A detailed weekly Elliott Wave analysis of IndiGo highlighting the Wave IV blue-box zone, right-side bullish outlook, and long-term upside potential.

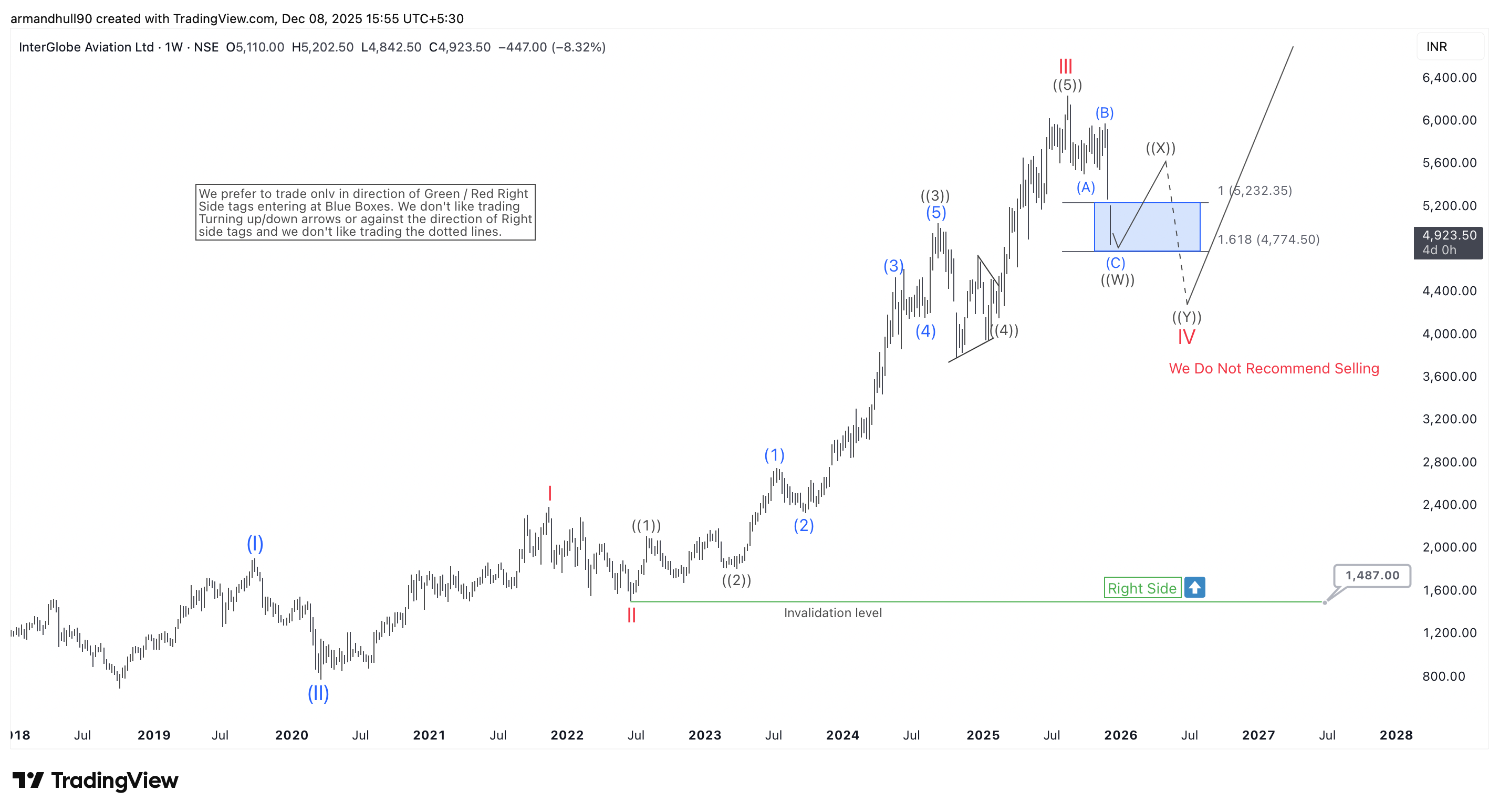

InterGlobe Aviation Ltd (NSE: INDIGO) remains in a strong long-term uptrend. The weekly chart shows a clean Elliott Wave structure that supports this view. The stock recently completed a higher-degree Wave III near the ₹6,000 area. After this peak, the price started a Wave IV correction. This pullback is normal within a larger bullish cycle.

The long-term rally began after Wave II finished in 2020. Since then, IndiGo moved higher in a strong impulsive structure. This move created a clear five-wave advance into Wave III. The current decline is part of Wave IV and is likely forming a double correction.

Wave IV Blue Box and Trading Strategy

The chart highlights a blue box support zone between ₹4,774 and ₹5,232. This area comes from the 1.0 and 1.618 Fibonacci extensions of the internal (A)-(B)-(C) pattern. The market often reacts from such zones. Buyers may step in here to continue the main trend. At the very least, a three-swing bounce is expected. The stock may then continue lower again to complete a full ((W))-((X))-((Y)) structure inside Wave IV.

We do not recommend selling here. The Right Side Tag favors buying, not selling. It signals that the dominant direction is still up. The invalidation level sits near ₹1,487. As long as prices stay above this level, the bullish outlook remains intact.

Wave IV should end once the market completes its swings. After that, Wave V can begin. Wave V may push the stock to new all-time highs. The projected path shows a strong advance that continues the long-term growth trend of IndiGo.

Conclusion:

InterGlobe Aviation still holds a bullish structure despite the current correction. The decline into the blue box is a normal part of the Elliott Wave cycle. It also creates a long-term buying opportunity for investors who follow the dominant trend. With Wave IV close to completion, the next major rally in Wave V may offer strong upside potential.

Back