $6. The share price peaked at $12.6 in April 2021.

Get to know the vaccine stocks providing an excellent return to shareholders.

Get to know the vaccine stocks providing an excellent return to shareholders.

Take-Two Interactive Software

Take-Two Interactive Software is a leading game publisher. The company owns two major publishing labels, Rockstar Games and 2K. Take-Two owns the best video game content around the world. Grand Theft Auto, owned by Take-Two, is the best-selling console game of all time. The company owns the top games in each category of online games

The gaming company is significantly expanding its development personal to support its pipeline. As of March 2021, the total headcount was 5,046, which is the highest the company has ever expanded to.

In the recent quarterly report, the company reported:

- Net Revenue of $858 million

- Net Income of $10.3 million

- Cash and Cash Equivalents of $2,732

Take-Two Interactive Software is a $16.4 billion company. Its share is trading at $142. The stock peaked at $210.43 at the start of 2021. The stock has depreciated but it is still trading at higher than the pre-pandemic levels.

There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

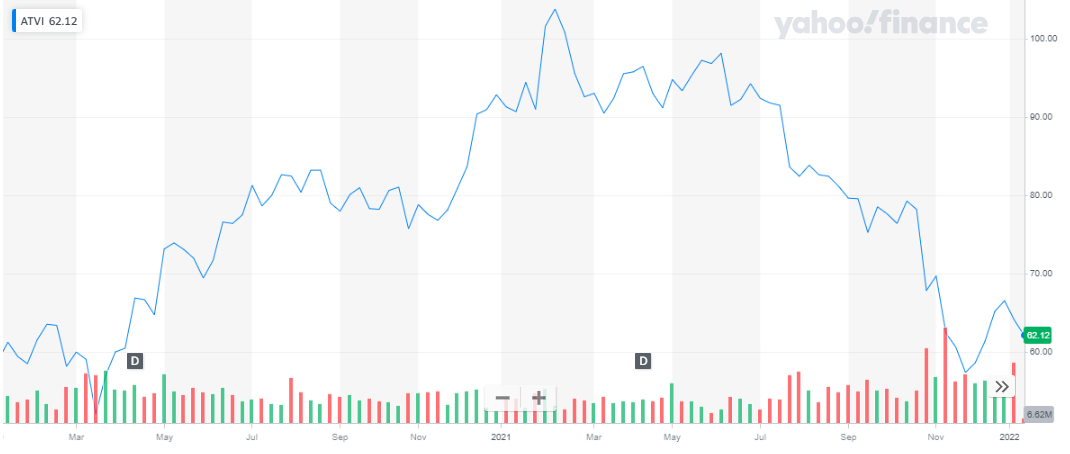

Activision Blizzard Inc.

Activision Blizzard Inc. develops and publishes interactive entertainment content and services. The company operates through three segments: Activision Publishing, Inc., Blizzard Entertainment, Inc., and King Digital Entertainment. It develops and distributes content and services on video game consoles, personal computers, and mobile devices. The company’s key franchises include Call of Duty, World of Warcraft, Overwatch, and Candy Crush.

In its recent quarterly report, the company reported:

- Net Revenue of $2,070 million

- Net Income of $639 million

Activision Blizzard has a healthy balance sheet with very little debt and very low liabilities. Its liquidity position is good and holds around $10 billion of cash in its recent earnings report. Get to know everything about high frequency trading.

Activision Blizzard Inc. is a $48.5 billion company. Its share is trading at $62.09. the share price skyrocketed after the March-2020 market crash. The stock price hit $103.8 since then the stock piece have dropped

Get to know the best EV stocks to invest in today.

Get to know the best EV stocks to invest in today.

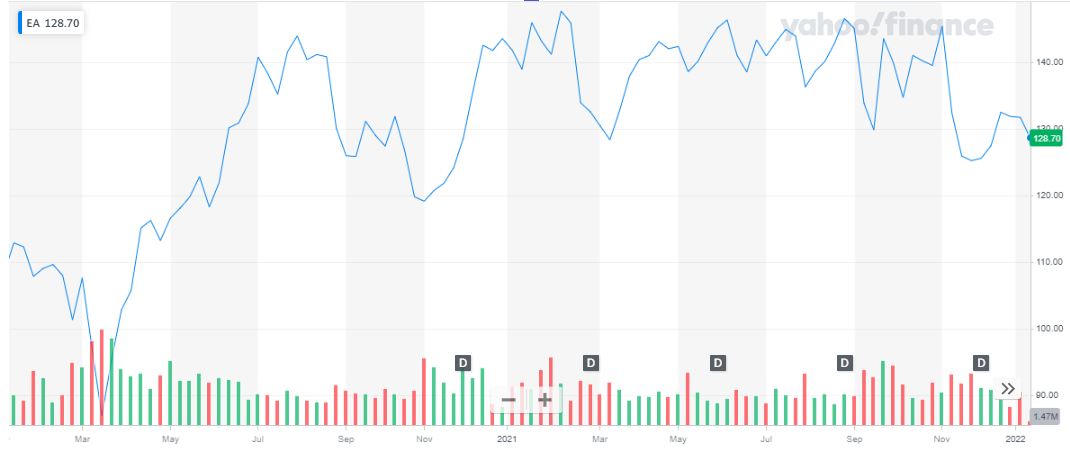

Electronic Arts

Electronic Arts Inc. is a global leader in digital interactive entertainment. EA develops and delivers games, content, and online services for Internet-connected consoles, mobile devices, and personal computers. Worldwide, EA has more than 450 million registered players.

The global football franchise of EA is one of the leading sports game properties in the world. In the first six months of FY 2021, a total of 100 million players were reported.

In the recent quarterly report, EA reported:

- Net Revenue of $1,826 million

- EPS of $1.02

Electronic Arts are a $36.4 billion company. Its share is trading at around $128.58. the company’s stock has skyrocketed in the past two years. Despite the ups and downs, the stock of Electronic Arts has maintained its upward journey. Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Read more:

Capcom

Capcom is a Japanese video game development and publishing company. Building on its origins as a game machine manufacturer, Capcom is now involved in all areas of the video game industry. It produces video games for Sony, Nintendo, and Microsoft game consoles, PCs, and handheld devices. Capcom has created many popular game franchises, including Street Fighter, Mega Man, and Resident Evil. On of the hot-selling games are Dead Rising, Lost Planet, and Monster Hunter 4 Ultimate. Capcom licenses its game brands to movies and TV, books and comics, collectibles and toys, and attractions and theater productions. It also makes coin-operated arcade machines and operates arcades in Japan. Capcom maintains operations in the U.S., U.K., Germany, France, Hong Kong, Taiwan, Singapore, and Tokyo. If you are seeking a steady stream of income, you should invest in REIT stocks.

In its recent quarterly earnings report, the company reports:

- Net Sales of $609 million (approx.)

- Digital content contributed 85% of the total sales

- Net Income of $193 million (approx.)

Capcom is a $4.68 billion company. Its share is trading at $10.97. the company’s stock went on a bullish run after the pandemic-driven market crash. The stock peaked at $17.35 during January 2021.

Sony Group Corporation

Sony Group Corporation

Sony Group Corp. engages in the development, design, manufacture, and sale of electronic equipment, instruments, devices, game consoles, and software for consumers, professionals, and industrial markets. It operates through the following segments: Game and Network Services, Music, Pictures, Home Entertainment and Sound, Imaging Products and Solutions, Mobile Communications, Semiconductors, Financial Services, and Others. The Game and Network Services segment deals with gaming machines, software, and network services.

In the recent quarterly report, the company reported:

- Total Sales of $20.6103 billion (Approx.)

- Gaming and Network Sales were $5.6 billion (Approx.)

- Net Income of $ 1.86 billion (Approx.)

The gaming and Network division has been Sony’s largest and most revenue-generating segment for many years now. Total contribution to revenue during the recent quarter was 27% and total contribution towards operating income was 26%

Sony Group is a $153 billion company. Its share is trading at $122.5. the share of Sony is on an upward streak for the last two years. It is currently trading at the highest price levels. The share kicked off the year 2021 at a price of $101.1 and concluded the year at a price of $126.4.

Investors are now looking for the finest solar energy stocks to invest in.

Investors are now looking for the finest solar energy stocks to invest in.

Tencent

Tencent Holdings is a multinational Chinese conglomerate and is considered the world’s largest video game company. It owns Riot Games and Tencent Music. It has over 600 investments, including 40% of Epic Games and 4% of Tesla.

In the recent quarterly report, the company reported:

- Total revenues were USD22.0 billion, representing a 13% year-on-year increase

- Domestic Games revenues grew by 5% year on year, driven by games including Honour of Kings, Call of Duty Mobile, and Moonlight Blade Mobile.

- International Games revenues grew by 20% year-on-year due to robust performance of games including Valorant and Clash of Clans

- Profit USD5.0 billion, a decrease of 2% year-on-year

Tencent is focusing on global game development capabilities through scaling up its China-based studios and establishing multi-hit international studios, and nurturing the growth of specialist genre-leading international studios.

Tencent is a $558.4 billion company. Its share is trading at $58.14. the stock peaked at $99.1 during February 2021. Get to know the best EV stocks to invest in today.

Sea Ltd.

Sea Ltd.

Sea Ltd. is an internet and mobile platform company, which engages in the provision of online gaming services. It operates through the following segments: Digital Entertainment, E-Commerce, and Digital Financial Services. The Digital Entertainment segment offers and develops mobile and PC online games. Also learn about Best Day Trading Stocks.

In the recent quarterly report, Sea Limited reported:

- Total GAAP revenue was US$2.7 billion, representing a 121.8% year-on-year increase

- Digital Entertainment Segment:

- Bookings were US$1.2 billion, representing an increase of 29.2% year on year.

- GAAP revenue was US$1.1 billion, representing an increase of 93.2% year on year.

- Quarterly active users reached 729.0 million, an increase of 27.4% year-on-year.

- Quarterly paying users grew by 42.7% year-on-year to 93.2 million

- Digital Entertainment Segment:

- Total gross profit was US$1.0 billion, up 147.5% year-on-year.

Sea Limited’s self-developed game “Free Fire” has been a huge hit.

-

- It has been ranked second by average monthly active users worldwide, as per the App Annie.

- Free Fire has been the highest-grossing mobile game within the regions: Southeast Asia, Latin America, and India as reported in the recent quarter.

- Free Fire was the highest-grossing mobile battle royale game for three consecutive quarters, and was the second-highest-grossing mobile game on Google Play for the third quarter of 2021, according to App Annie

Sea Limited has a market capitalization of around $104.4 billion. Its share is trading at $187.1. The stock of Sea Limited is on a bullish run for the past two years. The share kicked off the year 2021 at the price of $199.05 and the share was concluded the year at a price of $223.7.

Sci Play Corporation

Sci Play Corporation

SciPlay Corporation is a leading developer and publisher of digital games on mobile and web platforms, providing highly-entertaining free-to-play games to millions of people worldwide. e company currently offers seven core games, including four social casino games and three primary casual games

In its recent quarterly report, the company reported:

- Revenue of $146.6 million

- Net Income of $37 million

- Cash and Cash Equivalents of $330.8 million

- Average Monthly Revenue Per Paying User was $93.67

- Average Revenue Per Daily Active User was $0.69

SciPlay is a comparatively small company that has a market capitalization of $303.5 million. Its share is trading at $12.37. Investors always choose the best brokers that better suit his/her trading goals.

Conclusion

Conclusion

Like all investment gaming stocks are also prone to risks. No doubt the gaming industry has seem immense growth during COVID-19 but every gaming stock is prone to fluctuations and other risks. The above listed gaming stocks have proved to be an excellent stock due to sustainable growth prospects and evolving in the ever-changing industry.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Quantum Computing Stocks to Buy

- Best Fintech Stocks

- Best Swing Trading Stocks To Buy Now

- Best Long Term Stocks to Invest in 2024

- Best Stock & Forex Trading Courses

- Best Cryptocurrencies to Invest in

- Relative Strength Index – Basics and RSI Trading Strategies

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy