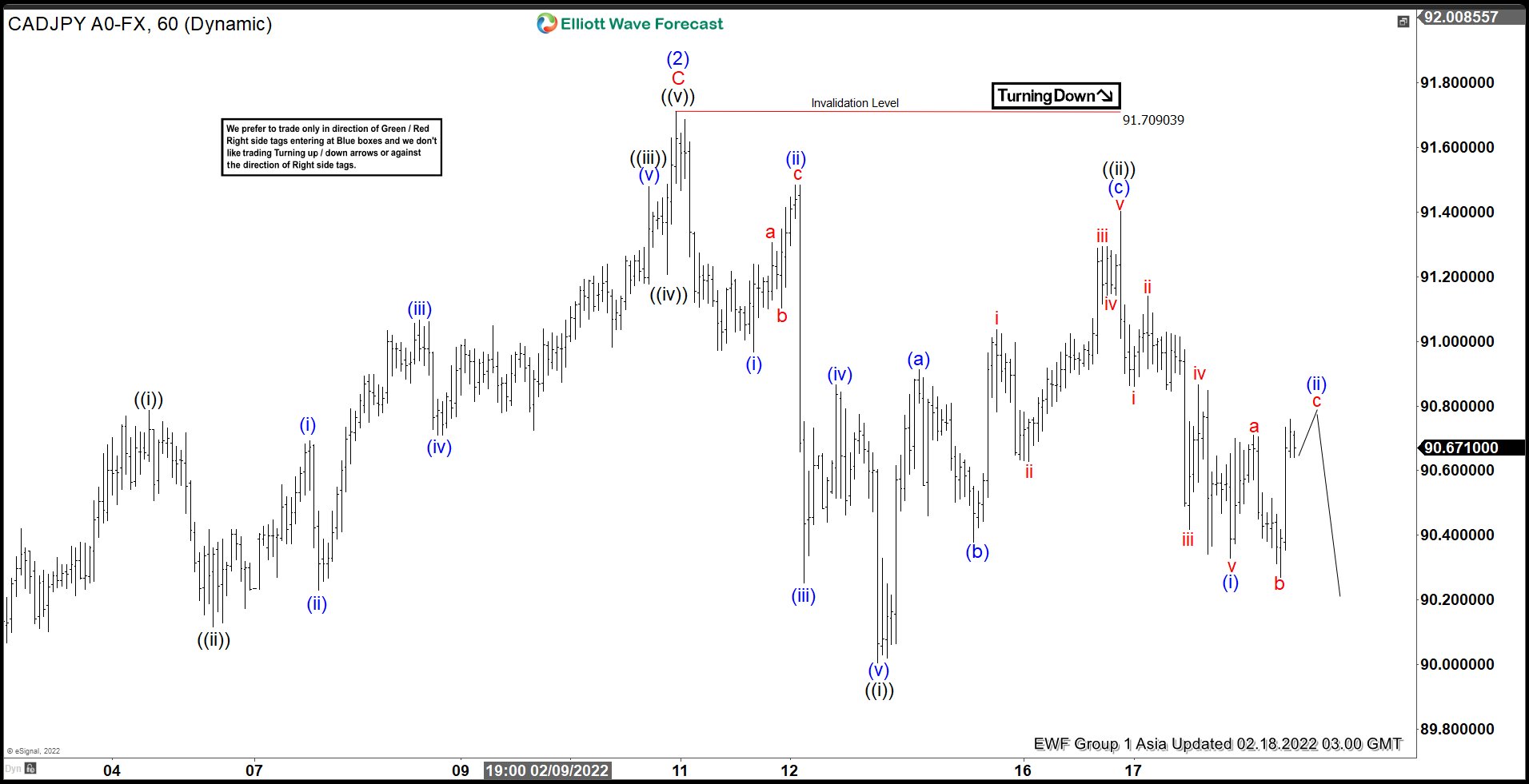

Short Term Elliott Wave View on CADJPY suggests that the rally to 91.7 ended wave (2). Pair has turned lower in wave (3) with internal subdivision as a 5 waves impulse Elliott Wave structure. Down from wave (2), wave (i) ended at 90.97 and rally in wave (ii) ended at 91.485. Pair resumes lower in wave (iii) towards 90.25 and rally in wave (iv) ended at 90.86. Final wave (v) lower ended at 90. This completed wave ((i)) in higher degree. Pair then corrected in wave ((ii)) which ended at 91.40.

Internal subdivision of wave ((ii)) unfolded as a zigzag Elliottwave structure. Up from wave ((i)), wave (a) ended at 90.91, pullback in wave (b) ended at 90.37, and wave (c) higher ended at 91.40. This completed wave ((ii)) in higher degree and pair has turned lower in wave ((iii)). Down from wave ((ii)), wave i ended at 90.86, wave ii ended at 91.13, wave iii ended at 90.419, wave iv ended at 90.86, and wave v ended at 90.32. This completed wave (i) of ((iii)) in higher degree. Near term, expect wave (ii) rally to correct the decline from wave ((ii)) peak before the next leg lower. As far as pivot at 91.7 high remains intact, rally should fail in 3, 7, or 11 swing for further downside.