What are Emerging Markets and Emerging Market Stocks?

Emerging markets refer to an economy that is undergoing significant economic growth and shows the majority of signs of a developed economy. Emerging markets are countries that are transitioning from the “developing” phase to the “developed” phase. Emerging market stocks are stocks of companies that operate in these developing or emerging economies.

These countries are characterized by

- High Economic Growth – In these countries governments implement policies that promote industrialization and rapid economic growth. These favorable policies lead to lower unemployment, higher disposable income per capita, higher investments, and better infrastructure

- High Growth Potential – Emerging markets are often attractive to foreign investors due to the high return on investment they can provide

- A large population

- Rapidly expanding middle class

Examples of emerging market countries are China, India, Brazil, and Russia. Investing in emerging market stocks can be riskier but they have the potential to produce higher returns. Due to their high growth potential, emerging market stocks are often considered a good investment opportunity for investors looking to increase the return on a stagnant portfolio.

Advantages of investing in emerging markets

Below listed are some of the advantages of investing in emerging markets stocks:

- Growth – One of the biggest advantages of investing in emerging market stocks is the potential for high growth.

- Diversification – Also, emerging market stocks provide excellent diversification in the portfolio. Economic downturns in one country or region can be offset by growth in another.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

- Reliable forex signals

Risks of investing in emerging markets

There are some risks that come with investment in emerging market stocks:

- Political risk. Emerging markets may have unstable, even volatile, governments. Political unrest can cause serious consequences for the economy and investors.

- Economic risk. These markets may often suffer from insufficient labor and raw materials, high inflation or deflation, unregulated markets, and unsound monetary policies. All of these factors can present challenges to investors.

- Currency risk. The value of emerging market currencies compared to the dollar can be extremely volatile. Any investment gains can be potentially lessened if a currency is devalued or drops significantly.

Best Emerging Market Stocks

Best Emerging Market Stocks

Here is a list of Best Emerging Market Stocks to Buy Right Now:

| Sr. | Company Name | Symbol | Price As of 19th June 2023 | Market Cap |

| 1 | Banco Bradesco | BBD | $ 3.51 | $ 38.04 billion |

| 2 | Grupo Televisa | TV | $ 5.2 | $ 2.92 billion |

| 3 | NIO | NIO | $ 9.23 | $ 15.58 billion |

| 4 | Alibaba Group | BABA | $ 87.91 | $ 225.26 billion |

| 5 | Sigma Lithium Corp | SGML | $ 38.73 | $ 4.138 billion |

| 6 | Baidu | BIDU | $ 145.34 | $ 51.97 billion |

| 7 | Sasol | SSL | $ 13.89 | $ 8.8 billion |

Banco Bradesco

Banco Bradesco is a provider of commercial banking and related financial solutions to large, mid-sized, and small companies; individuals; major local and international corporations; and institutions. It offers personal and corporate banking, international banking, investment and private banking, asset management, and capital market and insurance services. The bank’s offerings include deposit services; loans; card products; and consortium services. Bradesco provides insurance coverage to auto, health, life, accident, and property; pension plans, and capitalization bonds. It has an operational presence in the US, the UK, the Cayman Islands, Mexico, Argentina, Luxembourg, and Hong Kong. Bradesco is headquartered in Osasco, Brazil.

Banco Bradesco reported its first quarter report for the year 2023:

- Net Interest Income was reported at $ BRL 18,370.67 million as compared to BRL 16,373.18 million during the previous year

- The net income was BRL 5,399.79 million compared to BRL 8,037.19 million during the previous year’s same period

Banco Bradesco has a market cap of $ 37.29 billion. Its shares are trading at $ 3.51.

The stock started the year 2022 at a price of $ 3.42. Initially, the stock started to rise and hit a peak of $ 4.67. From here the stock reversed its course and started declining. The stock closed the year at $ 2.88 representing a 16 % decline during the year.

In 2023, after staying stagnant during the start of the year, the stock recently rose and last closed at 3.51. To date, the stock has appreciated by 22 %.

Read:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Grupo Televisa

Grupo Televisa SAB (Televisa) is a media company that provides video, data, voice, managed services, and direct-to-home satellite pay television systems. The company offers content for free-to-air and pay TV; and produces and distributes pay-TV brands and feeds. Televisa operates broadcast channels; provides advertising services through its pay-TV networks and online properties; and has an interest in the Univision Communications channel. It also publishes magazines and distribution, professional sports and live entertainment, radio production and broadcasting, feature film production and distribution, and gaming businesses. The company serves residential, commercial, government, enterprise, and business customers in Mexico and other countries. Televisa is headquartered in Mexico City, Mexico.

Grupo Televisa reported its first quarter report for the year 2023:

- Sales were reported at MXN 18,519.6 million compared to MXN 18,609.2 million during the previous year’s same period

- Net loss was reported at MXN 788.9 million compared to net income of MXN 52,642.1 million during the previous year’s same period

- Loss per share was MXN 0.28 compared to earnings per share of MXN 18.68 during the previous year’s same period

Grupo Televisa has a market cap of $ 2.92 billion. Its shares are trading at $ 5.2.

The stock started the year 2022 at $ 9.37. After an initial rise in price, the stock started to decline and closed the year at $ 4.56. Overall, the stock declined by 51 % during the year.

In 2023, the stock maintained its price level and last closed at $ 5.2. To date, the stock has appreciated by 14 %.

Also, learn:

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

NIO

Nio Inc (NIO) is an Automobile company that carries out the research and development production and sale of smart electric vehicles. The company offering products includes es7, es8, es6, et5, et7, ec6. It also develops battery-swapping technologies and autonomous driving technologies. Its services comprise a lifetime free warranty, lifetime free roadside rescue, and lifetime free car connectivity. The company’s electric vehicles apply NAD (NIO autonomous driving) technology, including the supercomputing platform NIO Adam and the super sensing system NIO Aquila. The company also provides the provision of charging piles, vehicle internet connection services, and extended lifetime warranties. It operates in the Netherlands, China, Hong Kong, Germany, Norway, and the US. NIO is headquartered in Shanghai, China.

NIO recently reported its first quarter results for the year 2023:

- Total revenues were reported at RMB 10,676.5 million (US 1,554.6 million) representing an increase of 7.7 % from the first quarter of 2022

- Loss from operations was reported at RMB 5,111.8 million (US 744.3 million) representing an increase of 133.6 % from the first quarter of 2022

- Net loss was reported at RMB 4,739.5 million (US 690.1 million), representing an increase of 165.9 % from the first quarter of 2022

- Earnings per share were reported at RMB 2.91 (US$0.42) as compared to RMB 1.12 in the first quarter of 2022

- NIO delivered 31,041 vehicles in the three months ended March 2023, increasing by 20.5% year-over-year

NIO has a market cap of $ 15.58 billion. Its shares are trading at $ 9.23.

The stock started the year 2022 at $ 31.68. The stock picked up a bearish trend and closed the year at $ 9.75. Overall, the stock declined by 70 % during the year.

In 2023, the stock continued its bearish rub but declined at a slower pace. To date, the stock has declined by 5.3 %.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Alibaba Group

Alibaba Group Holding Ltd (Alibaba Group) is a provider of e-commerce and technology infrastructure services. The company provides fundamental technology infrastructure services to merchants, brands, retailers, and businesses to market, sell and operate using the Internet. Its businesses comprise core commerce, digital media and entertainment, cloud computing, and other innovation initiatives. Alibaba Group provides services through its subsidiaries, including Taobao, Tmall, Freshippo, Aliexpress, Lazada, Alibaba.com, 1688.com, ele.me, Youku, DingTalk, Alimama, Alibaba Cloud, and Cai Niao. It also offers logistic services through the Koubei and Cainiao Network. The company has a business presence in Hong Kong, China, Taiwan, the US, the UK, Korea, Singapore, Italy, France, Germany, the Netherlands, Japan, Australia, and New Zealand. Alibaba Group is headquartered in Hangzhou, Zhejiang, China.

Alibaba reported full-year results ending 31st March 2023:

- Revenue was reported at RMB 868,687 million (USD 126,491 million), an increase of 2 % year-over-year

- Income from operations was RMB 100,351 million (USD 4,612 million), an increase of 44 % year-over-year

- Net income was reported at RMB 65,573 million (USD 9,548 million, showing a year-over-year increase of 39 %

- Earnings per share were reported at RMB 3.43 (USD 0.50)

Alibaba has a market cap of $ 225.26 billion. Its shares are trading at $ 87.91.

The stock started the year 2022 at $ 118.79. The stock started off with a bearish trend and dropped as low as $ 63.74. Eventually, the stock closed at $ 88.09 representing 25.58 %.

In 2023, the stock went through multiple dips and peaks and last closed at $ 87.91. To date, the stock was able to maintain its price level.

Sigma Lithium Corp

Sigma Lithium Corp

Sigma Lithium Corporation engages in the exploration and development of lithium deposits in Brazil. It holds a 100% interest in the Grota do Cirilo, Genipapo, Santa Clara, and São José properties comprising 29 mineral rights covering an area of approximately 185 square kilometers located in the Araçuaí and Itinga regions of the state of Minas Gerais, Brazil. It serves the electric vehicle industry worldwide. The company was formerly known as Sigma Lithium Resources Corporation and changed its name to Sigma Lithium Corporation in July 2021. The company is headquartered in São Paulo, Brazil.

Sigma Lithium reported its full-year financials for the year 2022:

- Net Loss was reported at CAD $ 126.7 million, as compared to CAD $ 34.7 million in the previous year

- Net loss per share was reported at CAD $ 1.26, as compared to net loss per share for the previous year at CAD $ 0.39

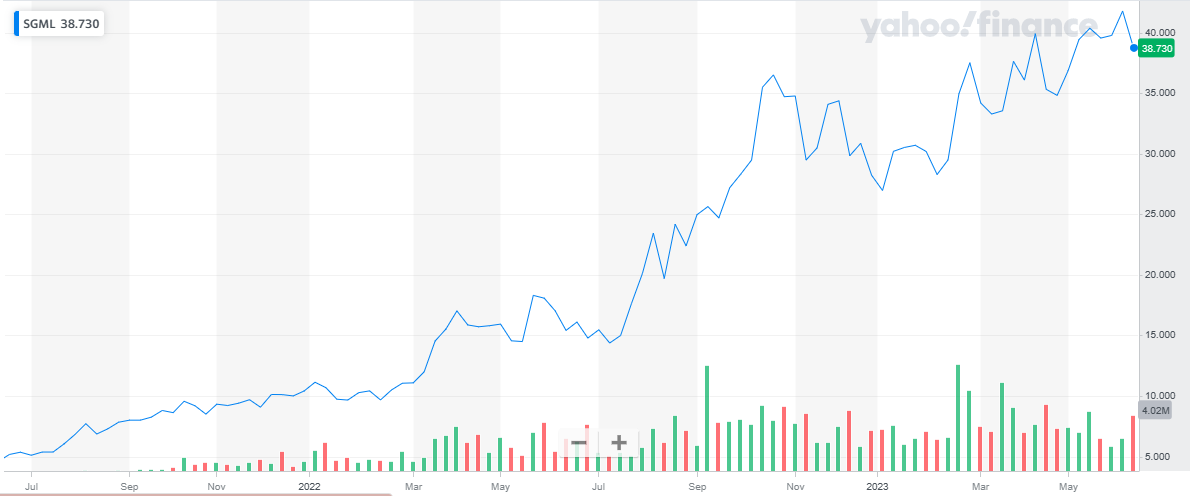

Sigma Lithium has a market cap of $ 4.15 billion. Its shares are trading at $ 38.73.

The stock started the year 2022 at a price of $ 10.41. The stock continued with the bullish trend it was on and closed the year at $ 28.22. During the year, the stock appreciated by a whopping 171 %.

In 2023, the stock continued with its bullish trend and last closed at $ 38.73, representing a 37.3 % appreciation to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Baidu

Baidu Inc (Baidu) is a provider of Chinese-language Internet-related search services, Artificial intelligence. It offers a search engine that is a bundle of web searches, video searches, image searches, news, web dictionary, top searches and search index, and open platform. It also offers online marketing services and advertising services. Its products portfolio includes Baidu App, Hoakan, Quanmin, Baidu Wiki, Baidu Knows, Baidu Experience, Baidu Post, Baidu Union, DuerOS, Baidu Maps, Baidu Feed, and Baidu Health. The company also offers services such as P4P, Marketing Cloud Platform, and AI Cloud. Its products and services enable users to find information and businesses to reach potential customers. The company sells its products through its direct sales team and third-party distributors. Baidu is headquartered in Beijing, China.

Baidu Inc recently reported its first quarter report for the year 2023:

- Total Revenues were reported at RMB 31.14 billion (USD 4.5 billion), as compared to RMB 31.14 billion for the previous year’s same period

- Operating Income was reported at RMB 4.98 billion (USD 725 million), as compared to RMB 2.6 billion for the previous year’s same period

- Net Income was reported at RMB 5.8 billion (USD 848 million), as compared to a net loss of RMB 885 million for the previous year’s same period

- Earnings per share were reported at RMB 15.92 (USD 2.32), as compared to a net loss per share of RMB 2.87 for the previous year’s same period

Baidu has a market cap of $ 51.97 billion. Its shares are trading at $ 145.34.

The stock started the year 2022 at $ 148.79. Throughout the year the stock went through multiple dips and peaks. During the year the stock went as low as $ 78.54 and eventually closed the year at $ 114.38. Overall, the stock declined by 23 % during the year.

In 2023, the stock picked up a bullish trend and rose to $ 156.27. The stock last closed at $ 145.34 representing a 27 % decline to date.

Sasol

Sasol

Sasol Ltd (Sasol) is an integrated energy and chemical company. It develops and commercializes technologies; and builds and operates facilities to produce a range of products, including liquid fuels, chemicals, and low-carbon electricity. The company’s product offerings include industrial heating fuels, naphtha, and illuminating paraffin transport fuels, lubricants and lubricant base oils, liquefied petroleum gas, automotive and industrial lubricants, greases, cleaners and degreasers, automotive and burner fuels. It also produces natural gas, methane-rich gas, base chemicals, and essential care chemicals. It operates through a network of upstream, regional operating hubs, and customer-facing strategic business units. The company has an operational presence in the Middle East and Africa, the Americas, Asia, and Europe. Sasol is headquartered in Sandton, South Africa.

Below are the half-year financial results for Sasol Ltd:

- Total turnover was reported at R 171 billion, as compared to R 119.9 billion during the previous year’s same period

- Total Earnings were reported at R 14.7 billion, as compared to R 16 billion during the previous year’s same period

- Earnings per share were reported at R 23.23, as compared to R 23.98 during the previous year’s same period

Sasol has a market cap of $ 8.8 billion. Its shares are trading at $ 13.89.

The stock started in the year 2022 at $ 16.4. The stock kicked off the year with a bullish pattern. The stock peaked at $ 26.87 during the year and eventually closed at $ 15.71. Overall, the stock declined by 4 % during the year.

In 2023, the stock picked up a declining trend and last closed at $ 13.89. To date, the stock closed by 11.6 %.

Also, read:

Also, read:

Conclusion

Emerging markets offer the potential for high growth and diversification of investment portfolios. The performance of emerging markets can be influenced by various domestic factors such as education standards, political situation, and infrastructure.

Whether to invest in an emerging market or not has no definite answer. It depends on the investor’s financial goals and it is a personal decision for him/ her. However, when basic caution is exercised, the rewards of investing in an emerging market can outweigh the risks; the biggest growth and the highest-returning stocks are going to be found in the fastest-growing economies.

Checkout: